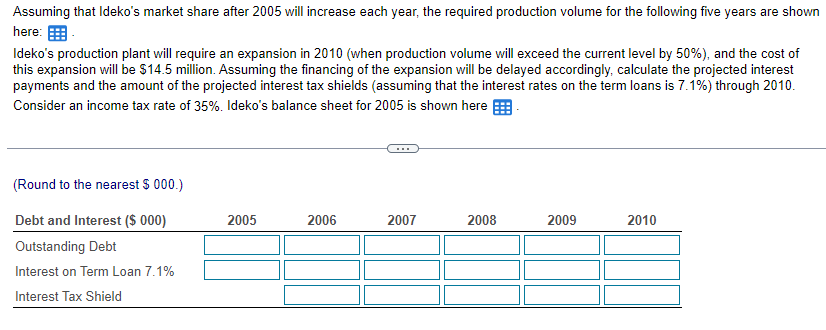

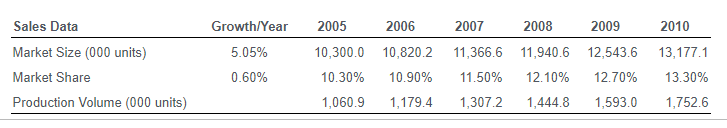

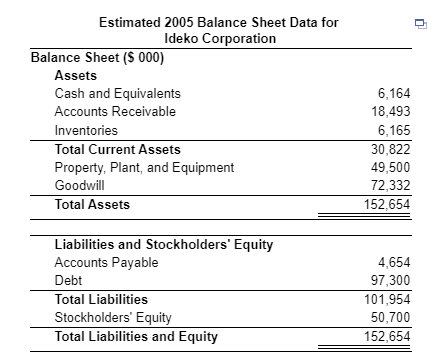

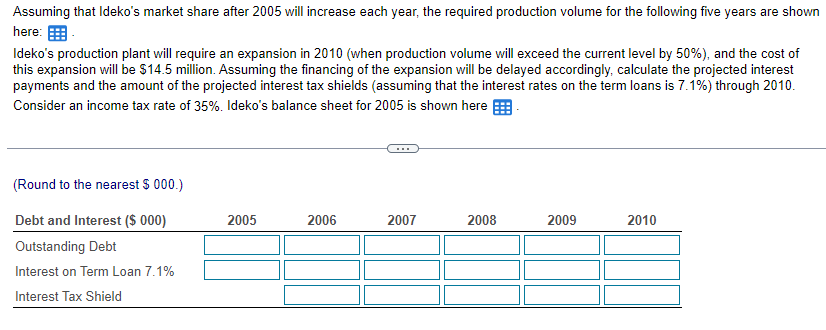

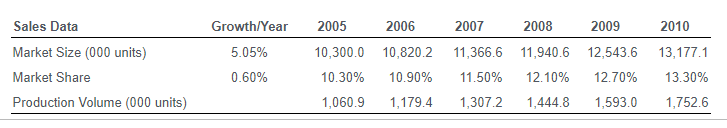

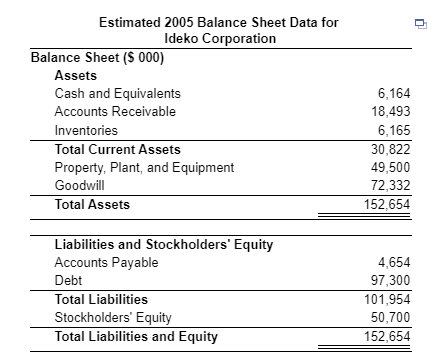

Assuming that Ideko's market share after 2005 will increase each year, the required production volume for the following five years are shown here: Ideko's production plant will require an expansion in 2010 (when production volume will exceed the current level by 50% ), and the cost of this expansion will be $14.5 million. Assuming the financing of the expansion will be delayed accordingly, calculate the projected interest payments and the amount of the projected interest tax shields (assuming that the interest rates on the term loans is 7.1% ) through 2010 . Consider an income tax rate of 35%. Ideko's balance sheet for 2005 is shown here (Round to the nearest $000.) \begin{tabular}{lcrrrrrr} Sales Data & Growth/Year & \multicolumn{1}{c}{2005} & \multicolumn{1}{c}{2006} & 2007 & 2008 & 2009 & 2010 \\ \hline Market Size (000 units) & 5.05% & 10,300.0 & 10,820.2 & 11,366.6 & 11,940.6 & 12,543.6 & 13,177.1 \\ Market Share & 0.60% & 10.30% & 10.90% & 11.50% & 12.10% & 12.70% & 13.30% \\ Production Volume (000 units) & & 1,060.9 & 1,179.4 & 1,307.2 & 1,444.8 & 1,593.0 & 1,752.6 \\ \hline \end{tabular} Estimated 2005 Balance Sheet Data for Ideko Corporation \begin{tabular}{lr} \hline Balance Sheet ($000) & \\ Assets & 6,164 \\ Cash and Equivalents & 18,493 \\ Accounts Receivable & 6,165 \\ Inventories & 30,822 \\ \hline Total Current Assets & 49,500 \\ Property, Plant, and Equipment & 72,332 \\ Goodwill & 152,654 \\ \hline Total Assets & \\ \hline \end{tabular} \begin{tabular}{lr} \hline Liabilities and Stockholders' Equity & \\ Accounts Payable & 4,654 \\ Debt & 97,300 \\ \hline Total Liabilities & 101,954 \\ Stockholders' Equity & 50,700 \\ \hline Total Liabilities and Equity & 152,654 \\ \hline \hline \end{tabular} Assuming that Ideko's market share after 2005 will increase each year, the required production volume for the following five years are shown here: Ideko's production plant will require an expansion in 2010 (when production volume will exceed the current level by 50% ), and the cost of this expansion will be $14.5 million. Assuming the financing of the expansion will be delayed accordingly, calculate the projected interest payments and the amount of the projected interest tax shields (assuming that the interest rates on the term loans is 7.1% ) through 2010 . Consider an income tax rate of 35%. Ideko's balance sheet for 2005 is shown here (Round to the nearest $000.) \begin{tabular}{lcrrrrrr} Sales Data & Growth/Year & \multicolumn{1}{c}{2005} & \multicolumn{1}{c}{2006} & 2007 & 2008 & 2009 & 2010 \\ \hline Market Size (000 units) & 5.05% & 10,300.0 & 10,820.2 & 11,366.6 & 11,940.6 & 12,543.6 & 13,177.1 \\ Market Share & 0.60% & 10.30% & 10.90% & 11.50% & 12.10% & 12.70% & 13.30% \\ Production Volume (000 units) & & 1,060.9 & 1,179.4 & 1,307.2 & 1,444.8 & 1,593.0 & 1,752.6 \\ \hline \end{tabular} Estimated 2005 Balance Sheet Data for Ideko Corporation \begin{tabular}{lr} \hline Balance Sheet ($000) & \\ Assets & 6,164 \\ Cash and Equivalents & 18,493 \\ Accounts Receivable & 6,165 \\ Inventories & 30,822 \\ \hline Total Current Assets & 49,500 \\ Property, Plant, and Equipment & 72,332 \\ Goodwill & 152,654 \\ \hline Total Assets & \\ \hline \end{tabular} \begin{tabular}{lr} \hline Liabilities and Stockholders' Equity & \\ Accounts Payable & 4,654 \\ Debt & 97,300 \\ \hline Total Liabilities & 101,954 \\ Stockholders' Equity & 50,700 \\ \hline Total Liabilities and Equity & 152,654 \\ \hline \hline \end{tabular}