Question

Assuming that the combined company can save $100 million in costs (pre-tax) after the merger, and that the tax rate is 25%, estimate the value

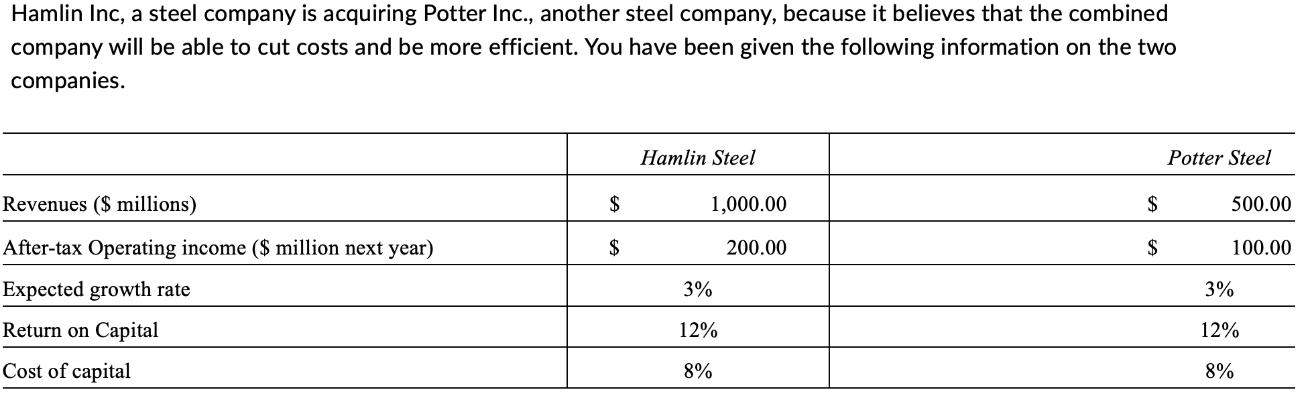

Hamlin Inc, a steel company is acquiring Potter Inc., another steel company, because it believes that the combined company will be able to cut costs and be more efficient. You have been given the following information on the two companies. Revenues ($ millions) After-tax Operating income ($ million next year) Expected growth rate Return on Capital Cost of capital $ $ Hamlin Steel 1,000.00 200.00 3% 12% 8% $ $ Potter Steel 500.00 100.00 3% 12% 8%

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To estimate the value of the combined company after the merger we can use the following steps Calcul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Valuation The Art and Science of Corporate Investment Decisions

Authors: Sheridan Titman, John D. Martin

3rd edition

133479528, 978-0133479522

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App