Answered step by step

Verified Expert Solution

Question

1 Approved Answer

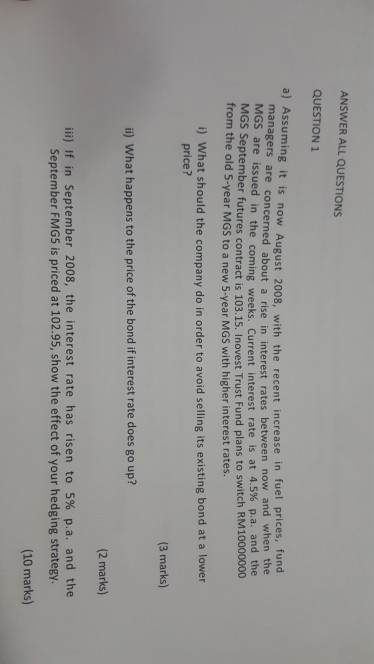

assuming it is now august 2008, with the recent ANSWER ALL QUESTIONS QUESTION 1 a) Assuming it is now August 2008, with the recent increase

assuming it is now august 2008, with the recent

ANSWER ALL QUESTIONS QUESTION 1 a) Assuming it is now August 2008, with the recent increase in fuel prices, fund managers are concerned about a rise in interest rates between now and when the as are issued in the coming weeks. Current interest rate is at 4.5% pa. and the s September futures contract is 103.15. Inovest Trust Fund plans to switch RM10000000 MGS from the old S-year MGS to a new 5-year MGS with higher interest rates. i) What should the company do in order to avoid selling its existing bond at a lower price? (3 marks) i) What happens to the price of the bond if interest rate does go up? (2 marks) iii) If in September 2008, the interest rate has risen to 5% pa. and the September FMG5 is priced at 102.95, show the effect of your hedging strategy. (10 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started