Answered step by step

Verified Expert Solution

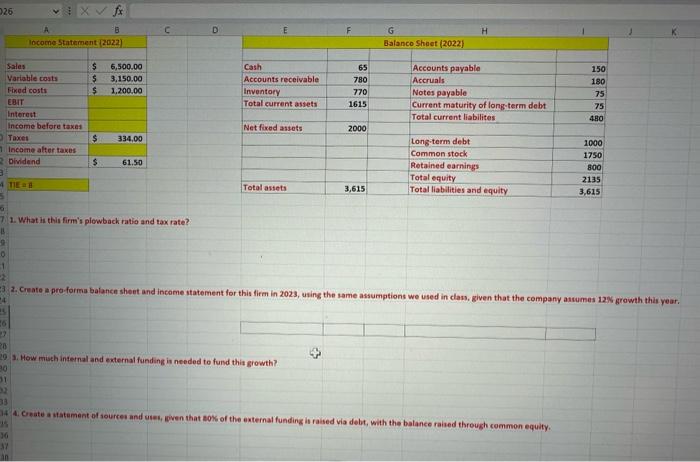

Question

1 Approved Answer

Assumptions: 1. We assume that fixed costs are only fixed up to a point. For simplicity, we assume that the company is operating at full

Assumptions: 1. We assume that fixed costs are only fixed up to a point. For simplicity, we assume that the company is operating at full capacity. Thus, all assets and costs (both fixed and variable) will expand proportionately to sales. 2. We keep interest the same at this point because we do not know how much the company will be borrowing for 2022. 3. We assume the same dividend payout rate in 2023 as in 2022.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started