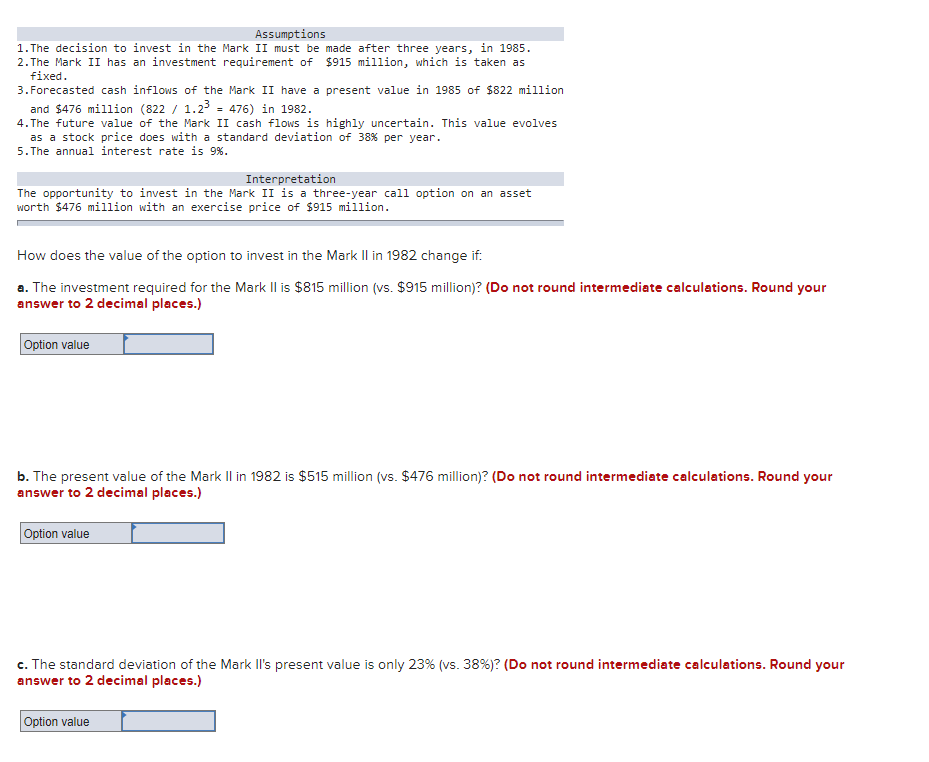

Assumptions

1. The decision to invest in the Mark II must be made after three years, in 1985. 2. The Mark II has an investment requirement of $915 million, which is taken as fixed. 3. Forecasted cash inflows of the Mark II have a present value in 1985 of $822 million and $476 million (822 / 1.23 = 476) in 1982. 4. The future value of the Mark II cash flows is highly uncertain. This value evolves as a stock price does with a standard deviation of 38% per year. 5. The annual interest rate is 9%.

Interpretation

The opportunity to invest in the Mark II is a three-year call option on an asset worth $476 million with an exercise price of $915 million.

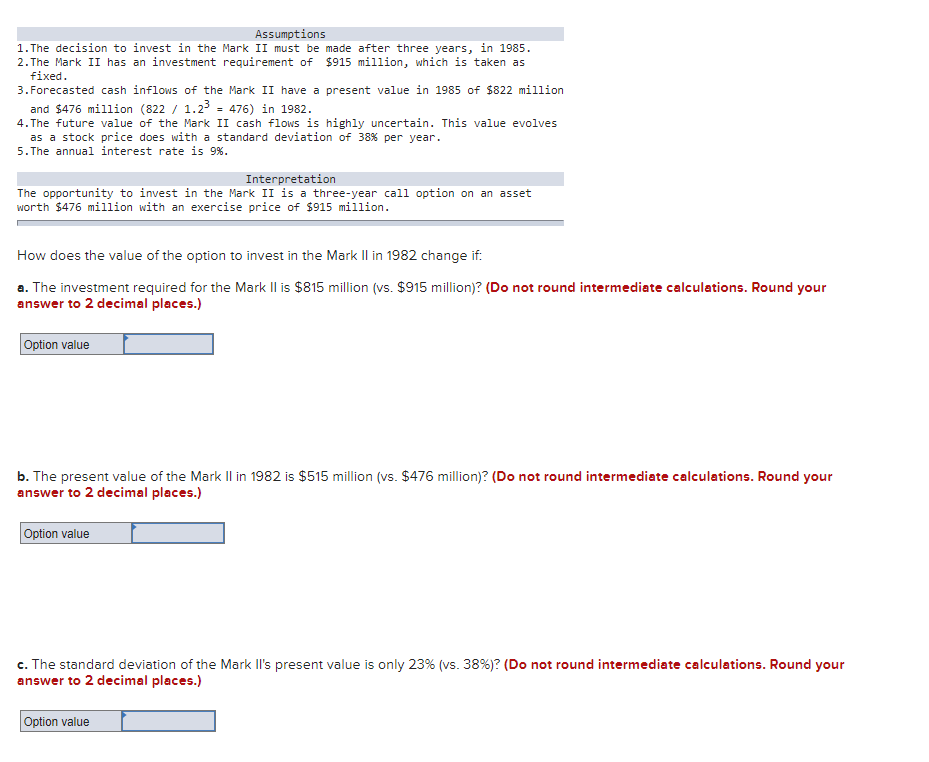

Assumptions 1. The decision to invest in the Mark II must be made after three years, in 1985. 2. The Mark II has an investment requirement of $915 million, which is taken as fixed. 3. Forecasted cash inflows of the Mark II have a present value in 1985 of $822 million and $476 million (822 / 1.2 = 476) in 1982. 4. The future value of the Mark II cash flows is highly uncertain. This value evolves as a stock price does with a standard deviation of 38% per year. 5. The annual interest rate is 9%. Interpretation The opportunity to invest in the Mark II is a three-year call option on an asset worth $476 million with an exercise price of $915 million. How does the value of the option to invest in the Mark II in 1982 change if: a. The investment required for the Mark II is $815 million (vs. $915 million)? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Option value b. The present value of the Mark II in 1982 is $515 million (vs. $476 million)? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Option value c. The standard deviation of the Mark II's present value is only 23% (vs. 38%) ? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Option value Assumptions 1. The decision to invest in the Mark II must be made after three years, in 1985. 2. The Mark II has an investment requirement of $915 million, which is taken as fixed. 3. Forecasted cash inflows of the Mark II have a present value in 1985 of $822 million and $476 million (822 / 1.2 = 476) in 1982. 4. The future value of the Mark II cash flows is highly uncertain. This value evolves as a stock price does with a standard deviation of 38% per year. 5. The annual interest rate is 9%. Interpretation The opportunity to invest in the Mark II is a three-year call option on an asset worth $476 million with an exercise price of $915 million. How does the value of the option to invest in the Mark II in 1982 change if: a. The investment required for the Mark II is $815 million (vs. $915 million)? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Option value b. The present value of the Mark II in 1982 is $515 million (vs. $476 million)? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Option value c. The standard deviation of the Mark II's present value is only 23% (vs. 38%) ? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Option value