Question: Assuming Jay and JoAnn have this same business that they run as a partnership, prepare their joint Federal income tax return for 2022. Attached is

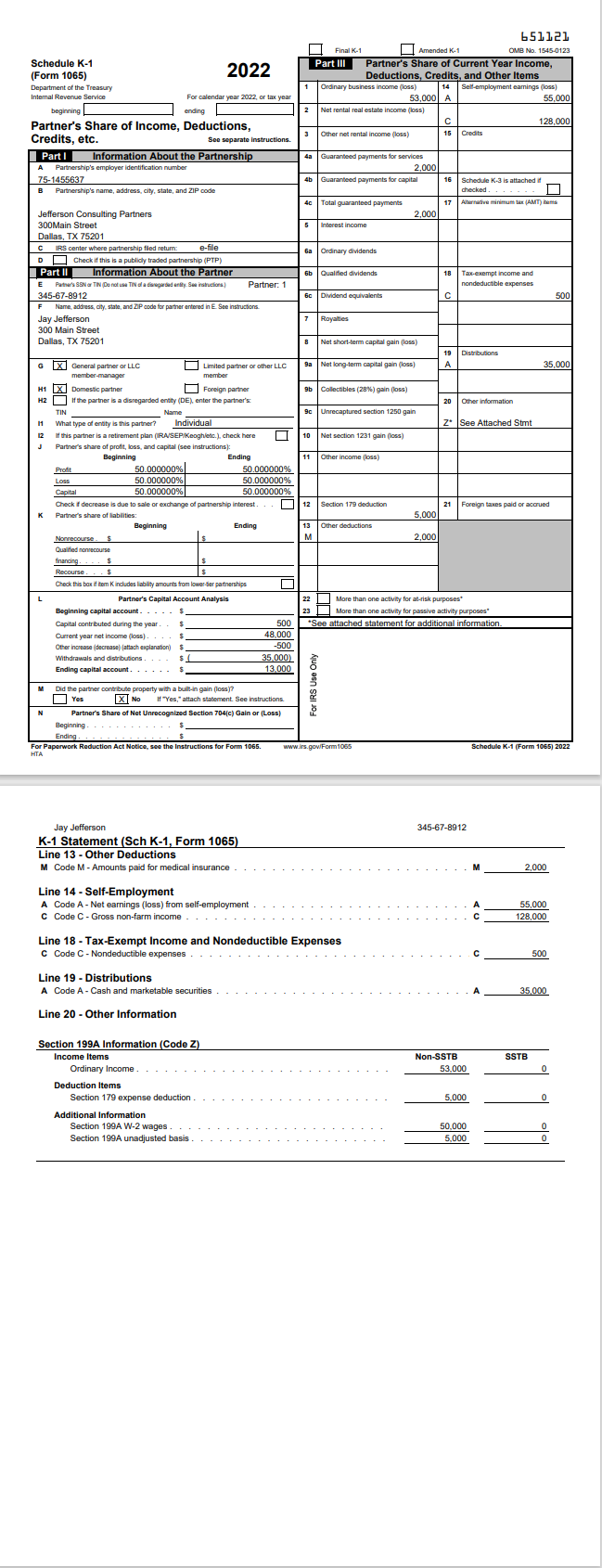

Assuming Jay and JoAnn have this same business that they run as a partnership, prepare their joint Federal income tax return for 2022. Attached is the copy of the partnership K-1 for each of them. Assume that they have no dependents, do not have any other income or itemized deductions, and they made quarterly Federal income tax payments totaling $7,000. Don't forget to include a standard deduction. Complete Schedule E (page 2), Schedule SEs, Form 4562, and a Form 1040. Submit return and all required forms in E-Campus. When the taxpayers receive K-1's, start with Schedule E and work forward to Schedule SE and Form 8995, then complete the actual Form 1040.

