Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assumptions in CAPM and cost of failure (Answer All Please) Fill in the blank section : decrease or increase increasing or decreasing decreases or increases

Assumptions in CAPM and cost of failure (Answer All Please)

Assumptions in CAPM and cost of failure (Answer All Please)

Fill in the blank section : decrease or increase increasing or decreasing decreases or increases

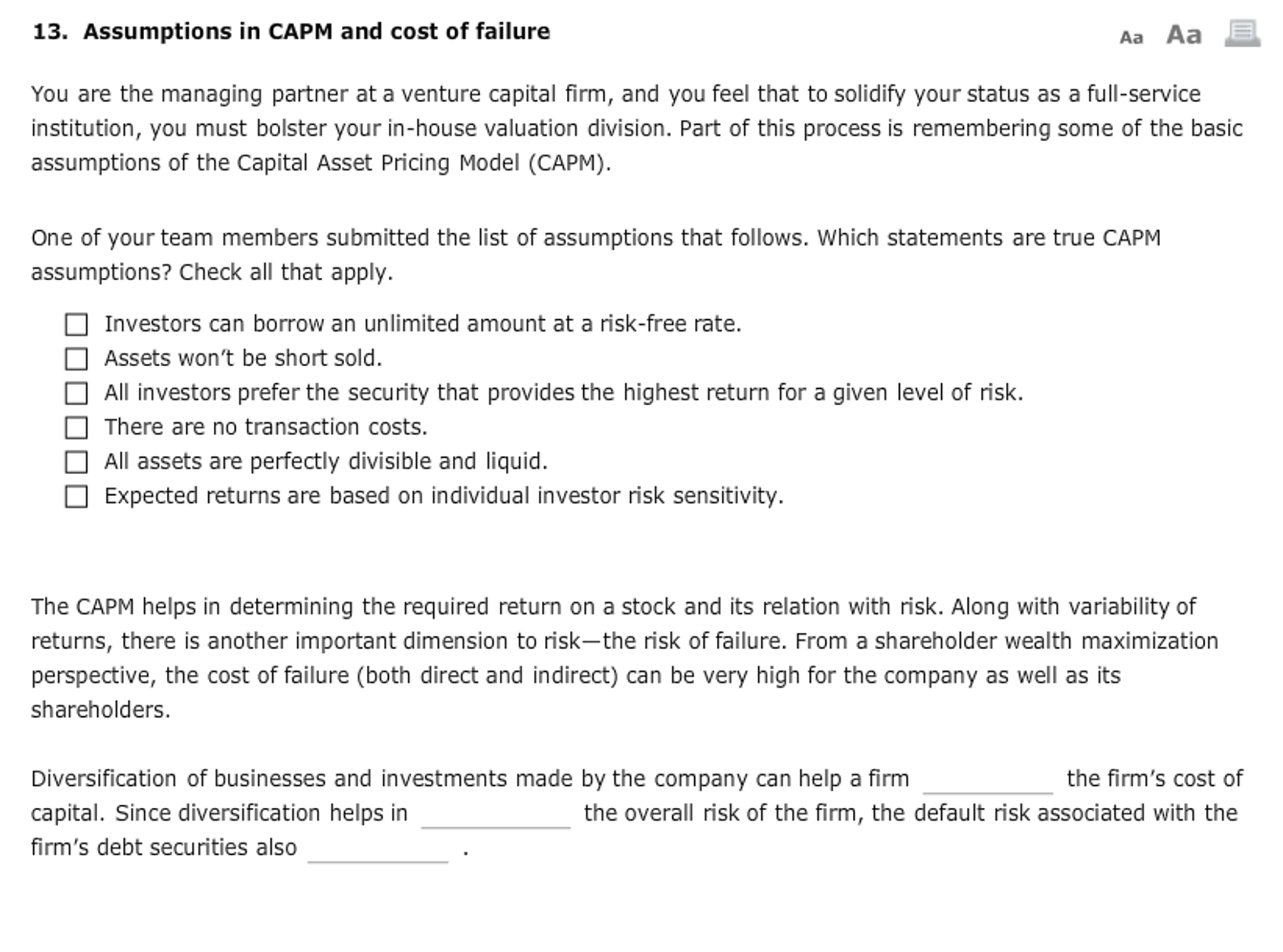

13. Assumptions in CAPM and cost of failure Aa Aa You are the managing partner at a venture capital firm, and you feel that to solidify your status as a full-service institution, you must bolster your in-house valuation division. Part of this process is remembering some of the basic assumptions of the Capital Asset Pricing Model (CAPM) One of your team members submitted the list of assumptions that follows. Which statements are true CAPM assumptions? Check all that apply Investors can borrow an unlimited amount at a risk-free rate Assets won't be short sold All investors prefer the security that provides the highest return for a given level of risk. There are no transaction costs AII assets are perfectly divisible and liquid. Expected returns are based on individual investor risk sensitivity The CAPM helps in determining the required return on a stock and its relation with risk. Along with variability of returns, there is another important dimension to risk-the risk of failure. From a shareholder wealth maximization perspective, the cost of failure (both direct and indirect) can be very high for the company as well as its shareholders. Diversification of businesses and investments made by the company can help a firm capital. Since diversification helps in firm's debt securities also the firm's cost of the overall risk of the firm, the default risk associated with theStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started