Question: Assuming Jay and JoAnn have this same business that they run as a partnership, prepare their joint Federal income tax return for 2 0 2

Assuming Jay and JoAnn have this same business that they run as a partnership, prepare their joint Federal income tax return for Attached is the copy of the partnership K for each of them a total of Forms K Assume that they have no dependents, do not have any other income or itemized deductions, and they made quarterly Federal income tax payments totaling $ Dont forget to include a standard deduction. Create the preliminary tax worksheet. begintabularll

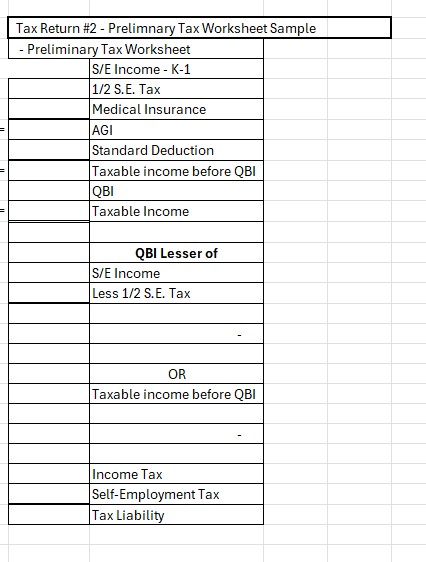

hline & Tax Return # Prelimnary Tax Worksheet

hline & Preliminary Tax Worksheet

hline & SE Income K

hline & SE Tax

hline & Medical Insurance

hline & AGI

hline & Standard Deduction

hline & Taxable income before QBI

hline & QBI

hline & Taxable Income

hline &

hline & QBI Lesser of

hline & SE Income

hline & Less SE Tax

hline &

hline &

hline &

hline & OR

hline & Taxable income before QBI

hline &

hline &

hline &

hline & Income Tax

hline & SelfEmployment Tax

hline & Tax Liability

hline

endtabular Jay Jefferson K Statement Sch K JoAnn Jefferson K Statement Sch K

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock