Answered step by step

Verified Expert Solution

Question

1 Approved Answer

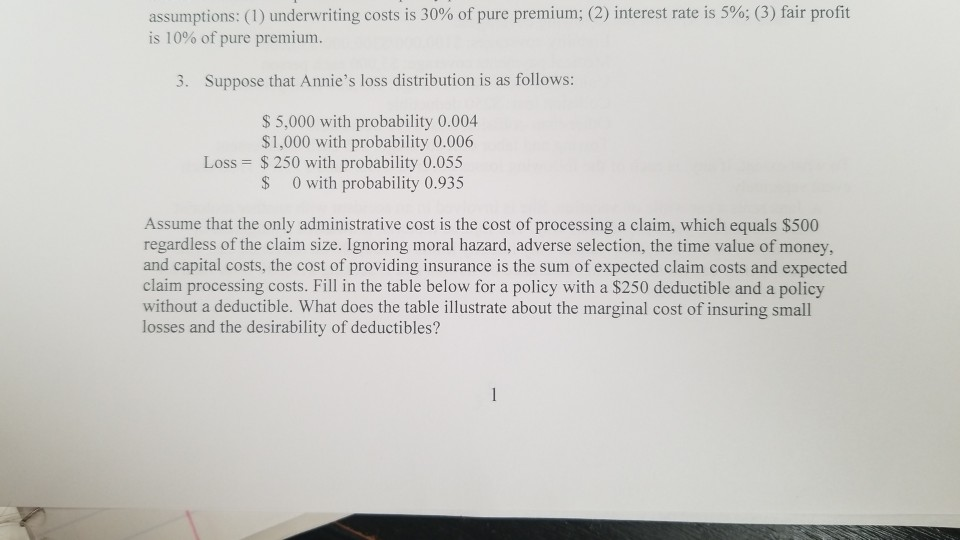

assumptions: (1) underwriting costs is 30% of pure premium; (2) interest rate is 5%; (3) fair profit is 10% of pure premium. 3. Suppose that

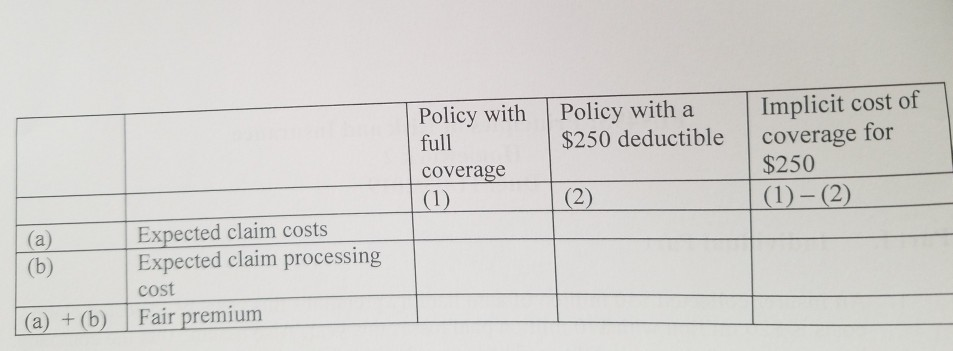

assumptions: (1) underwriting costs is 30% of pure premium; (2) interest rate is 5%; (3) fair profit is 10% of pure premium. 3. Suppose that Annie's loss distribution is as follows: $ 5.000 with probability 0.004 $1,000 with probability 0.006 Loss = $ 250 with probability 0.055 $ 0 with probability 0.935 Assume that the only administrative cost is the cost of processing a claim, which equals $500 regardless of the claim size. Ignoring moral hazard, adverse selection, the time value of money. and capital costs, the cost of providing insurance is the sum of expected claim costs and expected claim processing costs. Fill in the table below for a policy with a $250 deductible and a policy without a deductible. What does the table illustrate about the marginal cost of insuring small losses and the desirability of deductibles? Policy with full coverage (1) Policy with a $250 deductible Implicit cost of coverage for $250 (1)-(2) (2) Expected claim costs Expected claim processing cost Fair premium (a) + (b)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started