Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assuming that FDI decides to move its production overseas, and using Rileys expected changes in costs from such a change in manufacturing and projected growth

Assuming that FDI decides to move its production overseas, and using Rileys expected changes in costs from such a change in manufacturing and projected growth rates (Table 2), how long would it take to achieve Rossis profitability goal?

What do you think FDI should do with its production: continue in North America or move it overseas? Discuss the quantitative, qualitative, and ethical factors, if any, that come into play with this decision

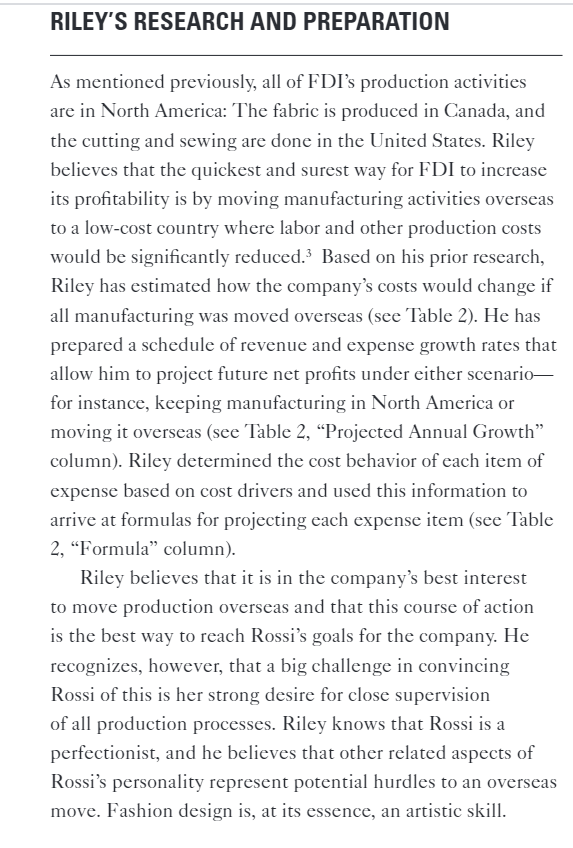

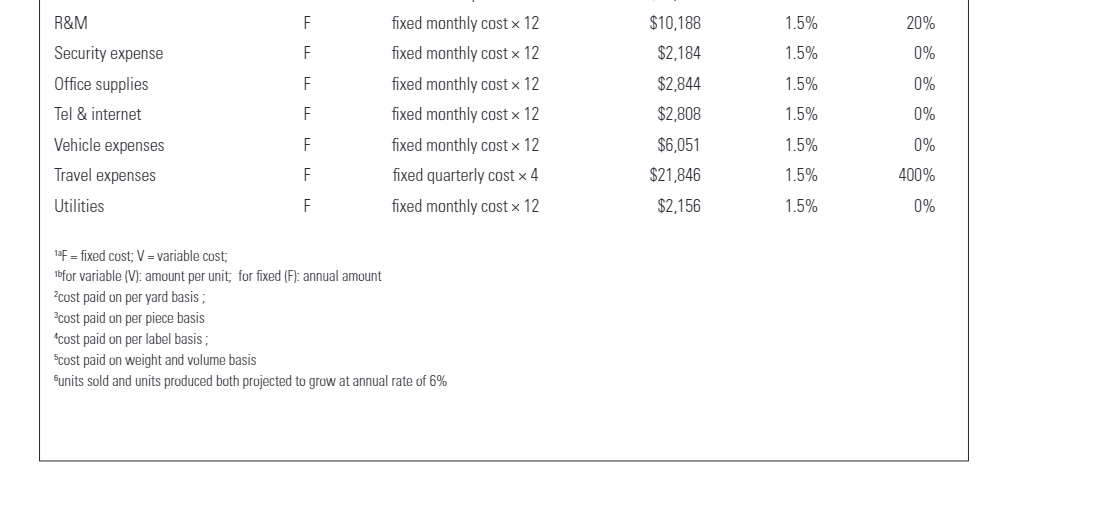

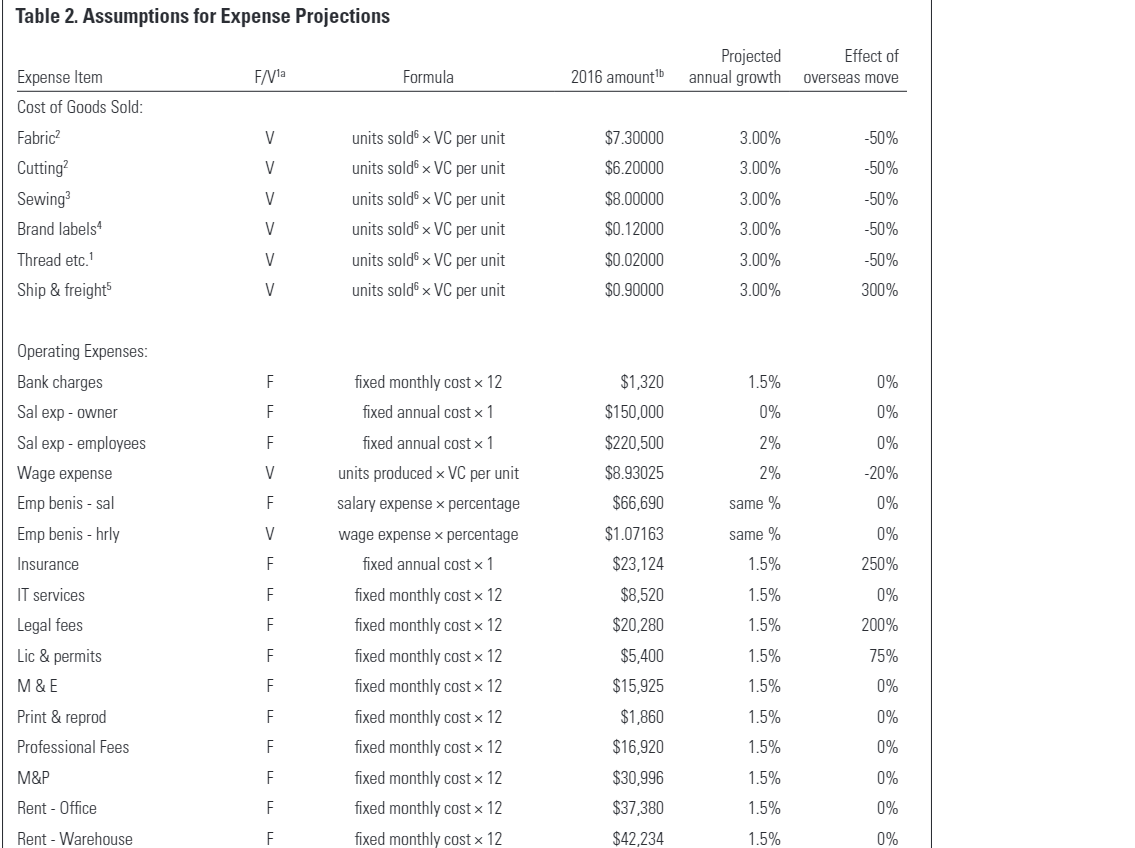

RILEY'S RESEARCH AND PREPARATION As mentioned previously, all of FDI's production activities are in North America: The fabric is produced in Canada, and the cutting and sewing are done in the United States. Riley believes that the quickest and surest way for FDI to increase its profitability is by moving manufacturing activities overseas to a low-cost country where labor and other production costs would be significantly reduced. Based on his prior research, Riley has estimated how the company's costs would change if all manufacturing was moved overseas (see Table 2). He has prepared a schedule of revenue and expense growth rates that allow him to project future net profits under either scenario- for instance, keeping manufacturing in North America or moving it overseas (see Table 2, Projected Annual Growth column). Riley determined the cost behavior of each item of expense based on cost drivers and used this information to arrive at formulas for projecting each expense item (see Table 2, Formula column). Riley believes that it is in the company's best interest to move production overseas and that this course of action is the best way to reach Rossi's goals for the company. He recognizes, however, that a big challenge in convincing Rossi of this is her strong desire for close supervision of all production processes. Riley knows that Rossi is a perfectionist, and he believes that other related aspects of Rossi's personality represent potential hurdles to an overseas move. Fashion design is, at its essence, an artistic skill. R&M F 1.5% 20% F 1.5% 0% 1.5% 0% Security expense Office supplies Tel & internet Vehicle expenses Travel expenses F F fixed monthly cost x 12 fixed monthly cost x 12 fixed monthly cost x 12 fixed monthly cost x 12 fixed monthly cost x 12 fixed quarterly cost x 4 fixed monthly cost x 12 $10,188 $2,184 $2,844 $2,808 $6,051 $21,846 1.5% 0% F 1.5% 0% 400% F 1.5% Utilities F $2,156 1.5% 