Answered step by step

Verified Expert Solution

Question

1 Approved Answer

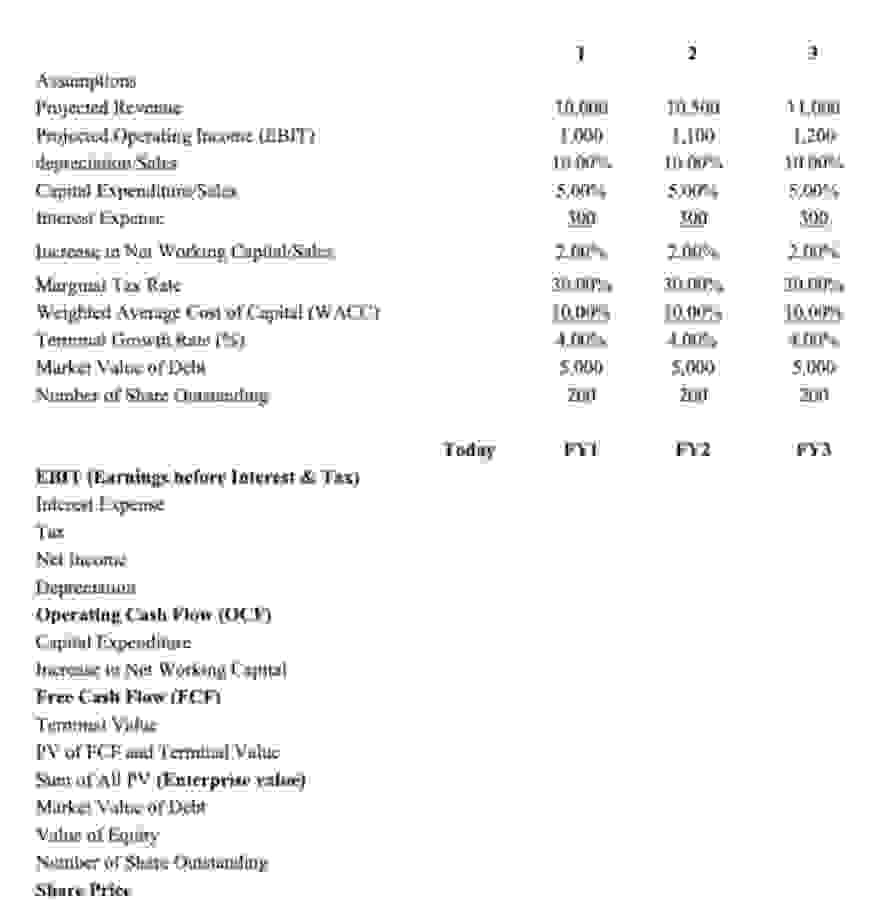

Assumptions Projected Revenue 1 0 , 0 0 0 1 0 , 5 0 0 1 1 , 0 0 0 Projected Operating Income (

Assumptions

Projected Revenue

Projected Operating Income EBIT

depreciationSales

Capital ExpenditureSales

Interest Expense

Increase in Net Working CapitalSales

Marginal Tax Rate

Weighted Average Cost of Capital WACC

Terminal Growth Rate

Market Value of Debt

Number of Share Outstanding

Today FY FY FY

EBIT Earnings before Interest & Tax

Interest Expense

Tax

Net Income

Depreciation

Operating Cash Flow OCF

Capital Expenditure

Increase in Net Working Capital

Free Cash Flow FCF

Terminal Value

PV of FCF and Terminal Value

Sum of All PV Enterprise value

Market Value of Debt

Value of Equity

Number of Share Outstanding

Share Price

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started