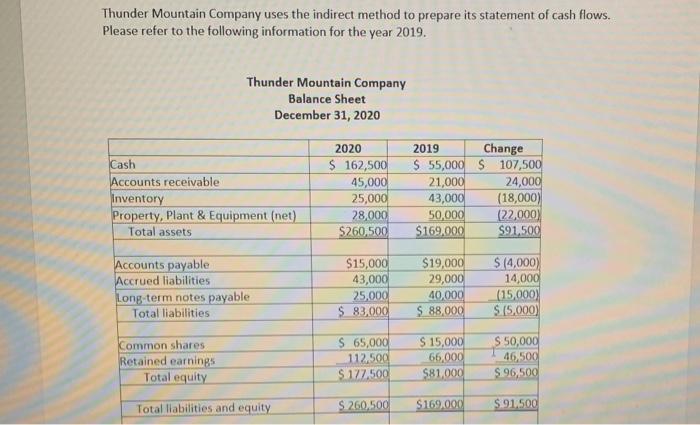

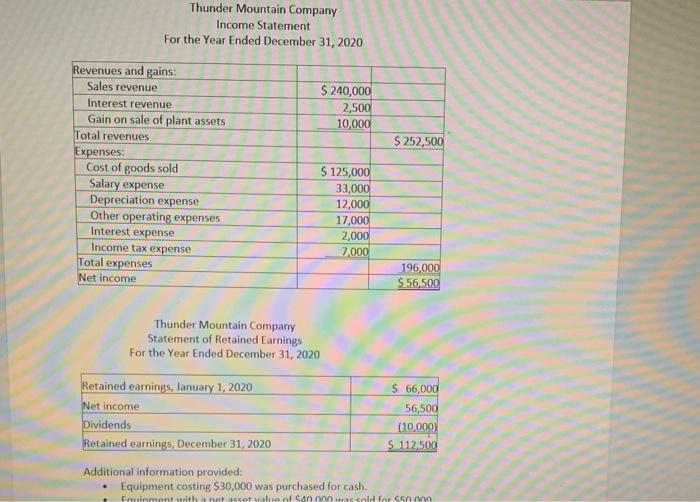

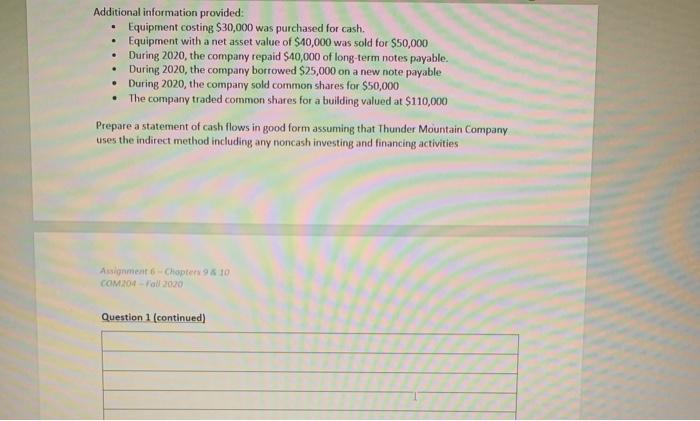

Thunder Mountain Company uses the indirect method to prepare its statement of cash flows. Please refer to the following information for the year 2019. Thunder Mountain Company Balance Sheet December 31, 2020 Cash Accounts receivable Inventory Property, Plant & Equipment (net) Total assets 2020 $ 162,500 45,000 25,000 28,000 S260,500 2019 Change $ 55,000 $ 107,500 21,000 24,000 43,000 (18,000) 50,000 22,000) $169,000 $91,500 Accounts payable Accrued liabilities Long term notes payable Total liabilities $15,000 43,000 25,000 $ 83,000 $19,000 29,000 40.000 $ 88,000 S (4,000) 14,000 (15,000) $ 15,000) Common shares Retained earnings Total equity $ 65,000 112.500 $ 177.500 $ 15,000 66,000 $81.000 S 50,000 46,500 $ 96,500 Total liabilities and equity $ 260,500 $ 169,000 $.91.500 Thunder Mountain Company Income Statement For the Year Ended December 31, 2020 $ 240,000 2,500 10,000 $ 252,500 Revenues and gains: Sales revenue Interest revenue Gain on sale of plant assets Total revenues Expenses: Cost of goods sold Salary expense Depreciation expense Other operating expenses Interest expense Income tax expense Total expenses Net income $ 125,000 33,000 12,000 17,000 2,000 7,000 196,000 S.56,500 Thunder Mountain Company Statement of Retained Earnings For the Year Ended December 31, 2020 Retained earnings, January 1, 2020 Net income Dividends Retained earnings, December 31, 2020 $ 66,000 56,500 (10,000) S 112.500 Additional information provided: Equipment costing $30,000 was purchased for cash. Finment with set walf san fran . . Additional information provided Equipment costing $30,000 was purchased for cash. Equipment with a net asset value of $40,000 was sold for $50,000 During 2020, the company repaid $40,000 of long-term notes payable. During 2020, the company borrowed $25,000 on a new note payable During 2020, the company sold common shares for $50,000 The company traded common shares for a building valued at $110,000 Prepare a statement of cash flows in good form assuming that Thunder Mountain Company uses the indirect method including any noncash investing and financing activities Assignment Chapter 9 & 10 COM204 a 2020 Question 1 (continued)