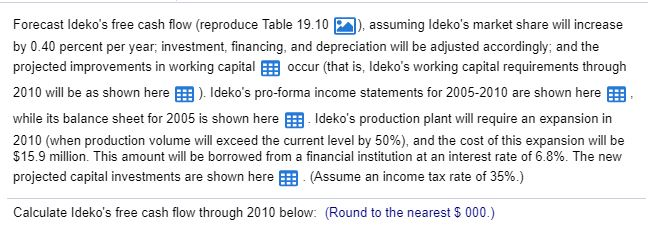

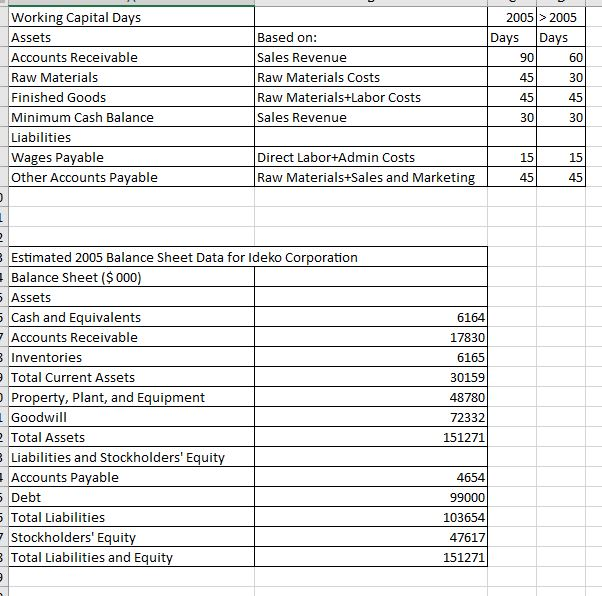

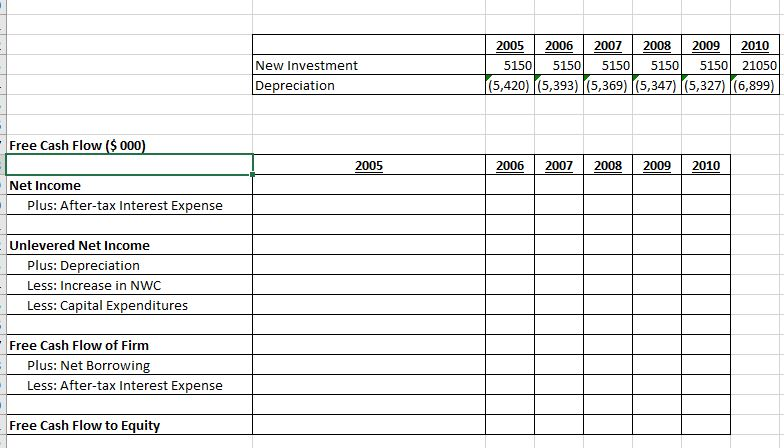

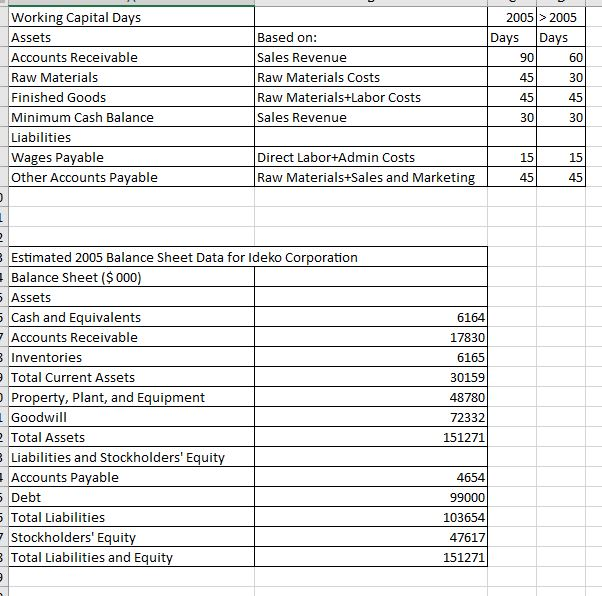

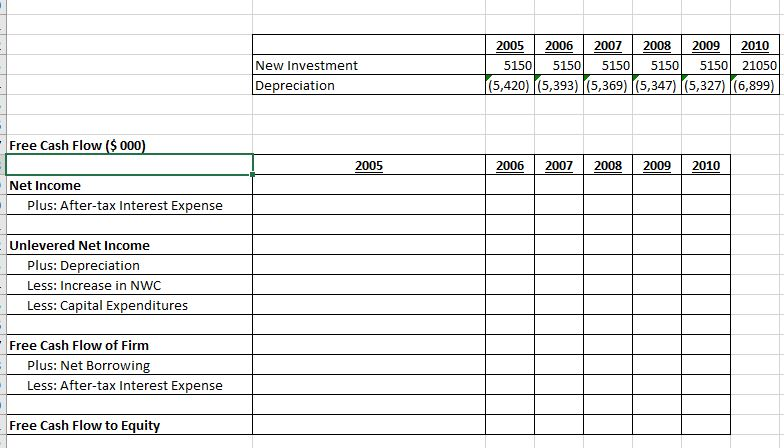

), assuming Ideko's market share will increase Forecast Ideko's free cash flow (reproduce Table 19.10 by 0.40 percent per year; investment, financing, and depreciation will be adjusted accordingly; and the projected improvements in working capitaloccur (that is, Ideko's working capital requirements through 2010 will be as shown here Ideko's pro-forma income statements for 2005-2010 are shown here Ideko's production plant will require an expansion in while its balance sheet for 2005 is shown here 2010 (when production volume will exceed the current level by 50%), and the cost of this expansion will be $15.9 million. This amount will be borrowed from a financial institution at an interest rate of 6.8%. The new projected capital investments are shown here (Assume an income tax rate of 35%.) Calculate Ideko's free cash flow through 2010 below: (Round to the nearest S 000.) Working Capital Days 2005 2005 Assets Based on: Days Days Accounts Receivable Raw Materials Sales Revenue 90 60 Raw Materials Costs 45 30 Raw Materials+Labor Costs Sales Revenue Finished Goods 45 45 Minimum Cash Balance 30 30 Liabilities Wages Payable Other Accounts Payable Direct Labor+Admin Costs Raw Materials+Sales and Marketing 15 15 45 Estimated 2005 Balance Sheet Data for ldeko Corporation Balance Sheet ($000) 5Assets 5 Cash and Equivalents Accounts Receivable 6164 17830 Inventories 6165 9Total Current Assets Property, Plant, and Equipment Goodwill 30159 48780 72332 2Total Assets Liabilities and Stockholders' Equity Accounts Payable 4654 5 Debt 99000 5 Total Liabilities Stockholders' Equity Total Liabilities and Equity 103654 47617 151271 2005 2006 2007 2008 2009 2010 New Investment 5150 5150 5150 5150 5150 21050 (5,420) (5,393) (5,369) (5,347)(5,327) (6,899) Depreciation Free Cash Flow ($ 000) 2006 2007 2009 2010 2005 2008 Net Income Plus: After-tax Interest Expense Unlevered Net Income Plus: Depreciation Less: Increase in NWC Less: Capital Expenditures Free Cash Flow of Firm Plus: Net Borrowing Less: After-tax Interest Expense Free Cash Flow to Equity 2005 Working Capital (S 000) 2006 2007 2008 2009 2010 Assets Accounts Receivable 17,830 18,039 13,222 14,685 16.286 19,956 2,091 Raw Materials 1,938 1,427 1,573 1,732 