Answered step by step

Verified Expert Solution

Question

1 Approved Answer

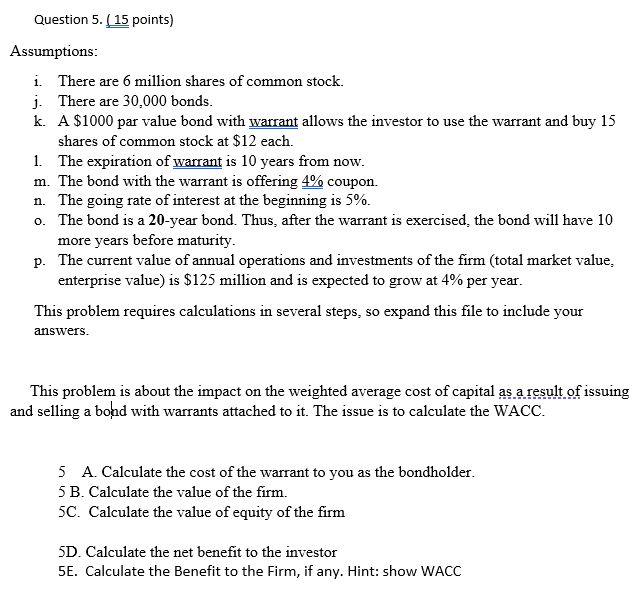

Assumptions: i . There are 6 million shares of common stock. j . There are 3 0 , 0 0 0 bonds. k . A

Assumptions:

i There are million shares of common stock.

j There are bonds.

k A $ par value bond with warrant allows the investor to use the warrant and buy

shares of common stock at $ each.

The expiration of warrant is years from now.

m The bond with the warrant is offering coupon.

n The going rate of interest at the beginning is

o The bond is a year bond. Thus, after the warrant is exercised, the bond will have

more years before maturity.

p The current value of annual operations and investments of the firm total market value,

enterprise value is $ million and is expected to grow at per year.

This problem requires calculations in several steps, so expand this file to include your

answers.

This problem is about the impact on the weighted average cost of capital as a result of issuing

and selling a bond with warrants attached to it The issue is to calculate the WACC.

A Calculate the cost of the warrant to you as the bondholder.

B Calculate the value of the firm.

C Calculate the value of equity of the firm

D Calculate the net benefit to the investor

E Calculate the Benefit to the Firm, if any. Hint: show WACC

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started