Assuming PTS manufactures two products: Mang and Banny.

Mang has a direct cost of $100. Its manufacturing process uses 10 hours in Mixing, 10 hours in Assemblyand 2 hours in finishing department. Banny has a direct cost of $200 and each unit requires 10 hours in Mixing, 20 hours in Assembly and 20 hours in Finishing. Calculate the manufacturing costs assigned to each unitof product.

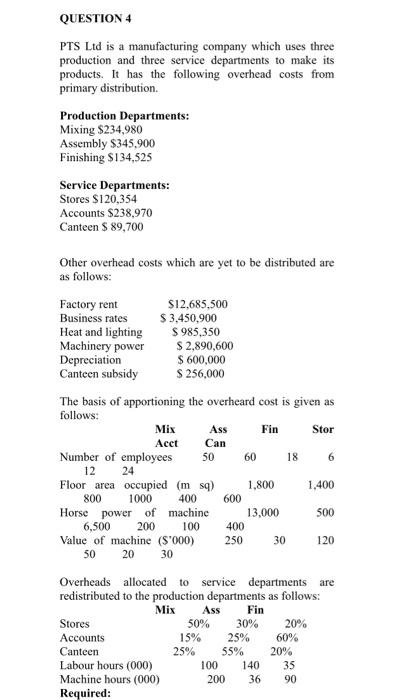

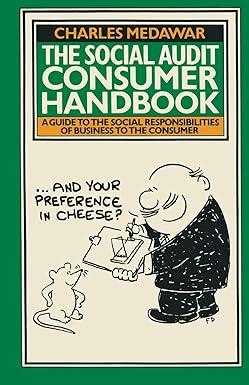

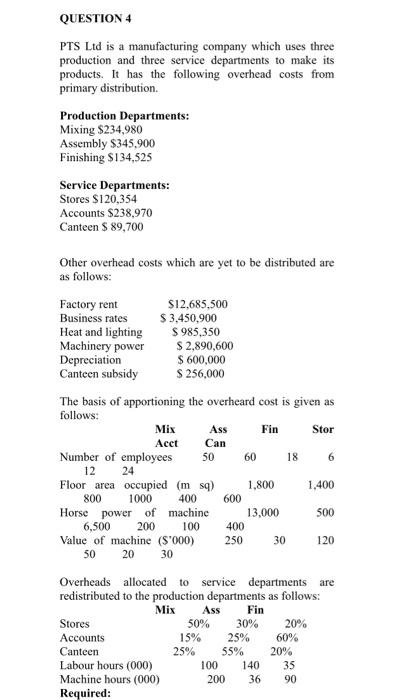

A. Prepare overhead analysis sheet to determine the total overhead allocated to production departments.

NB: Round all figures up to the nearest whole number.

B. Calculate the overhead absorption rates using an appropriate base

C. Assuming PTS manufactures two products: Mang and Banny.

Mang has a direct cost of $100. Its manufacturing process uses 10 hours in Mixing, 10 hours in Assembly and 2 hours in finishing department. Banny has a direct cost of $200 and each unit requires 10 hours in Mixing, 20 hours in Assembly and 20 hours in Finishing. Calculate the manufacturing costs assigned to each unit of product.

