Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assuming they file as married jointly and use the standard deduction, what is Paul Down and Eileen Dover's 2023 taxable income? Paul Down and Eileen

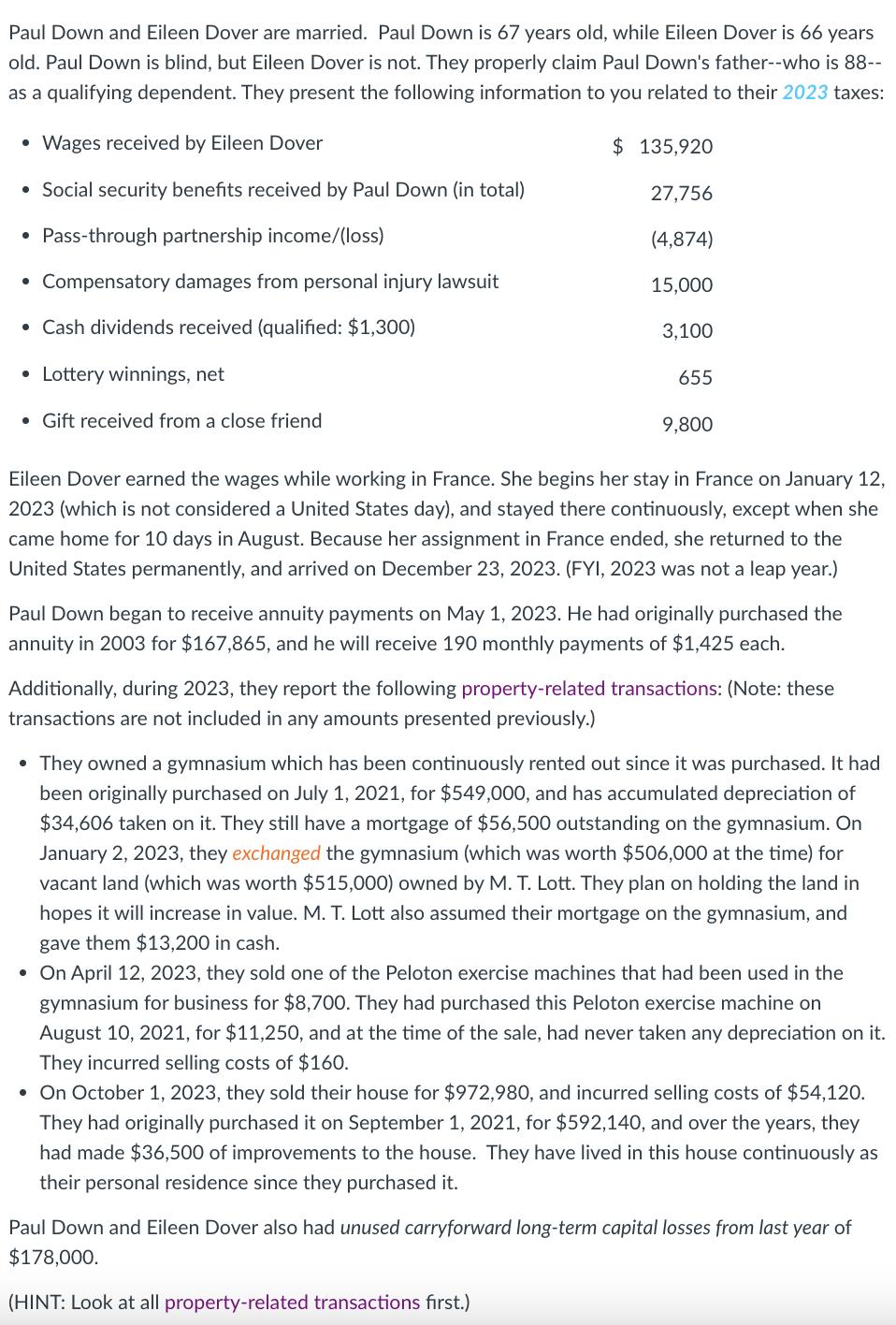

Assuming they file as married jointly and use the standard deduction, what is Paul Down and Eileen Dover's 2023 taxable income?

Paul Down and Eileen Dover are married. Paul Down is 67 years old, while Eileen Dover is 66 years old. Paul Down is blind, but Eileen Dover is not. They properly claim Paul Down's father--who is 88-- as a qualifying dependent. They present the following information to you related to their 2023 taxes: Wages received by Eileen Dover Social security benefits received by Paul Down (in total) Pass-through partnership income/(loss) Compensatory damages from personal injury lawsuit Cash dividends received (qualified: $1,300) Lottery winnings, net Gift received from a close friend $ 135,920 27,756 (4,874) 15,000 3,100 655 9,800 Eileen Dover earned the wages while working in France. She begins her stay in France on January 12, 2023 (which is not considered a United States day), and stayed there continuously, except when she came home for 10 days in August. Because her assignment in France ended, she returned to the United States permanently, and arrived on December 23, 2023. (FYI, 2023 was not a leap year.) Paul Down began to receive annuity payments on May 1, 2023. He had originally purchased the annuity in 2003 for $167,865, and he will receive 190 monthly payments of $1,425 each. Additionally, during 2023, they report the following property-related transactions: (Note: these transactions are not included in any amounts presented previously.) They owned a gymnasium which has been continuously rented out since it was purchased. It had been originally purchased on July 1, 2021, for $549,000, and has accumulated depreciation of $34,606 taken on it. They still have a mortgage of $56,500 outstanding on the gymnasium. On January 2, 2023, they exchanged the gymnasium (which was worth $506,000 at the time) for vacant land (which was worth $515,000) owned by M. T. Lott. They plan on holding the land in hopes it will increase in value. M. T. Lott also assumed their mortgage on the gymnasium, and gave them $13,200 in cash. On April 12, 2023, they sold one of the Peloton exercise machines that had been used in the gymnasium for business for $8,700. They had purchased this Peloton exercise machine on August 10, 2021, for $11,250, and at the time of the sale, had never taken any depreciation on it. They incurred selling costs of $160. On October 1, 2023, they sold their house for $972,980, and incurred selling costs of $54,120. They had originally purchased it on September 1, 2021, for $592,140, and over the years, they had made $36,500 of improvements to the house. They have lived in this house continuously as their personal residence since they purchased it. Paul Down and Eileen Dover also had unused carryforward long-term capital losses from last year of $178,000. (HINT: Look at all property-related transactions first.)

Step by Step Solution

★★★★★

3.32 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Tax Analysis for Paul Down and Eileen Dover Income Eileen Dovers wages 135920 Paul Downs social security benefits 27756 Passthrough partnership income...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started