Answered step by step

Verified Expert Solution

Question

1 Approved Answer

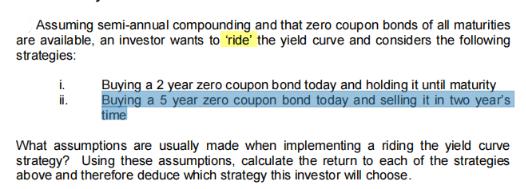

Assuming semi-annual compounding and that zero coupon bonds of all maturities are available, an investor wants to 'ride' the yield curve and considers the

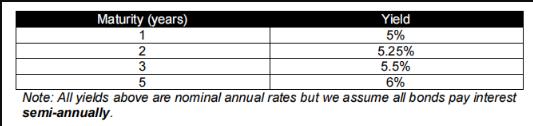

Assuming semi-annual compounding and that zero coupon bonds of all maturities are available, an investor wants to 'ride' the yield curve and considers the following strategies: i. ii. Buying a 2 year zero coupon bond today and holding it until maturity Buying a 5 year zero coupon bond today and selling it in two year's time What assumptions are usually made when implementing a riding the yield curve strategy? Using these assumptions, calculate the return to each of the strategies above and therefore deduce which strategy this investor will choose. Maturity (years) 1 2 3 5 Yield 5% 5.25% 5.5% 6% Note: All yields above are nominal annual rates but we assume all bonds pay interest semi-annually.

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Assumptions usually made when implementing a riding the yield curve strategy The yield curve remains ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started