Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assuming Tech Geek's annualized WACC (weighted average cost of capital) is 8% and its innualized CFFA(Cash flow from Assets) are growing at 5%, you are

Assuming Tech Geek's annualized WACC (weighted average cost of capital) is 8% and its

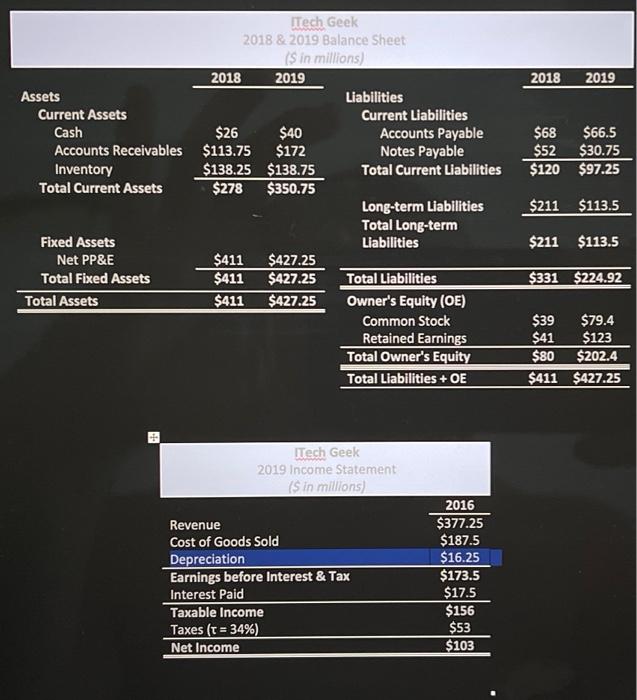

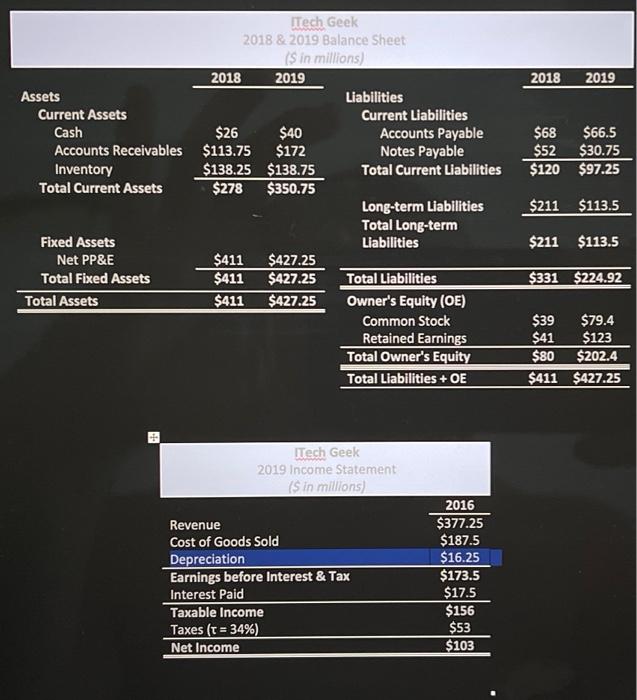

2018 2019 $26 $68 $66.5 $52 $30.75 $120 $97.25 Tech Geek 2018 & 2019 Balance Sheet (Sin millions) 2018 2019 Assets Liabilities Current Assets Current Liabilities Cash $40 Accounts Payable Accounts Receivables $113.75 $172 Notes Payable Inventory $138.25 $138.75 Total Current Liabilities Total Current Assets $278 $350.75 Long-term Liabilities Total Long-term Fixed Assets Liabilities Net PP&E $411 $427.25 Total Fixed Assets $411 $427.25 Total Liabilities Total Assets $411 $427.25 Owner's Equity (OE) Common Stock Retained Earnings Total Owner's Equity Total Liabilities + OE $211 $113.5 $211 $113.5 $331 $224.92 $39 $79.4 $41 $123 $80 $202.4 $411 $427.25 Tech Geek 2019 Income Statement (Sin millions) Revenue Cost of Goods Sold Depreciation Earnings before Interest & Tax Interest Paid Taxable income Taxes (t = 34%) Net Income 2016 $377.25 $187.5 $16.25 $173.5 $17.5 $156 $53 $103 innualized CFFA(Cash flow from Assets) are growing at 5%, you are to estimate the current value of ITech Geek.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started