Answered step by step

Verified Expert Solution

Question

1 Approved Answer

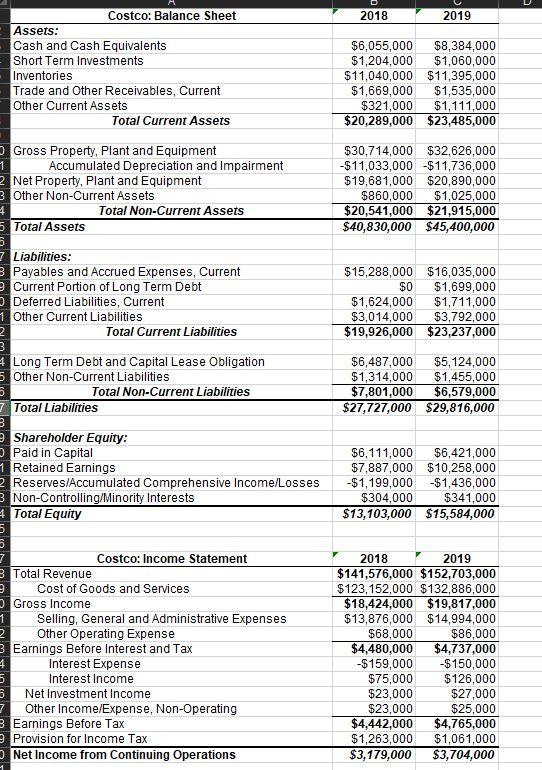

Assuming that the cost of goods and services represents the variable costs for Costco, and that SGA and other operating expenses represent their fixed costs,

Assuming that the cost of goods and services represents the variable costs for Costco, and that SGA and other operating expenses represent their fixed costs, what is the degree of operating leverage for Costco in 2019?

Liabilities: Payables and Accrued Expenses, Current Current Portion of Long Term Debt Deferred Liabilities, Current Other Current Liabilities Total Current Liabilities \begin{tabular}{|r|r|} \hline$15,288,000 & $16,035,000 \\ \hline$0 & $1,699,000 \\ \hline$1,624,000 & $1,711,000 \\ \hline$3,014,000 & $3,792,000 \\ \hline$19,926,000 & $23,237,000 \\ \hline \end{tabular} Long Term Debt and Capital Lease Obligation Other Non-Current Liabilities Total Non-Current Liabilities Total Liabilities \begin{tabular}{|r|r|} \hline$6,487,000 & $5,124,000 \\ \hline$1,314,000 & $1,455,000 \\ \hline$7,801,000 & $6,579,000 \\ \hline$27,727,000 & $29,816,000 \\ \hline \end{tabular} Shareholder Equity: \begin{tabular}{|lrr|} \hline Paid in Capital & $6,111,000 & $6,421,000 \\ Retained Earnings & $7,887,000 & $10,258,000 \\ \hline Reserves/Accumulated Comprehensive Income/Losses & $1,199,000 & $1,436,000 \\ \hline Non-Controlling/Minority Interests & $304,000 & $341,000 \\ \hline Total Equity & $13,103,000 & $15,584,000 \\ \hline \end{tabular} \begin{tabular}{|crrr|} \hline Costco: Income Statement & \multicolumn{1}{c}{2018} & \multicolumn{1}{c}{2019} \\ \hline Total Revenue & $141,576,000 & $152,703,000 \\ \hline Cost of Goods and Services & $123,152,000 & $132,886,000 \\ \cline { 2 - 4 } Gross Income & $18,424,000 & $19,817,000 \\ Selling, General and Administrative Expenses & $13,876,000 & $14,994,000 \\ Other Operating Expense & $68,000 & $86,000 \\ \hline Earnings Before Interest and Tax & $4,480,000 & $4,737,000 \\ Interest Expense & $159,000 & $150,000 \\ Interest Income & $75,000 & $126,000 \\ \hline Net Investment Income & $23,000 & $27,000 \\ \hline Other Income/Expense, Non-Operating & $23,000 & $25,000 \\ \hline Earnings Before Tax & $4,442,000 & $4,765,000 \\ \hline Provision for Income Tax & $1,263,000 & $1,061,000 \\ \hline Net Income from Continuing Operations & $3,179,000 & $3,704,000 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started