Loveshine is an Australian retailer that sells skincare, make-up, hair care and body products. It only sells products that meet its strict ethical and environmental

Loveshine is an Australian retailer that sells skincare, make-up, hair care and body products. It only sells products that meet its strict ethical and environmental standards.

Loveshine does not sell products that are harmful to the environment (eg those that contain toxic ingredients or are packaged in single-use plastic). The company maintains an ethical supply chain that produces no harmful impacts on people or animals.

Loveshine provides consumers with information about their products to help consumers make ethical, environmentally friendly and well-considered choices with their purchase from Loveshine’s online and retail stores.

Loveshine has developed its own range of personal care products called ‘Naturelove’. This range includes shampoo, conditioner, toothpaste and beauty creams. All products in the Naturelove range are produced under the highest ethical standards and contain no toxic ingredients. All Naturelove packaging can be composted or returned for recycling at Loveshine’s retail stores

The corporate tax rate applicable to Loveshine is 30%.

Lightning Limited

On 1 October 2020, Loveshine acquired 60% of the shares in Lightning Limited, a smaller, reputable company in the market. Loveshine believes this acquisition will target buyers who are looking for a cheaper alternative when purchasing environmentally friendly products.

The consideration Loveshine transferred for the acquisition of Lightning was $18,000,000 in cash.

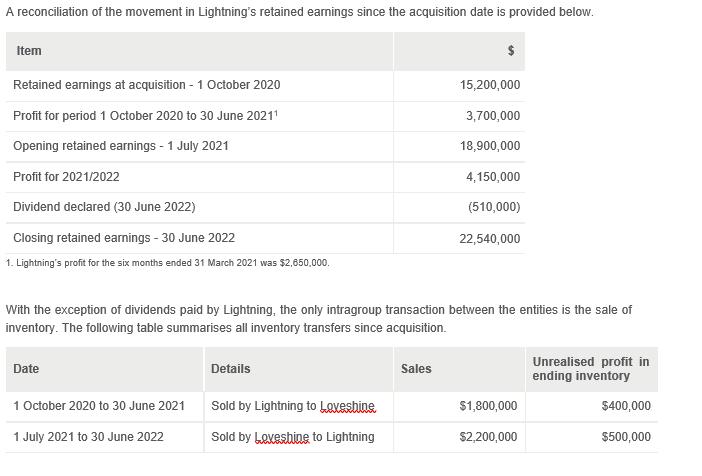

Loveshine also agreed to pay Lightning’s former shareholders an extra $900,000 if Lightning achieved a target profit of $2,500,000 in the six months following the acquisition. At the acquisition date, the fair value of this possible additional payment was considered to be $700,000.

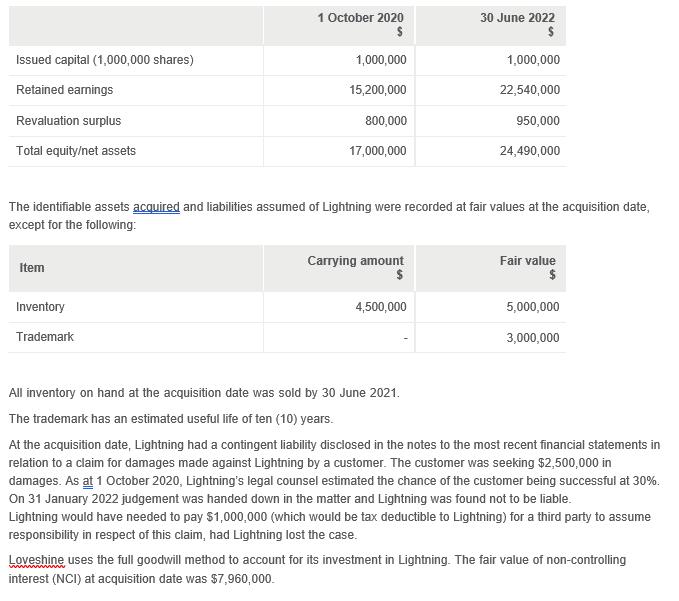

Details of Lightning’s recorded net assets are as follows:

Required:

1. Prepare the acquisition analysis for Loveshine’s investment in Lightning to calculate total goodwill and the allocation of goodwill between Loveshine and the non-controlling interest at 30 June 2022.

2. Prepare all consolidation journals for Loveshine’s investment in Lightning for the year ended 30 June 2022. Show all workings.

3. To avoid paying $900,000 to Lightning's former shareholders for meeting the $2,500,000 earnings target, Loveshine's board requested Loveshine's CFO (who is a Chartered Accountant) to suggest a way to reduce Lightning's profit. The CFO suggested for Loveshine to charge Lightning a management fee, which would reduce Lightning's profit for the six months to 31 March 2021 to less than $2,500,000. Identify and explain two key ethical issues that arise from the CFO's suggestion.

Issued capital (1,000,000 shares) Retained earnings Revaluation surplus Total equity/net assets Item 1 October 2020 $ Inventory Trademark 1,000,000 15,200,000 800,000 17,000,000 The identifiable assets acquired and liabilities assumed of Lightning were recorded at fair values at the acquisition date, except for the following: Carrying amount $ 30 June 2022 $ 4,500,000 1,000,000 22,540,000 950,000 24,490,000 Fair value 5,000,000 3,000,000 All inventory on hand at the acquisition date was sold by 30 June 2021. The trademark has an estimated useful life of ten (10) years. At the acquisition date, Lightning had a contingent liability disclosed in the notes to the most recent financial statements in relation to a claim for damages made against Lightning by a customer. The customer was seeking $2,500,000 in damages. As at 1 October 2020, Lightning's legal counsel estimated the chance of the customer being successful at 30%. On 31 January 2022 judgement was handed down in the matter and Lightning was found not to be liable. Lightning would have needed to pay $1,000,000 (which would be tax deductible to Lightning) for a third party to assume responsibility in respect of this claim, had Lightning lost the case. Loveshine uses the full goodwill method to account for its investment in Lightning. The fair value of non-controlling interest (NCI) at acquisition date was $7,960,000.

Step by Step Solution

3.45 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

1 The acquisition analysis for Loveshines investment in Lightning to ca...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started