0% 1aF = fixed cost; V=variable cost; 1bfor variable (V): amount per unit, for fixed (F): annual amount ?cost paid on per yard basis; 3cost paid on per piece basis 'cost paid on per label basis; Scost paid on weight and volume basis Sunits sold and units produced both projected to grow at annual rate of 6% Table 2. Assumptions for Expense Projections Projected annual growth Effect of Overseas move F/V1a Formula 2016 amount Expense Item Cost of Goods Sold: V 3.00% -50% V $7.30000 $6.20000 $8.00000 3.00% -50% V -50% Fabric Cutting? Sewing Brand labels Thread etc.) Ship & freight units solde x VC per unit units solde x VC per unit units solde VC per unit units solde VC per unit units soldex VC per unit units solde x VC per unit 3.00% 3.00% V $0.12000 -50% V $0.02000 3.00% -50% V $0.90000 3.00% 300% F 1.5% 0% fixed monthly cost x 12 fixed annual cost x 1 $1,320 $150,000 F 0% 0% Operating Expenses: Bank charges Sal exp-owner Sal exp-employees Wage expense Emp benis - sal Emp benis - hrly F 2% fixed annual cost x 1 units produced x VC per unit salary expense x percentage 0% -20% V 2% F same % 0% V 0% wage expense x percentage fixed annual cost x 1 same % 1.5% Insurance F 250% IT services F 1.5% 0% F 1.5% 200% Legal fees Lic & permits M&E $220,500 $8.93025 $66,690 $1.07163 $23,124 $8,520 $20,280 $5,400 $15,925 $1,860 $16,920 $30,996 $37,380 $42,234 F 1.5% 75% F 1.5% fixed monthly cost x 12 fixed monthly cost x 12 fixed monthly cost x 12 fixed monthly cost x 12 fixed monthly cost x 12 fixed monthly cost x 12 fixed monthly cost x 12 fixed monthly cost x 12 fixed monthly cost x 12 0% 0% F Print & reprod Professional Fees 1.5% 1.5% F 0% F 1.5% 0% M&P Rent - Office F 1.5% 0% Rent - Warehouse F 1.5% 0% RILEY'S RESEARCH AND PREPARATION As mentioned previously, all of FDI's production activities are in North America: The fabric is produced in Canada, and the cutting and sewing are done in the United States. Riley believes that the quickest and surest way for FDI to increase its profitability is by moving manufacturing activities overseas to a low-cost country where labor and other production costs would be significantly reduced. Based on his prior research, Riley has estimated how the company's costs would change if all manufacturing was moved overseas (see Table 2). He has prepared a schedule of revenue and expense growth rates that allow him to project future net profits under either scenario- for instance, keeping manufacturing in North America or moving it overseas (see Table 2, Projected Annual Growth column). Riley determined the cost behavior of each item of expense based on cost drivers and used this information to arrive at formulas for projecting each expense item (see