Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assuming the old PCB machine is not sold, what are the free cash flows for PCB A and PCB B for Years 0 to 6?

Assuming the old PCB machine is not sold, what are the free cash flows for PCB A and PCB B for Years 0 to 6?

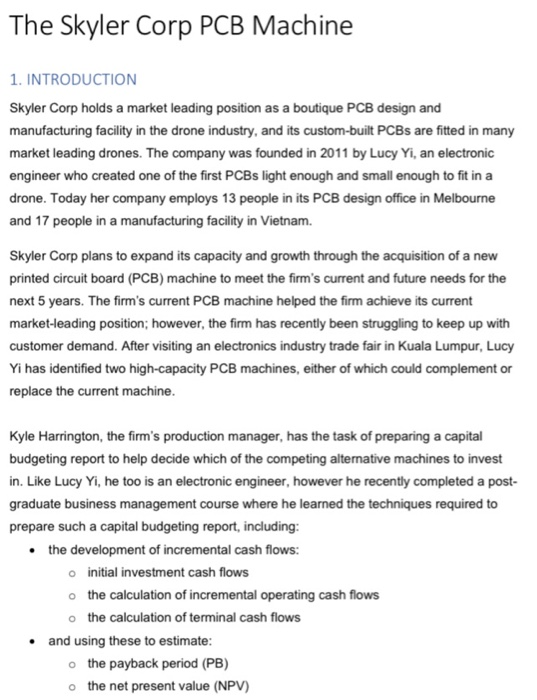

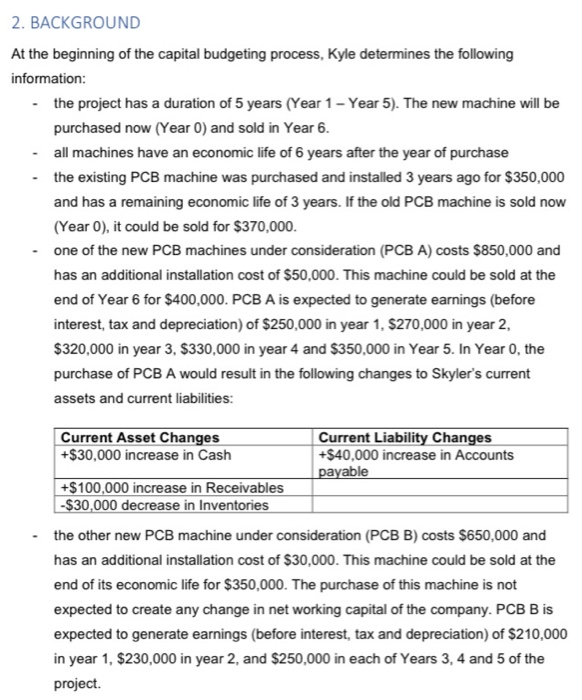

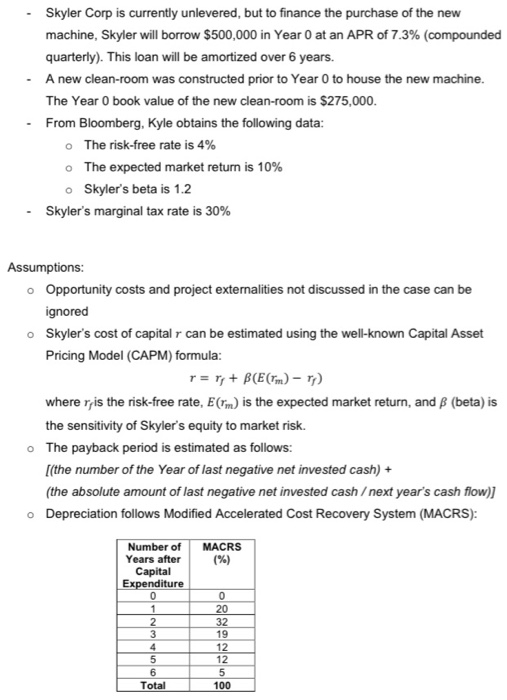

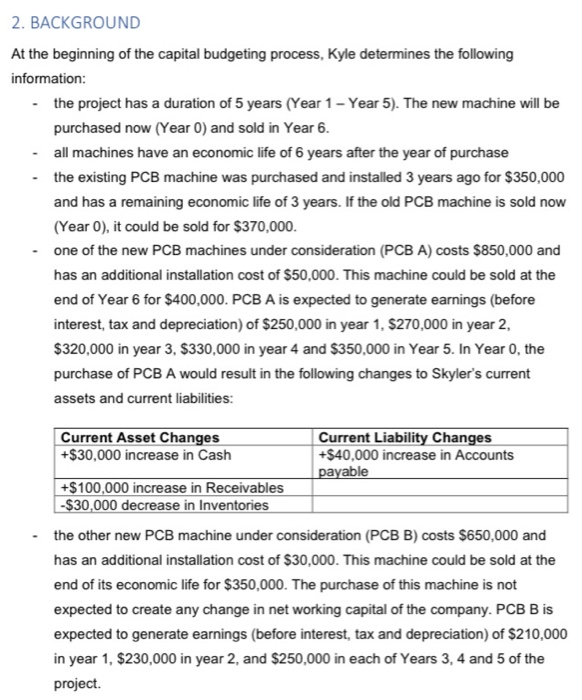

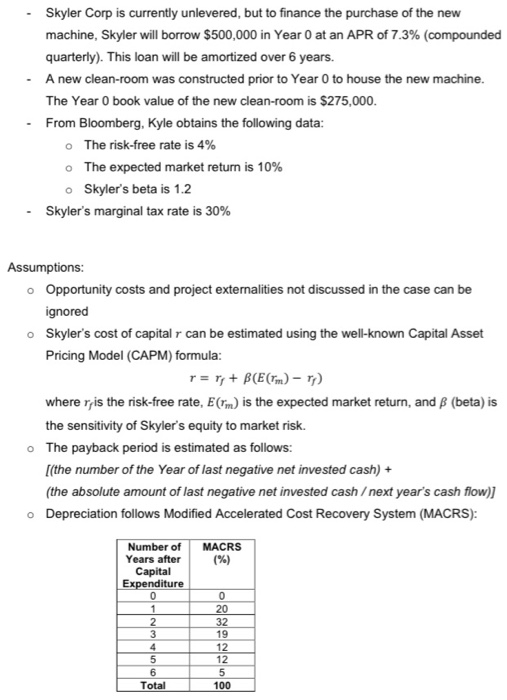

The Skyler Corp PCB Machine 1. INTRODUCTION Skyler Corp holds a market leading position as a boutique PCB design and manufacturing facility in the drone industry, and its custom-built PCBs are fitted in many market leading drones. The company was founded in 2011 by Lucy Yi, an electronic engineer who created one of the first PCBs light enough and small enough to fit in a drone. Today her company employs 13 people in its PCB design office in Melbourne and 17 people in a manufacturing facility in Vietnam. Skyler Corp plans to expand its capacity and growth through the acquisition of a new printed circuit board (PCB) machine to meet the firm's current and future needs for the next 5 years. The firm's current PCB machine helped the firm achieve its current market-leading position; however, the firm has recently been struggling to keep up with customer demand. After visiting an electronics industry trade fair in Kuala Lumpur, Lucy Yi has identified two high-capacity PCB machines, either of which could complement or replace the current machine. Kyle Harrington, the firm's production manager, has the task of preparing a capital budgeting report to help decide which of the competing alternative machines to invest in. Like Lucy Yi, he too is an electronic engineer, however he recently completed a post- graduate business management course where he learned the techniques required to prepare such a capital budgeting report, including: the development of incremental cash flows: o initial investment cash flows o the calculation of incremental operating cash flows o the calculation of terminal cash flows and using these to estimate: o the payback period (PB) o the net present value (NPV) 2. BACKGROUND At the beginning of the capital budgeting process, Kyle determines the following information: - the project has a duration of 5 years (Year 1-Year 5). The new machine will be purchased now (Year O) and sold in Year 6. all machines have an economic life of 6 years after the year of purchase - the existing PCB machine was purchased and installed 3 