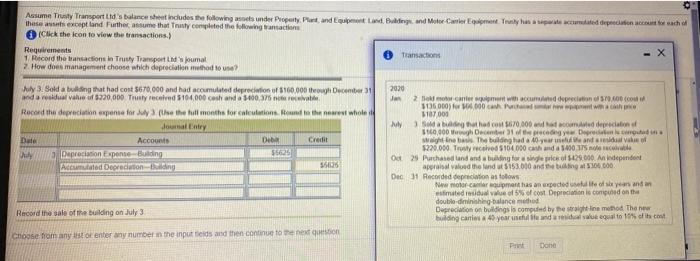

Assumn Thuy Transport Ladbalance sheet includes the following uses under Property Plast, and Equipment Boing and Motor Crement. Tuy hearted coche these except and Further assume that Tully completed the following transactions Click the icon to view the transactions.) Requirements Transactions 1 Record the transactions in Truy Transport und jumat 2. How does management choose which depreciation method to use? 200 fly 3. Sold a bug that had cost 5670,000 and had accumulated depreciation of 160.000 throwth December 31 da residual ve 220,000. Thusly received 5104.000 cost and a $400.376 receive Record the depreciation expense for the the full month for calculations. Read to the nearest whole Journal Entry Accounts Credit Depreciation Experte Building sto Accumulated Deed on 556.25 Date Ja 2 Bocane with accumul depreciation Socco 136000) 10.000 1187 000 My Sabaha o 5670.000 de mercato Ha 100 Decemia spicatigy one . weight in the building had a 40 yendada $220.000 Trowych 510400 cath and a 5400 175 Oct 25 Purchased and and a building for single price of 129.000. An independent apraisal valued the land $153.000 and bling 500.000 DO 31 Recorded depreciation as to ows caruman has an expected sale of years and estimated residual value of 5% of cost Depreciation is computed on the double-dinishing balance method Depreciation on buildings is compued by the line med the new building cars 4 years are equal to 10% of the Record the sale of the building on July 3 Choose from any or enter any number the input beds and then continue to be Done Assumn Thuy Transport Ladbalance sheet includes the following uses under Property Plast, and Equipment Boing and Motor Crement. Tuy hearted coche these except and Further assume that Tully completed the following transactions Click the icon to view the transactions.) Requirements Transactions 1 Record the transactions in Truy Transport und jumat 2. How does management choose which depreciation method to use? 200 fly 3. Sold a bug that had cost 5670,000 and had accumulated depreciation of 160.000 throwth December 31 da residual ve 220,000. Thusly received 5104.000 cost and a $400.376 receive Record the depreciation expense for the the full month for calculations. Read to the nearest whole Journal Entry Accounts Credit Depreciation Experte Building sto Accumulated Deed on 556.25 Date Ja 2 Bocane with accumul depreciation Socco 136000) 10.000 1187 000 My Sabaha o 5670.000 de mercato Ha 100 Decemia spicatigy one . weight in the building had a 40 yendada $220.000 Trowych 510400 cath and a 5400 175 Oct 25 Purchased and and a building for single price of 129.000. An independent apraisal valued the land $153.000 and bling 500.000 DO 31 Recorded depreciation as to ows caruman has an expected sale of years and estimated residual value of 5% of cost Depreciation is computed on the double-dinishing balance method Depreciation on buildings is compued by the line med the new building cars 4 years are equal to 10% of the Record the sale of the building on July 3 Choose from any or enter any number the input beds and then continue to be Done