Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assuming purchase costs are declining, determine which statements below correctly describe what happens to cost of goods sold under FIFO, LIFO and weighted average cost

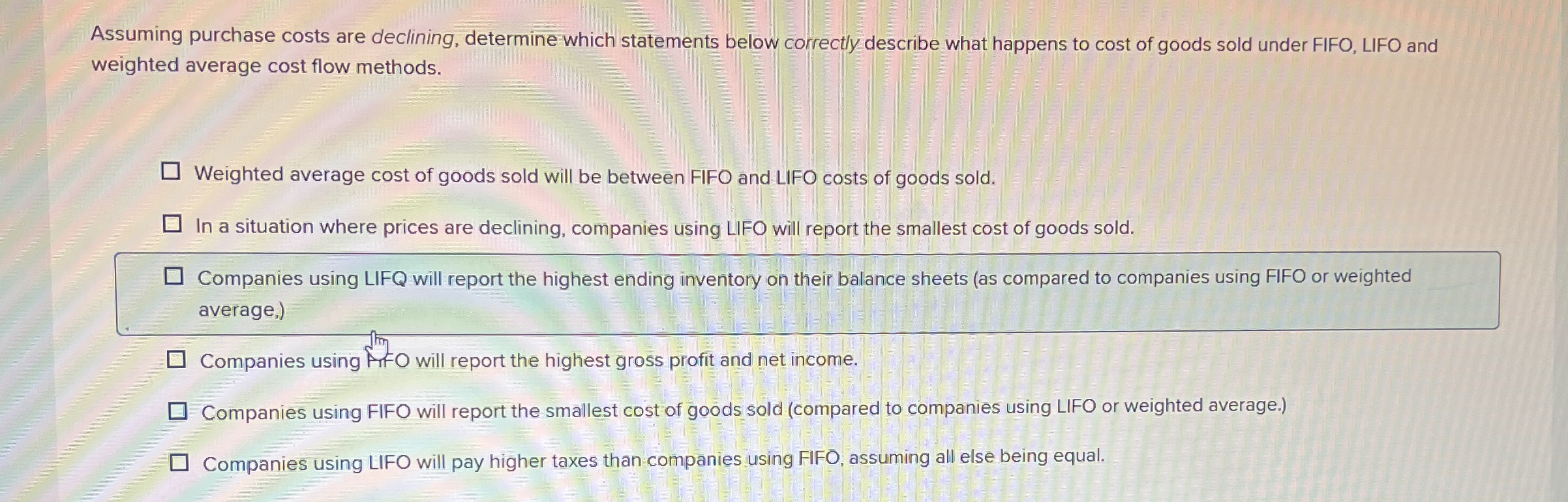

Assuming purchase costs are declining, determine which statements below correctly describe what happens to cost of goods sold under FIFO, LIFO and

weighted average cost flow methods.

Weighted average cost of goods sold will be between FIFO and LIFO costs of goods sold.

In a situation where prices are declining, companies using LIFO will report the smallest cost of goods sold.

Companies using LIFQ will report the highest ending inventory on their balance sheets as compared to companies using FIFO or weighted

average,

Companies using frFO will report the highest gross profit and net income.

Companies using FIFO will report the smallest cost of goods sold compared to companies using LIFO or weighted average.

Companies using LIFO will pay higher taxes than companies using FIFO, assuming all else being equal.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started