years ago for $350,000 and has a remaining economic life of 3 years. If the old PCB machine is sold now (Year O), it could be sold for $370,000. one of the new PCB machines under consideration (PCB A) costs $850,000 and has an additional installation cost of $50,000. This machine could be sold at the end of Year 6 for $400,000. PCB A is expected to generate earnings (before interest, tax and depreciation) of $250,000 in year 1, $270,000 in year 2, $320,000 in year 3, $330,000 in year 4 and $350,000 in Year 5. In Year 0, the purchase of PCB A would result in the following changes to Skyler's current assets and current liabilities: Current Asset Changes +$30,000 increase in Cash Current Liability Changes +$40,000 increase in Accounts payable +$100,000 increase in Receivables -$30,000 decrease in Inventories the other new PCB machine under consideration (PCB B) costs $650,000 and has an additional installation cost of $30,000. This machine could be sold at the end of its economic life for $350,000. The purchase of this machine is not expected to create any change in net working capital of the company. PCB B is expected to generate earnings (before interest, tax and depreciation) of $210,000 in year 1, $230,000 in year 2, and $250,000 in each of Years 3, 4 and 5 of the project. Skyler Corp is currently unlevered, but to finance the purchase of the new machine, Skyler will borrow $500,000 in Year 0 at an APR of 7.3% (compounded quarterly). This loan will be amortized over 6 years. A new clean-room was constructed prior to Year O to house the new machine. The Year 0 book value of the new clean-room is $275,000 - From Bloomberg, Kyle obtains the following data: o The risk-free rate is 4% o The expected market return is 10% o Skyler's beta is 1.2 - Skyler's marginal tax rate is 30% Assumptions: o Opportunity costs and project externalities not discussed in the case can be ignored o Skyler's cost of capital r can be estimated using the well-known Capital Asset Pricing Model (CAPM) formula: r = r + B(E(Tm) - ) where ris the risk-free rate, Erm) is the expected market return, and B (beta) is the sensitivity of Skyler's equity to market risk. The payback period is estimated as follows: [(the number of the Year of last negative net invested cash) + (the absolute amount of last negative net invested cashext year's cash flow)] o Depreciation follows Modified Accelerated Cost Recovery System (MACRS): MACRS (%) Number of Years after Capital Expenditure 0 2 Total

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started