Answered step by step

Verified Expert Solution

Question

1 Approved Answer

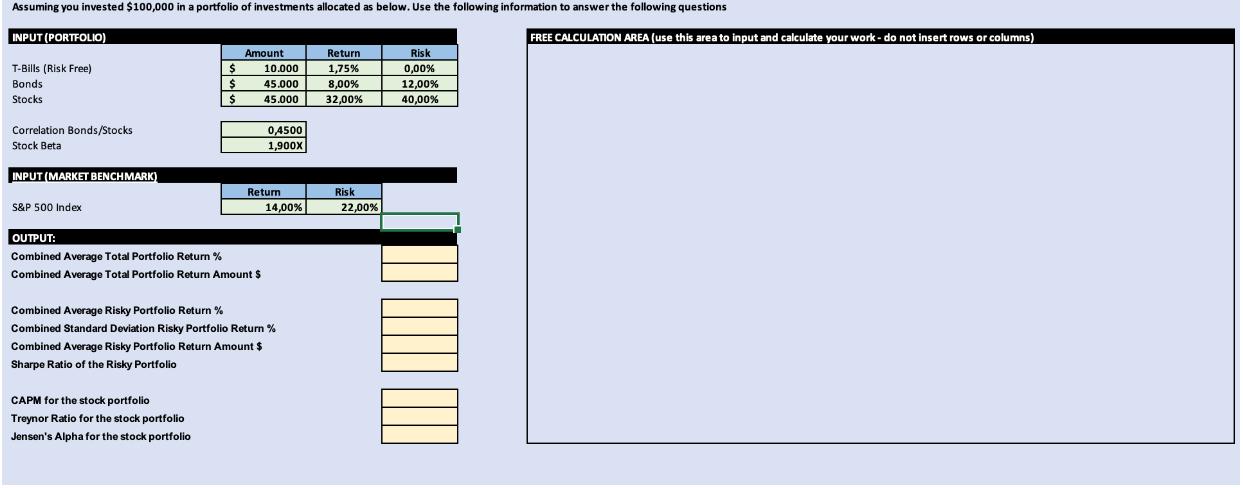

Assuming you invested $100,000 in a portfolio of investments allocated as below. Use the following information to answer the following questions INPUT (PORTFOLIO) FREE

Assuming you invested $100,000 in a portfolio of investments allocated as below. Use the following information to answer the following questions INPUT (PORTFOLIO) FREE CALCULATION AREA (use this area to input and calculate your work - do not insert rows or columns) Amount Return Risk T-Bills (Risk Free) $ 10.000 1,75% 0,00% Bonds $ 45.000 8,00% 12,00% Stocks $ 45.000 32,00% 40,00% Correlation Bonds/Stocks 0,4500 Stock Beta 1,900X INPUT (MARKET BENCHMARK) Return Risk S&P 500 Index 14,00% 22,00% OUTPUT: Combined Average Total Portfolio Return % Combined Average Total Portfolio Return Amount $ Combined Average Risky Portfolio Return % Combined Standard Deviation Risky Portfolio Return % Combined Average Risky Portfolio Return Amount $ Sharpe Ratio of the Risky Portfolio CAPM for the stock portfolio Treynor Ratio for the stock portfolio Jensen's Alpha for the stock portfolio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the required outputs based on the information provided we will perform the following calculations 1 Calculate the Weighted Average Return ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started