Answered step by step

Verified Expert Solution

Question

1 Approved Answer

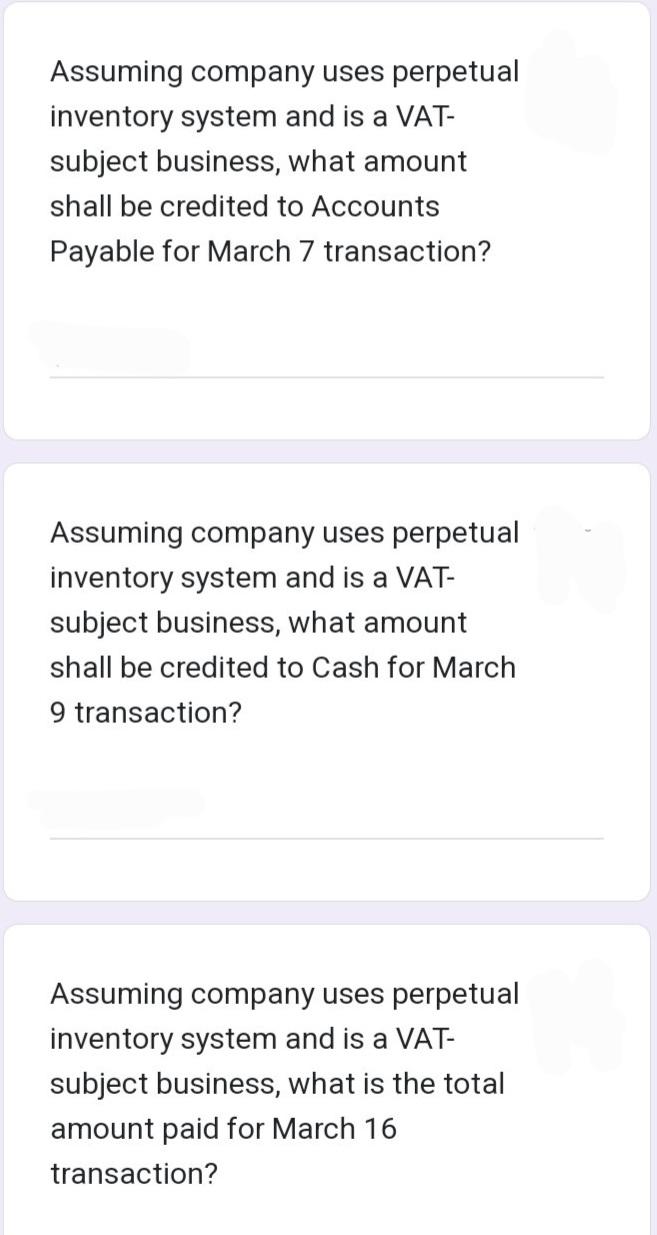

Assuming company uses perpetual inventory system and is a VAT- subject business, what amount shall be credited to Accounts Payable for March 7 transaction?