651121 Final K-1 Schedule K-1 (Form 1065) Department of the Treasury Internal Revenue Service beginning Partner's Share of Income, Deductions, Credits, etc. Part I Information About the Partnership Partnership's employer identification number 75-1455637 B Partnership's name, address, city, state, and ZIP code Jefferson Consulting Partners Part III 2022 Amended K-1 Partner's Share of Current Year Income, OMB No. 1545-0123 Deductions, Credits, and Other Items 1 Ordinary business income (loss) 14 Self-employment earnings (loss) For calendar year 2022, or tax year ending 53,000 A 55,000 2 Net rental real estate income (loss) C 128,000 Other net rental income (loss) 15 Credits See separate instructions. Guaranteed payments for services 2,000 Guaranteed payments for capital 16 Schedule K-3 is attached f checked Total guaranteed payments 17 Alternative minimum tax (AMT) 2,000 300Main Street 5 Interest income Dallas, TX 75201 IRS center where partnership filed return: Part II e-file Check if this is a publicly traded partnership (PTP) Information About the Partner Partner's SSN TIN (Do not use TIN of a disregarded entity. See instructions) 345-67-8912 E F Name, address, city, state, and ZIP code for partner entered in E. See instructions Jay Jefferson 300 Main Street Dallas, TX 75201 6a Ordinary dividends 6b Qualified dividends Partner: 1 18 Tax-exempt income and nondeductible expenses Dividend equivalents C 500 7 Royalties 8 Net short-term capital gain (loss) 19 Distributions G XGeneral partner or LLC member-manager Domestic partner Limited partner or other LLC member Net long-term capital gain (loss) 35,000 J H1 H2 TIN Foreign partner If the partner is a disregarded entity (DE), enter the partner's: What type of entity is this partner? Individual If this partner is a retirement plan (IRA/SEP/Keogh etc.), check here Partner's share of profit, loss, and capital (see instructions): 9b Collectibles (28%) gain (loss) 20 Other information 9c Unrecaptured section 1250 gain Z* See Attached Stmt 10 Net section 1231 gain (loss) Profit Loss Capital Beginning 50.000000% 50.000000% 50.000000% Ending 11 Other income (loss) 50.000000% 50.000000% 50.000000% Check if decrease is due to sale or exchange of partnership interest. Partner's share of liabilities: 12 Section 179 deduction 21 Foreign taxes paid or accrued 5,000 Beginning Ending 13 Other deductions Nonrecourse M 2,000 Qualified nonrecourse financing....$ Recourse $ Check this box if item Kincludes liability amounts from lower-dier partnerships L Partner's Capital Account Analysis Beginning capital account. Capital contributed during the year.. Current year net income (loss). $ Other increase (decrease) (attach explanation) $ 22 23 500 48,000 35,000) 13,000 Withdrawals and distributions. Ending capital account.. Did the partner contribute property with a built-in gain (loss)? Yes No If "Yes," attach statement. See instructions. N Partner's Share of Net Unrecognized Section 704(c) Gain or (Loss) Beginning Ending For Paperwork Reduction Act Notice, see the Instructions for Form 1065. Jay Jefferson K-1 Statement (Sch K-1, Form 1065) Line 13 - Other Deductions M Code M - Amounts paid for medical insurance. Line 14 - Self-Employment More than one activity for at-risk purposes* More than one activity for passive activity purposes" *See attached statement for additional information. or IRS Use Only www.irs.gov/Form1065 Schedule K-1 (Form 1065) 2022 A Code A - Net earnings (loss) from self-employment C Code C - Gross non-farm income Line 18 - Tax-Exempt Income and Nondeductible Expenses C Code C - Nondeductible expenses. Line 19 - Distributions A Code A - Cash and marketable securities Line 20 - Other Information Section 199A Information (Code Z) Income Items Ordinary Income.. Deduction Items 345-67-8912 M 2,000 55,000 128,000 500 35,000 Non-SSTB SSTB 53,000 Section 179 expense deduction. 5,000 Additional Information Section 199A W-2 wages. 50,000 Section 199A unadjusted basis. 5,000 0

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

To prepare Jay and JoAnns joint Federal income tax return for 2022 Ill start with the information provided in the partnership K1s Since they are a par... View full answer

Get step-by-step solutions from verified subject matter experts