QUESTION 4 PTS Ltd is a manufacturing company which uses three production and three service departments to make its products. It has the following overhead costs from primary distribution Production Departments: Mixing $234,980 Assembly $345,900 Finishing S134,525 Service Departments: Stores $120,354 Accounts $238,970 Canteen $ 89,700 Other overhead costs which are yet to be distributed are as follows: Factory rent $12,685,500 Business rates $ 3.450,900 Heat and lighting $ 985,350 Machinery power $ 2,890,600 Depreciation $ 600,000 Canteen subsidy $ 256,000 The basis of apportioning the overheard cost is given as follows: Mix Ass Fin Stor Acct Can Number of employees 50 60 18 6 12 24 Floor area occupied ( msg) 1.800 1,400 800 1000 400 600 Horse power of machine 13.000 500 6,500 200 100 400 Value of machine (S'000) 250 30 50 20 30 120 Overheads allocated to service departments are redistributed to the production departments as follows: Mix Ass Fin Stores 50% 30% 20% Accounts 15% 25% 60% Canteen 25% 55% 20% Labour hours (000) 100 140 35 Machine hours (000) 200 36 90 Required: QUESTION 4 PTS Ltd is a manufacturing company which uses three production and the service departments to make its products. It has the following othead costs from primary distribution Production Departments: Mixing $234.980 Assembly S345.900 Finishing $134,525 Service Departments: Stores $120.354 Accounts $238,970 Canteen $ 89,700 Other overhead costs which we yet to be distributed are as follows: Factory rent $12.685 500 Business rates S 3.450,900 Heat and lighting S 985 350 Machinery power $ 2.890.00 Depreciation $ 600.000 Canteen subsidy $ 25,000 The basis of apportioning the overhead cost is given as follows: Mis Ster Act Can Number of comployees 50 60 12 24 Floor area occupied (m) 1800 1,400 800 1000 400 600 Horsepower of machine 13.000 300 6,500 200 100 400 Value of machine (5000) 120 50 20 30 18 6 Overheads allocated to service departments are redistributed to the production departments as follows: Mix Ass Stores 50% 30 2013 Accounts 15 60 Canteen 255 55% 20% Labour hours (000) 100 35 Machine hours (000) 36 90 Required: Prepare overhead analysis sheet to determine the total overhead allocated to production departments NB: Round all figures up to the nearest whole number B. Calculate the overhead absceptie rates using an appropriate base C. Assuming PTS manufactures two products. Mang and Banny Mang has a direct cost of $100. 's manufacturing process uses 10 hours in Mixing, 10 hours in Assembly and 2 hours in finishing department Banny has a direct cost of $200 and each unit requires 10 hours in Mising. 20 hours in Assembly and 20 hours in Finishing Calculate the manufacturing costs aged to each unit of product QUESTION 4 PTS Ltd is a manufacturing company which uses three production and three service departments to make its products. It has the following overhead costs from primary distribution Production Departments: Mixing $234,980 Assembly $345,900 Finishing S134,525 Service Departments: Stores $120,354 Accounts $238,970 Canteen $ 89,700 Other overhead costs which are yet to be distributed are as follows: Factory rent $12,685,500 Business rates $ 3.450,900 Heat and lighting $ 985,350 Machinery power $ 2,890,600 Depreciation $ 600,000 Canteen subsidy $ 256,000 The basis of apportioning the overheard cost is given as follows: Mix Ass Fin Stor Acct Can Number of employees 50 60 18 6 12 24 Floor area occupied ( msg) 1.800 1,400 800 1000 400 600 Horse power of machine 13.000 500 6,500 200 100 400 Value of machine (S'000) 250 30 50 20 30 120 Overheads allocated to service departments are redistributed to the production departments as follows: Mix Ass Fin Stores 50% 30% 20% Accounts 15% 25% 60% Canteen 25% 55% 20% Labour hours (000) 100 140 35 Machine hours (000) 200 36 90 Required: QUESTION 4 PTS Ltd is a manufacturing company which uses three production and the service departments to make its products. It has the following othead costs from primary distribution Production Departments: Mixing $234.980 Assembly S345.900 Finishing $134,525 Service Departments: Stores $120.354 Accounts $238,970 Canteen $ 89,700 Other overhead costs which we yet to be distributed are as follows: Factory rent $12.685 500 Business rates S 3.450,900 Heat and lighting S 985 350 Machinery power $ 2.890.00 Depreciation $ 600.000 Canteen subsidy $ 25,000 The basis of apportioning the overhead cost is given as follows: Mis Ster Act Can Number of comployees 50 60 12 24 Floor area occupied (m) 1800 1,400 800 1000 400 600 Horsepower of machine 13.000 300 6,500 200 100 400 Value of machine (5000) 120 50 20 30 18 6 Overheads allocated to service departments are redistributed to the production departments as follows: Mix Ass Stores 50% 30 2013 Accounts 15 60 Canteen 255 55% 20% Labour hours (000) 100 35 Machine hours (000) 36 90 Required: Prepare overhead analysis sheet to determine the total overhead allocated to production departments NB: Round all figures up to the nearest whole number B. Calculate the overhead absceptie rates using an appropriate base C. Assuming PTS manufactures two products. Mang and Banny Mang has a direct cost of $100. 's manufacturing process uses 10 hours in Mixing, 10 hours in Assembly and 2 hours in finishing department Banny has a direct cost of $200 and each unit requires 10 hours in Mising. 20 hours in Assembly and 20 hours in Finishing Calculate the manufacturing costs aged to each unit of product