Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assuming no employees are subject to ceilings for their earnings, Harris Company has the following information for the pay period of January 15-31. Gross payroll

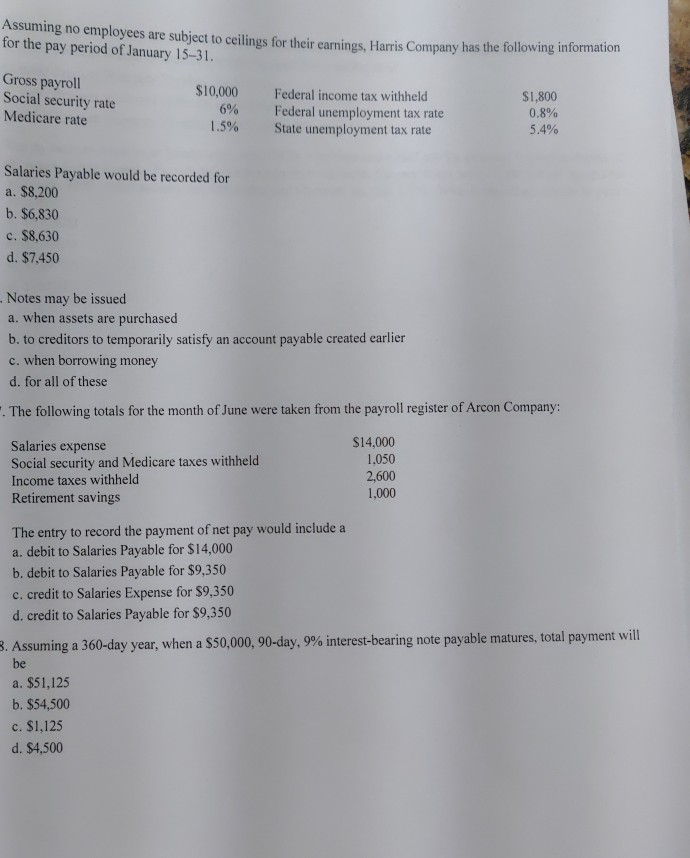

Assuming no employees are subject to ceilings for their earnings, Harris Company has the following information for the pay period of January 15-31. Gross payroll Social security rate Medicare rate $10,000 6% 1.5% Federal income tax withheld Federal unemployment tax rate State unemployment tax rate $1,800 0.8% 5.4% Salaries Payable would be recorded for a. $8,200 b. $6,830 c. $8,630 d. $7.450 Notes may be issued a. when assets are purchased b. to creditors to temporarily satisfy an account payable created earlier c. when borrowing money d. for all of these Thlowing total forte of im re taken from the payoll rgiater of Arcon Comary Salaries expense Social security and Medicare taxes withheld Income taxes withheld Retirement savings S14,000 1.050 2,600 1,000 The entry to record the payment of net pay would include a a. debit to Salaries Payable for $14,000 b. debit to Salaries Payable for $9,350 c. credit to Salaries Expense for $9,350 d. credit to Salaries Payable for $9,350 . Assuming a 360 day year, when a $50,000, 90 day, 9% interest-bearing note payable matures, total payment will be a. $51,125 b. $54,500 c. $1,125 d. $4,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started