Question

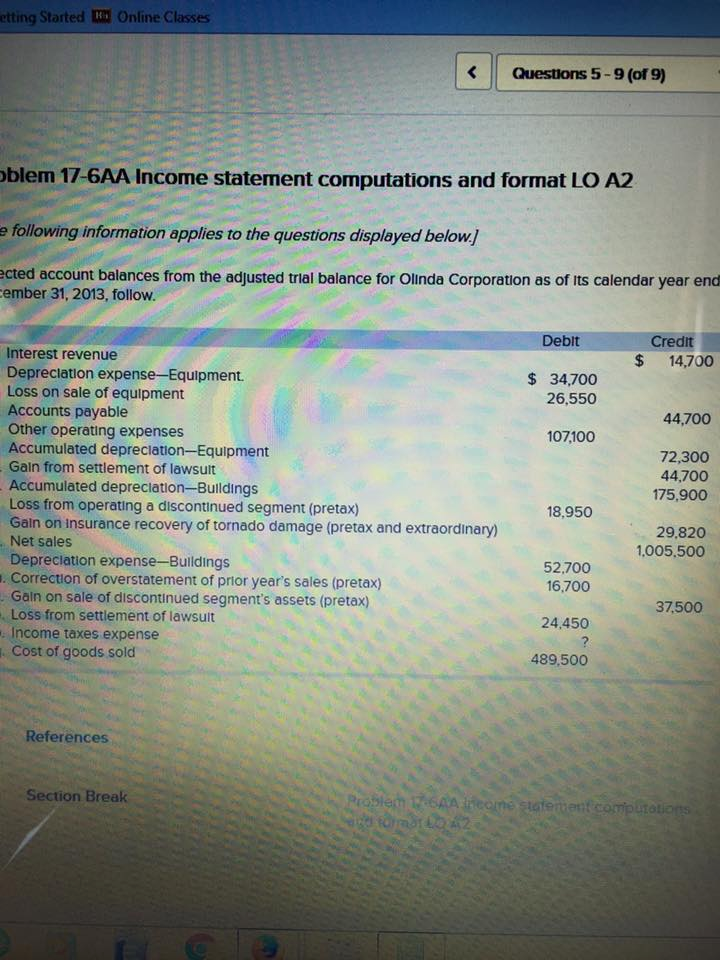

assuming assuming the income tax rate is 40 percent for all items. . . What is the amoutn of income fromcontinuing operations before income taxes?

assuming

assuming the income tax rate is 40 percent for all items. . .

What is the amoutn of income fromcontinuing operations before income taxes?

What is the amount of the income taxes expense?

What is the amount of income from continuing operations after taxes?

What is the total amount of after-tax income (loss) associated with teh discontinued segment?

What is the amount of income (Loss) before the extraordinary items?

What is the amoutn of net income for the year?

I really am having a hard time figuring out HOW to calculate these items. . . I have been stairing at it for two days. . . PLEASSE I beg of you, help me understand the process of calculating these items. :(

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started