Table 2, Formula column). Riley believes that it is in the company's best interest to move production overseas and that this course of action is the best way to reach Rossi's goals for the company. He recognizes, however, that a big challenge in convincing Rossi of this is her strong desire for close supervision of all production processes. Riley knows that Rossi is a perfectionist, and he believes that other related aspects of Rossi's personality represent potential hurdles to an overseas move. Fashion design is, at its essence, an artistic skill. R&M F 1.5% 20% F 1.5% 0% 1.5% 0% Security expense Office supplies Tel & internet Vehicle expenses Travel expenses F F fixed monthly cost x 12 fixed monthly cost x 12 fixed monthly cost x 12 fixed monthly cost x 12 fixed monthly cost x 12 fixed quarterly cost x 4 fixed monthly cost x 12 $10,188 $2,184 $2,844 $2,808 $6,051 $21,846 1.5% 0% F 1.5% 0% 400% F 1.5% Utilities F $2,156 1.5% 0% 1aF = fixed cost; V=variable cost; 1bfor variable (V): amount per unit, for fixed (F): annual amount ?cost paid on per yard basis; 3cost paid on per piece basis 'cost paid on per label basis; Scost paid on weight and volume basis Sunits sold and units produced both projected to grow at annual rate of 6% Table 2. Assumptions for Expense Projections Projected annual growth Effect of Overseas move F/V1a Formula 2016 amount Expense Item Cost of Goods Sold: V 3.00% -50% V $7.30000 $6.20000 $8.00000 3.00% -50% V -50% Fabric Cutting? Sewing Brand labels Thread etc.) Ship & freight units solde x VC per unit units solde x VC per unit units solde VC per unit units solde VC per unit units soldex VC per unit units solde x VC per unit 3.00% 3.00% V $0.12000 -50% V $0.02000 3.00% -50% V $0.90000 3.00% 300% F 1.5% 0% fixed monthly cost x 12 fixed annual cost x 1 $1,320 $150,000 F 0% 0% Operating Expenses: Bank charges Sal exp-owner Sal exp-employees Wage expense Emp benis - sal Emp benis - hrly F 2% fixed annual cost x 1 units produced x VC per unit salary expense x percentage 0% -20% V 2% F same % 0% V 0% wage expense x percentage fixed annual cost x 1 same % 1.5% Insurance F 250% IT services F 1.5% 0% F 1.5% 200% Legal fees Lic & permits M&E $220,500 $8.93025 $66,690 $1.07163 $23,124 $8,520 $20,280 $5,400 $15,925 $1,860 $16,920 $30,996 $37,380 $42,234 F 1.5% 75% F 1.5% fixed monthly cost x 12 fixed monthly cost x 12 fixed monthly cost x 12 fixed monthly cost x 12 fixed monthly cost x 12 fixed monthly cost x 12 fixed monthly cost x 12 fixed monthly cost x 12 fixed monthly cost x 12 0% 0% F Print & reprod Professional Fees 1.5% 1.5% F 0% F 1.5% 0% M&P Rent - Office F 1.5% 0% Rent - Warehouse F 1.5% 0%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started