Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assuming that Fix-IT Inc. adopts the FIFO inventory system, calculate the cost of goods sold for FY 2021. Assuming that Fix-IT Inc. adopts the LIFO

Assuming that Fix-IT Inc. adopts the FIFO inventory system, calculate the cost of goods sold for FY 2021.

Assuming that Fix-IT Inc. adopts the LIFO inventory system, calculate the cost of goods sold for FY 2021.

Assuming all other things equal, how would taxable income for FY 2021 differ under 1 and 2? In other words, under which method would Fix-IT Inc. have a lower tax expense?

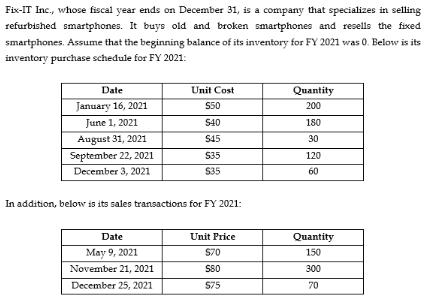

Fix-IT Inc., whose fiscal year ends on December 31, is a company that specializes in selling refurbished smartphones. It buys old and broken smartphones and resells the fixed smartphones. Assume that the beginning balance of its inventory for FY 2021 was 0. Below is its inventory purchase schedule for FY 2021: Date January 16, 2021 June 1, 2021 August 31, 2021 September 22, 2021 December 3, 2021 Unit Cost $50 $40 $45 535 $35 In addition, below is its sales transactions for FY 2021: Date May 9, 2021 November 21, 2021 December 25, 2021 Unit Price $70 S80 575 Quantity 200 180 30 120 60 Quantity 150 300 70

Step by Step Solution

★★★★★

3.32 Rating (140 Votes )

There are 3 Steps involved in it

Step: 1

Lets calculate the COGS under each method FIFO method Calculate the cost of goods sold for each sale...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started