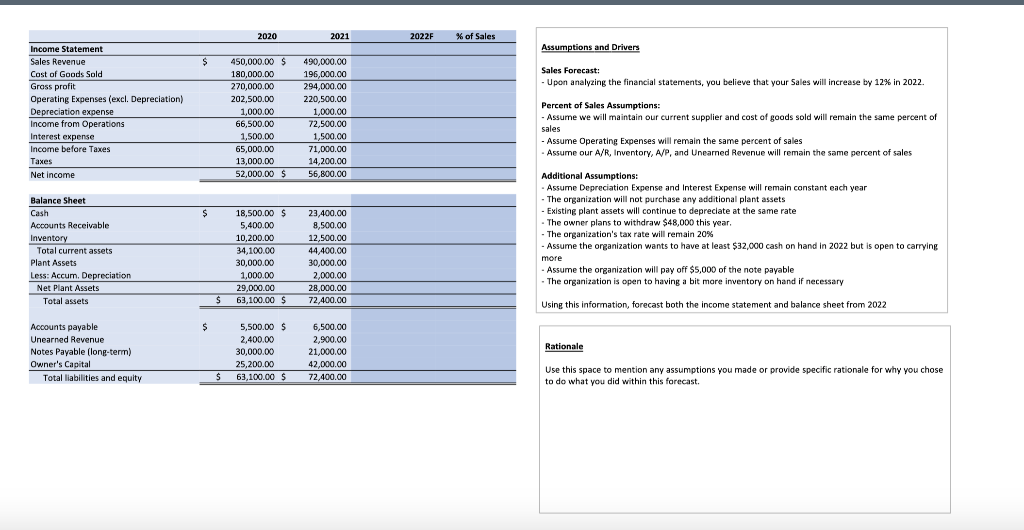

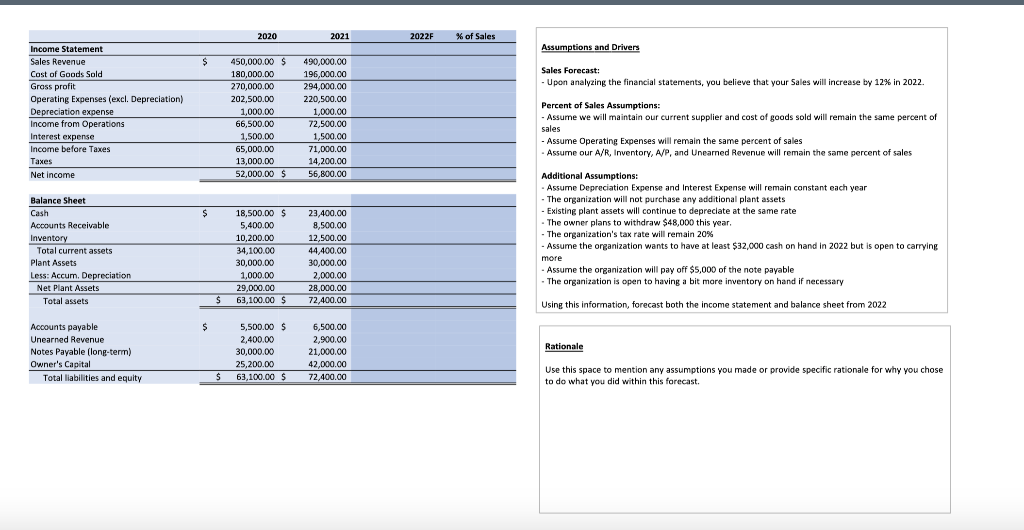

Assumptions and Drivers Sales Forecast: - Upon analyzing the financial statements, you believe that your Sales will increase by 12% in 2022. Percent of Sales Assumptions: - Assume we will maintain our curfent supplier and cost of goods sold will remain the same percent of sales - Assume Operating Expenses will remain the same percent of sales - Assume our A/R, Inventory, A/P, and Unearned Revenue will remain the same percent of sales Additional Assumptions: - Assume Depreciation Expense and Interest Expense will remain constant each year - The organization will not purchase any additional plant assets - Existing plant assets will continue to depreciate at the same rate - The owner plans to withdraw $48,000 this year. - The organization's tax rate will remain 20% - Assume the organization wants to have at least $32,000 cash on hand in 2022 but is open to carrying more - Assume the organization will pay off $5,000 of the note payable - The organization is open to having a bit more inventory on hand if necessary Using this information, forecast both the income statement and balance sheet from 2022 Rationale Use this space to mention any assumptions you made or provide specific rationale for why you chose to do what you did within this forecast. Assumptions and Drivers Sales Forecast: - Upon analyzing the financial statements, you believe that your Sales will increase by 12% in 2022. Percent of Sales Assumptions: - Assume we will maintain our curfent supplier and cost of goods sold will remain the same percent of sales - Assume Operating Expenses will remain the same percent of sales - Assume our A/R, Inventory, A/P, and Unearned Revenue will remain the same percent of sales Additional Assumptions: - Assume Depreciation Expense and Interest Expense will remain constant each year - The organization will not purchase any additional plant assets - Existing plant assets will continue to depreciate at the same rate - The owner plans to withdraw $48,000 this year. - The organization's tax rate will remain 20% - Assume the organization wants to have at least $32,000 cash on hand in 2022 but is open to carrying more - Assume the organization will pay off $5,000 of the note payable - The organization is open to having a bit more inventory on hand if necessary Using this information, forecast both the income statement and balance sheet from 2022 Rationale Use this space to mention any assumptions you made or provide specific rationale for why you chose to do what you did within this forecast