Question

Assuming Jeff and JoAnn this year started this same business that they run as a general S corporation, prepare the income tax return for 2019.

Assuming Jeff and JoAnn this year started this same business that they run as a general S corporation, prepare the income tax return for 2019. They each contributed $500 (a total of $1,000) in exchange for common stock. They each received a W-2 salary from the business.

You should complete a Form 1120-S including a Form 4562.

Note: In computing the income distributed on this K-1. the salaries were subtracted but the section 179 depreciation was not subtracted and reported separately. The amount of the officer's health insurance was deducted by the corporation, included in the W-2 wages and indicated on box 12 of the W-2.

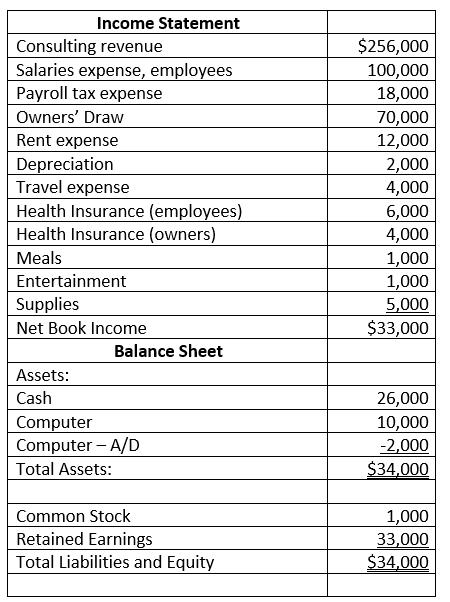

Income Statement Consulting revenue Salaries expense, employees Payroll tax expense Owners' Draw Rent expense Depreciation Travel expense Health Insurance Health Insurance (owners) Meals Entertainment Supplies Net Book Income Assets: Cash (employees) Balance Sheet Computer Computer - A/D Total Assets: Common Stock Retained Earnings Total Liabilities and Equity $256,000 100,000 18,000 70,000 12,000 2,000 4,000 6,000 4,000 1,000 1,000 5,000 $33,000 26,000 10,000 -2,000 $34,000 1,000 33,000 $34,000

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Form 1120S for AutoCare Plus Inc Part I Income Gross Receipts or Sales 50000000 Returns and Allowanc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started