1,904 5,809 Finished Goods 4,134 4,636 5,193 6,492 7,247 5,943 6,611 7,342 8,143 9,020 9,978 Minimum Cash Balance 25,896 28,793 Total Current Assets 29,845 31,970 35,455 39,272 Labilities 1,262 1,322 1,489 1,634 Wages Payable 1,791 2,011 3,751 Other Accounts Payable 3,262 4,303 4,924 5,487 6,047 6.558 7,278 Total Current Liabilities 4,524 5,073 5,792 8,058 20 Net Working Capital Increase in Net Working Capital 23,001 25,412 31,214 25,321 28.177 (4.498) 2,178 2.411 2,765 3,037 Income Statement (S 000) 2005 2006 2007 2008 2009 2010 109.738 Sales 72,309 80,432 89,331 99,076 121,400 Cost of Goods Sold Raw Materials (15,721) (17,358) (19,136) (21.067) (23.164) (25,436) (33,349) Direct Labor Costs (17,809) (20,246) (22.983) (26.053) (29.495) Gross Profit 38,779 42,828 47,212 51,956 57,079 62,615 Sales and Marketing (10,738) (13,070) (15,767) (18,874) (21,344) (23,612) Administrative (12,893) (11,928) (13,248) (13,702) (14,079) (15,576) 21,656 EBITDA 15,148 17,830 18,197 19,380 23,427 (5.420) (5,369) (5.327) (5,393) (5.347) (6,899) Depreciation EBIT 9,728 12.437 12,828 14,033 16,329 16,528 (6,732) (6,732) Interest Expense (net) (80) (6,732) (6.732) (6,732) 7,301 Pretax Income 9,648 5,705 6,096 9,597 9,796 (2,134) (2,555) (3,377) (1,997) (3,359) (3,429) Income Tax 3,708 6,271 3,962 4,746 6,238 6,367 Net Income ), assuming Ideko's market share will increase Forecast Ideko's free cash flow (reproduce Table 19.10 by 0.40 percent per year; investment, financing, and depreciation will be adjusted accordingly; and the projected improvements in working capitaloccur (that is, Ideko's working capital requirements through 2010 will be as shown here Ideko's pro-forma income statements for 2005-2010 are shown here Ideko's production plant will require an expansion in while its balance sheet for 2005 is shown here 2010 (when production volume will exceed the current level by 50%), and the cost of this expansion will be $15.9 million. This amount will be borrowed from a financial institution at an interest rate of 6.8%. The new projected capital investments are shown here (Assume an income tax rate of 35%.) Calculate Ideko's free cash flow through 2010 below: (Round to the nearest S 000.) Working Capital Days 2005 2005 Assets Based on: Days Days Accounts Receivable Raw Materials Sales Revenue 90 60 Raw Materials Costs 45 30 Raw Materials+Labor Costs Sales Revenue Finished Goods 45 45 Minimum Cash Balance 30 30 