Answered step by step

Verified Expert Solution

Question

1 Approved Answer

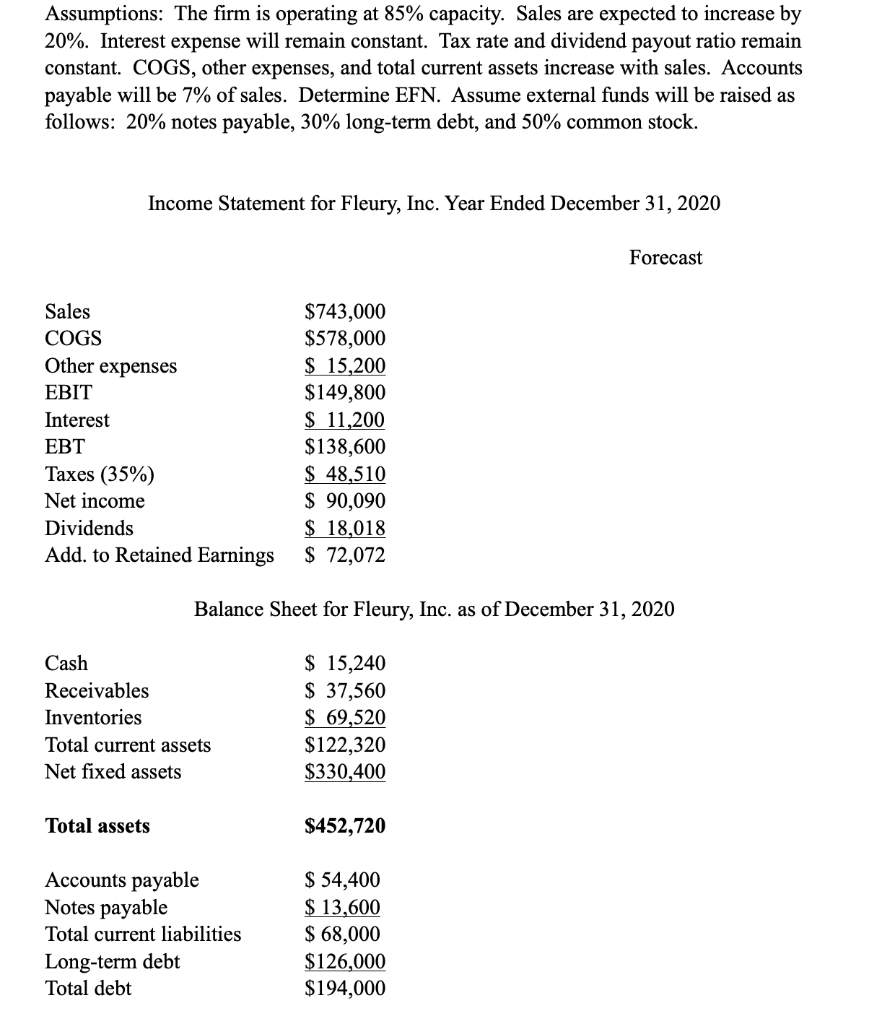

Assumptions: The firm is operating at 85% capacity. Sales are expected to increase by 20%. Interest expense will remain constant. Tax rate and dividend

Assumptions: The firm is operating at 85% capacity. Sales are expected to increase by 20%. Interest expense will remain constant. Tax rate and dividend payout ratio remain constant. COGS, other expenses, and total current assets increase with sales. Accounts payable will be 7% of sales. Determine EFN. Assume external funds will be raised as follows: 20% notes payable, 30% long-term debt, and 50% common stock. Income Statement for Fleury, Inc. Year Ended December 31, 2020 Forecast Sales $743,000 $578,000 $ 15,200 $149,800 $ 11,200 COGS Other expenses EBIT Interest $138,600 $ 48,510 $ 90,090 $ 18,018 $ 72,072 EBT Taxes (35%) Net income Dividends Add. to Retained Earnings Balance Sheet for Fleury, Inc. as of December 31, 2020 $ 15,240 $ 37,560 $ 69,520 $122,320 $330,400 Cash Receivables Inventories Total current assets Net fixed assets Total assets $452,720 $ 54,400 $ 13,600 $ 68,000 $126,000 $194,000 Accounts payable Notes payable Total current liabilities Long-term debt Total debt $112,000 $146,720 Common stock Retained Earnings Total Common equity $258,720 Total liabilities & equity $452,720

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

A B D E 1 2 Income Statement 3 Sales 891600 4 Costs 693600 Other expense...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started