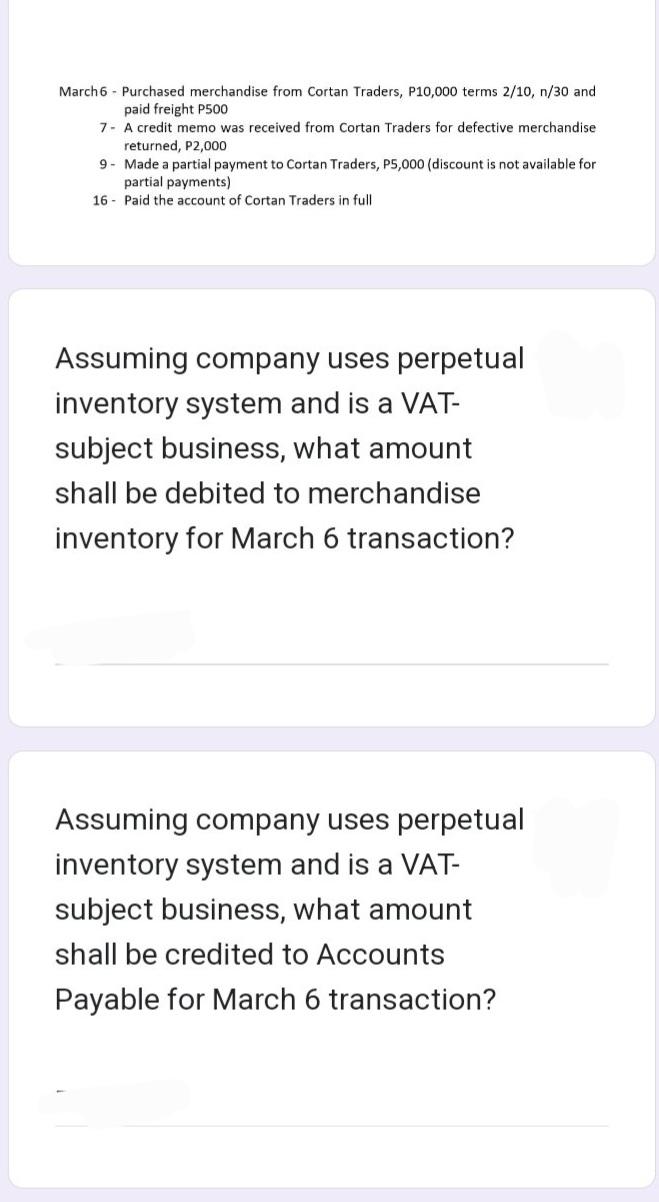

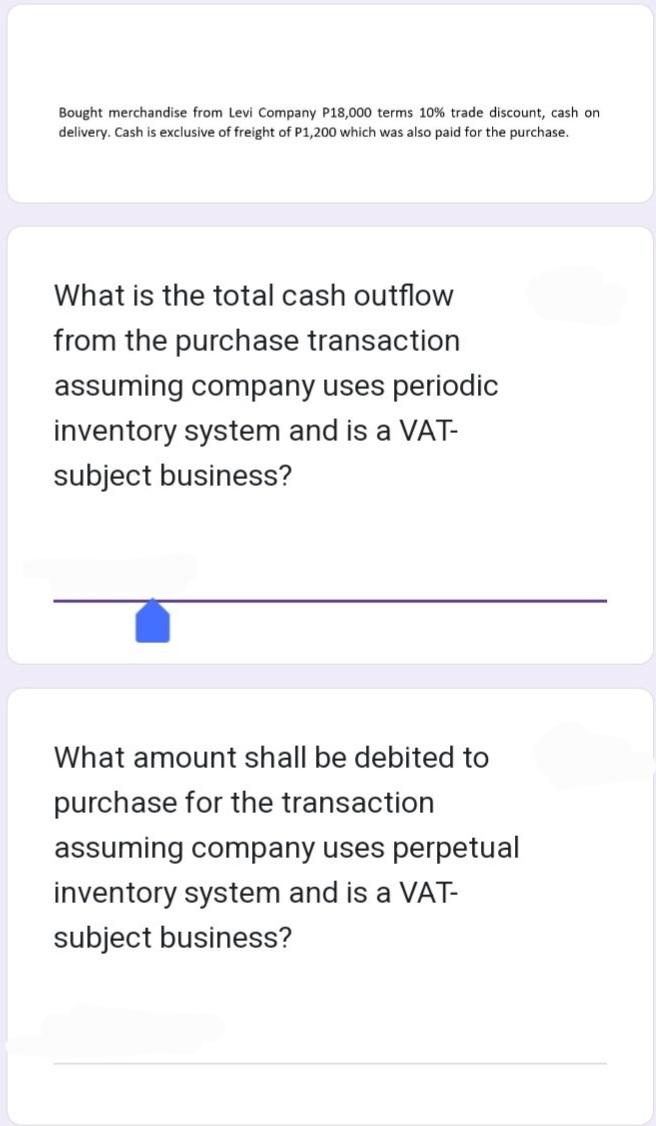

Assuming company uses perpetual inventory system and is a VAT- subject business, what amount shall be credited to Accounts Payable for March 7 transaction? Assuming company uses perpetual inventory system and is a VAT- subject business, what amount shall be credited to Cash for March 9 transaction? Assuming company uses perpetual inventory system and is a VAT- subject business, what is the total amount paid for March 16 transaction? March 6 Purchased merchandise from Cortan Traders, P10,000 terms 2/10, n/30 and. paid freight P500 7- A credit memo was received from Cortan Traders for defective merchandise returned, P2,000 9- Made a partial payment to Cortan Traders, P5,000 (discount is not available for partial payments) 16 Paid the account of Cortan Traders in full Assuming company uses perpetual inventory system and is a VAT- subject business, what amount shall be debited to merchandise inventory for March 6 transaction? Assuming company uses perpetual inventory system and is a VAT- subject business, what amount shall be credited to Accounts Payable for March 6 transaction? Bought merchandise from Levi Company P18,000 terms 10% trade discount, cash on delivery. Cash is exclusive of freight of P1,200 which was also paid for the purchase. What is the total cash outflow from the purchase transaction assuming company uses periodic inventory system and is a VAT- subject business? What amount shall be debited to purchase for the transaction assuming company uses perpetual inventory system and is a VAT- subject business?

Step by Step Solution

★★★★★

3.54 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

I will use the following information and assumptions The VAT rate is 12 which is the standard rate The company uses the gross method to record purchases and sales The company uses the perpetual invent...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started