Liabilities Wages Payable Other Accounts Payable Direct Labor+Admin Costs Raw Materials+Sales and Marketing 15 15 45 Estimated 2005 Balance Sheet Data for ldeko Corporation Balance Sheet ($000) 5Assets 5 Cash and Equivalents Accounts Receivable 6164 17830 Inventories 6165 9Total Current Assets Property, Plant, and Equipment Goodwill 30159 48780 72332 2Total Assets Liabilities and Stockholders' Equity Accounts Payable 4654 5 Debt 99000 5 Total Liabilities Stockholders' Equity Total Liabilities and Equity 103654 47617 151271 2005 2006 2007 2008 2009 2010 New Investment 5150 5150 5150 5150 5150 21050 (5,420) (5,393) (5,369) (5,347)(5,327) (6,899) Depreciation Free Cash Flow ($ 000) 2006 2007 2009 2010 2005 2008 Net Income Plus: After-tax Interest Expense Unlevered Net Income Plus: Depreciation Less: Increase in NWC Less: Capital Expenditures Free Cash Flow of Firm Plus: Net Borrowing Less: After-tax Interest Expense Free Cash Flow to Equity 2005 Working Capital (S 000) 2006 2007 2008 2009 2010 Assets Accounts Receivable 17,830 18,039 13,222 14,685 16.286 19,956 2,091 Raw Materials 1,938 1,427 1,573 1,732 1,904 5,809 Finished Goods 4,134 4,636 5,193 6,492 7,247 5,943 6,611 7,342 8,143 9,020 9,978 Minimum Cash Balance 25,896 28,793 Total Current Assets 29,845 31,970 35,455 39,272 Labilities 1,262 1,322 1,489 1,634 Wages Payable 1,791 2,011 3,751 Other Accounts Payable 3,262 4,303 4,924 5,487 6,047 6.558 7,278 Total Current Liabilities 4,524 5,073 5,792 8,058 20 Net Working Capital Increase in Net Working Capital 23,001 25,412 31,214 25,321 28.177 (4.498) 2,178 2.411 2,765 3,037 Income Statement (S 000) 2005 2006 2007 2008 2009 2010 109.738 Sales 72,309 80,432 89,331 99,076 121,400 Cost of Goods Sold Raw Materials (15,721) (17,358) (19,136) (21.067) (23.164) (25,436) (33,349) Direct Labor Costs (17,809) (20,246) (22.983) (26.053) (29.495) Gross Profit 38,779 42,828 47,212 51,956 57,079 62,615 Sales and Marketing (10,738) (13,070) (15,767) (18,874) (21,344) (23,612) Administrative (12,893) (11,928) (13,248) (13,702) (14,079) (15,576) 21,656 EBITDA 15,148 17,830 18,197 19,380 23,427 (5.420) (5,369) (5.327) (5,393) (5.347) (6,899) Depreciation EBIT 9,728 12.437 12,828 14,033 16,329 16,528 (6,732) (6,732) Interest Expense (net) (80) (6,732) (6.732) (6,732) 7,301 Pretax Income 9,648 5,705 6,096 9,597 9,796 (2,134) (2,555) (3,377) (1,997) (3,359) (3,429) Income Tax 3,708 6,271 3,962 4,746 6,238 6,367 Net Income