Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assuming that the appropriate discount rate for the project is the firm cost of capital. Determine the discount rate to be used for evaluating the

Assuming that the appropriate discount rate for the project is the firm cost of capital. Determine the discount rate to be used for evaluating the target project.

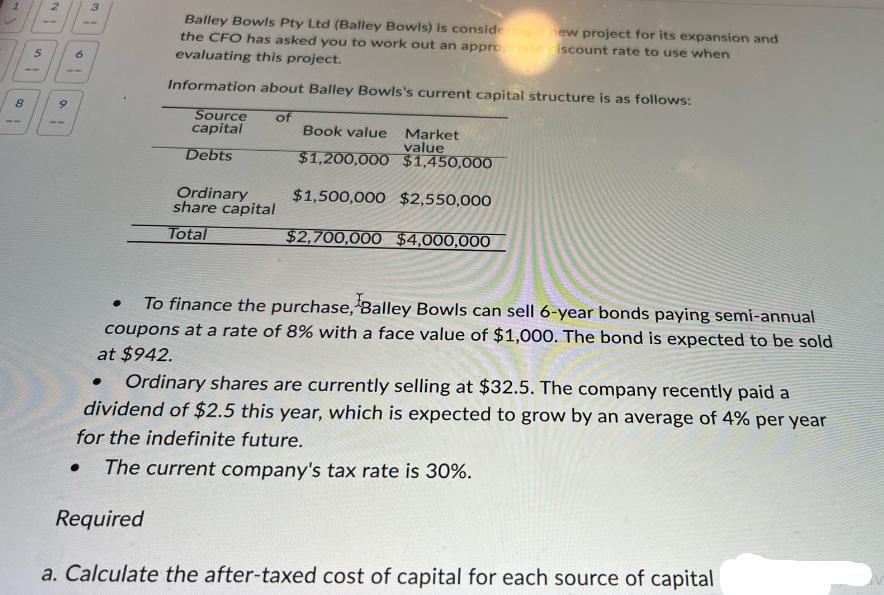

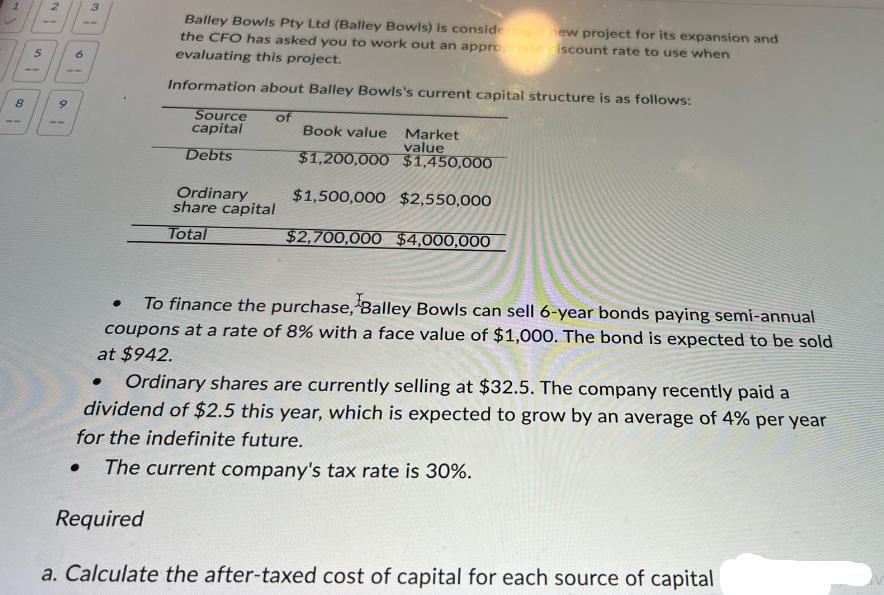

8 5 1 2 9 6 31 Balley Bowls Pty Ltd (Balley Bowls) is conside new project for its expansion and the CFO has asked you to work out an appropre siscount rate to use when evaluating this project. Information about Balley Bowls's current capital structure is as follows: of Source capital Debts Ordinary share capital Total Book value Market value $1,200,000 $1,450,000 $1,500,000 $2,550,000 $2,700,000 $4,000,000 To finance the purchase, Balley Bowls can sell 6-year bonds paying semi-annual coupons at a rate of 8% with a face value of $1,000. The bond is expected to be sold at $942. Ordinary shares are currently selling at $32.5. The company recently paid a dividend of $2.5 this year, which is expected to grow by an average of 4% per year for the indefinite future. The current company's tax rate is 30%. Required a. Calculate the after-taxed cost of capital for each source of capital

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the aftertax cost of capital for each source of capital we need to consider the cost of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started