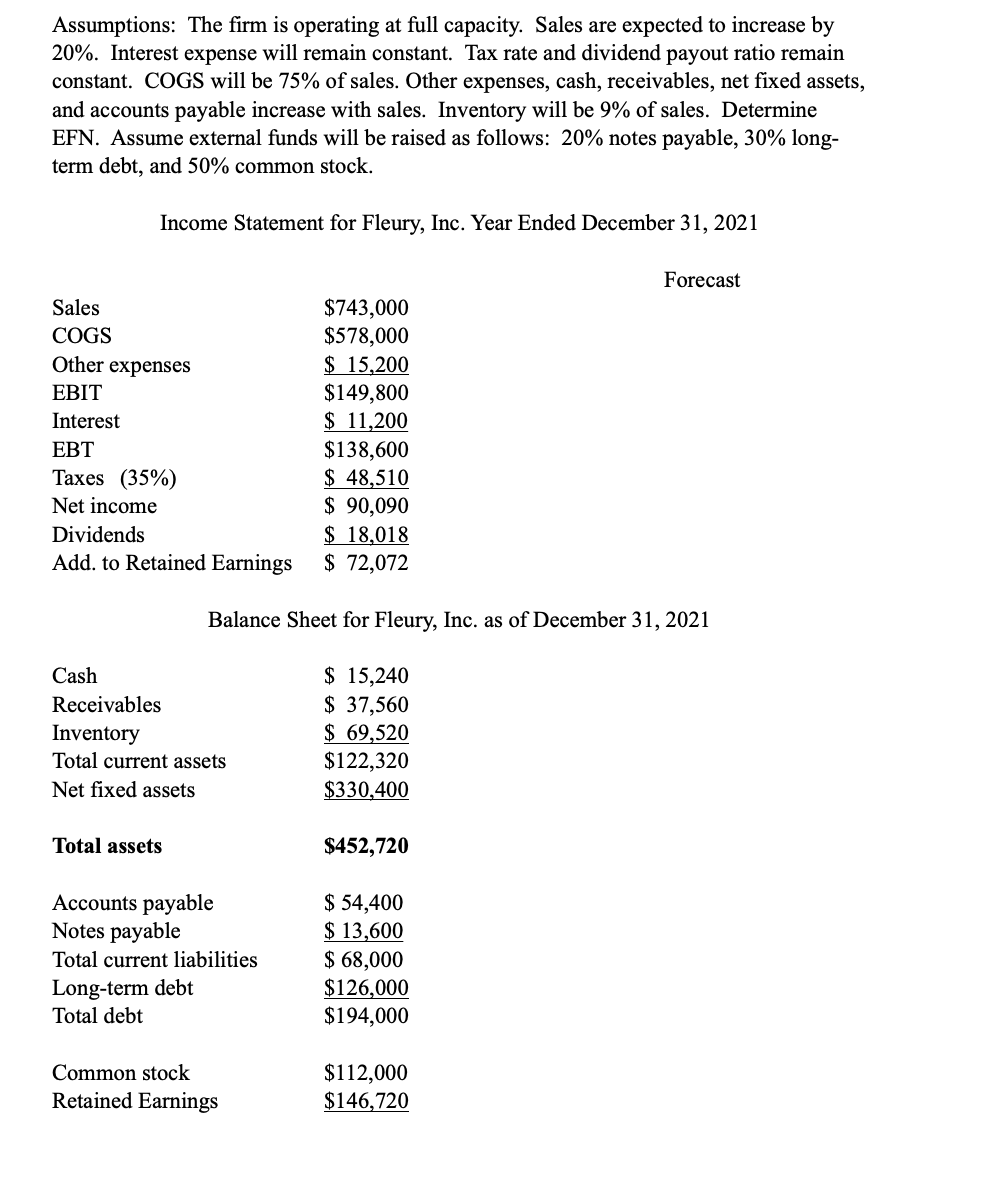

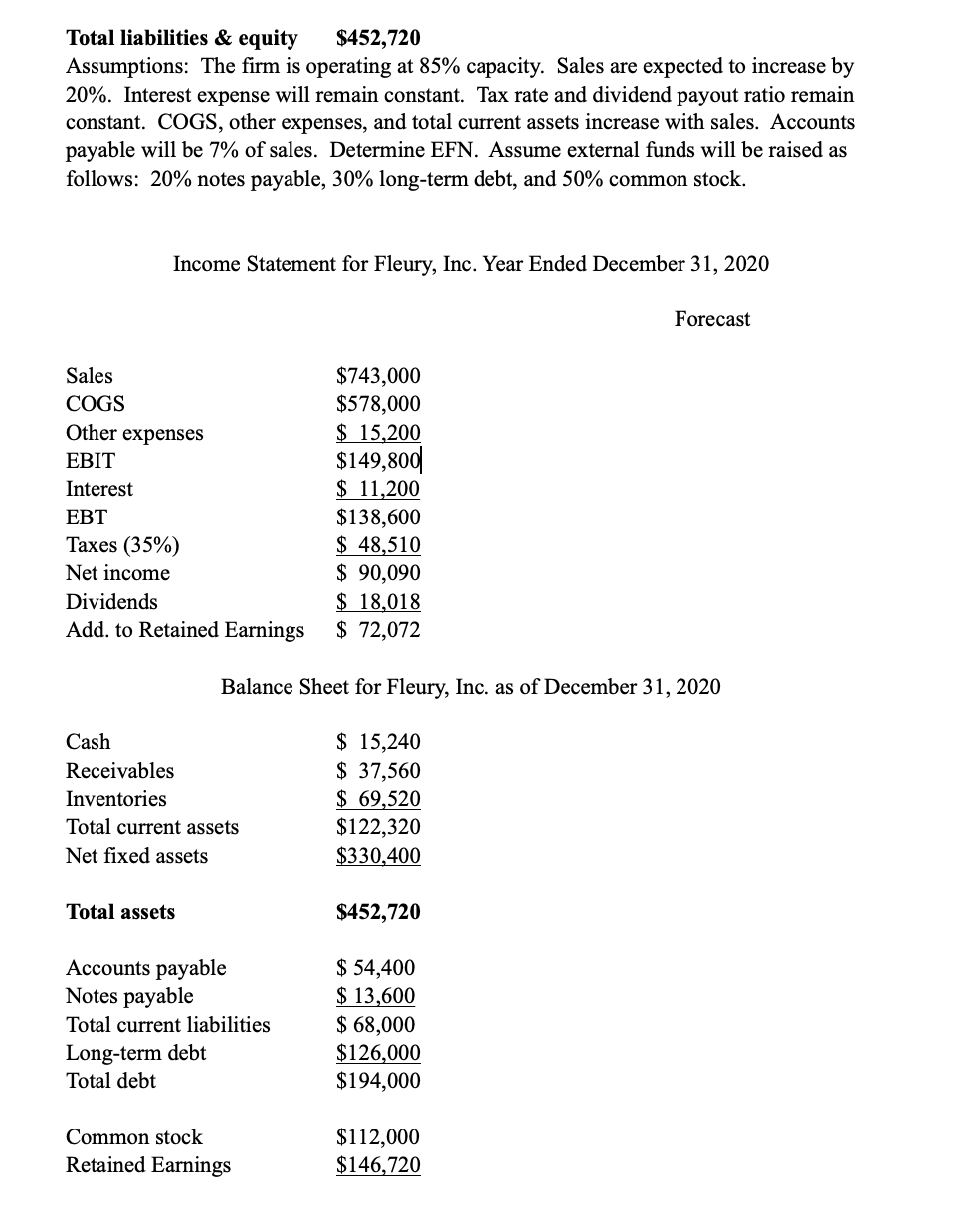

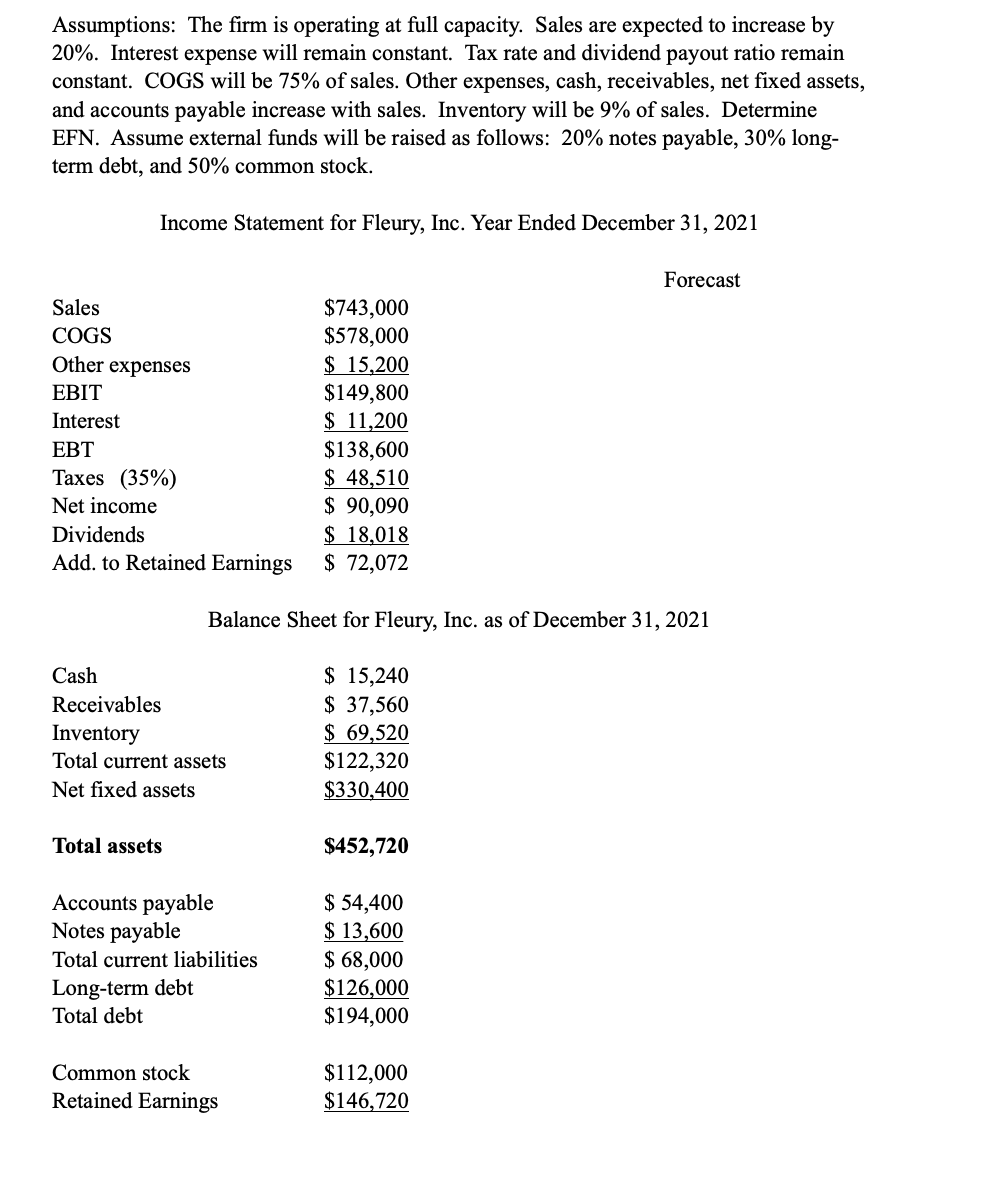

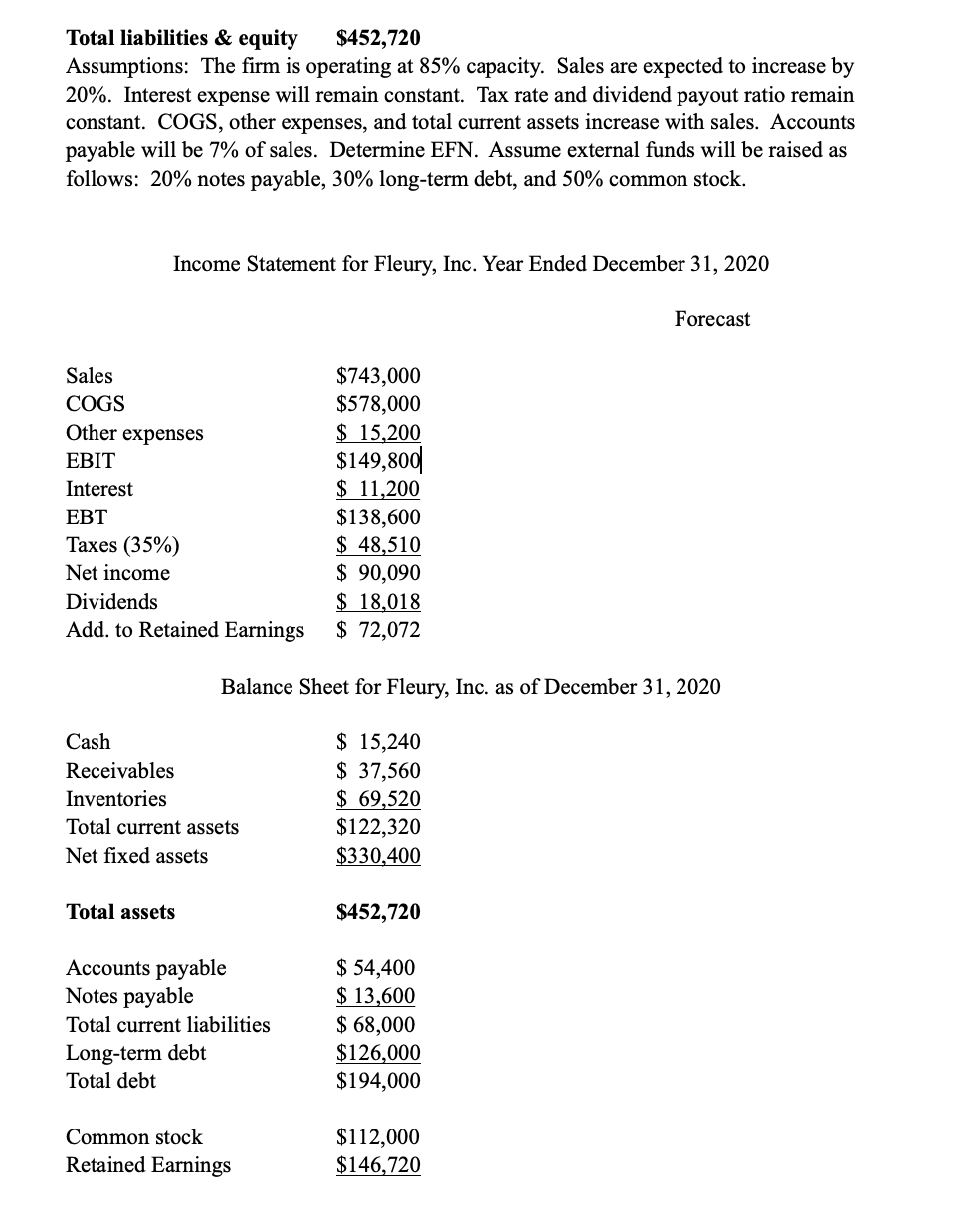

Assumptions: The firm is operating at full capacity. Sales are expected to increase by 20%. Interest expense will remain constant. Tax rate and dividend payout ratio remain constant. COGS will be 75% of sales. Other expenses, cash, receivables, net fixed assets, and accounts payable increase with sales. Inventory will be 9% of sales. Determine EFN. Assume external funds will be raised as follows: 20% notes payable, 30% long- term debt, and 50% common stock. Income Statement for Fleury, Inc. Year Ended December 31, 2021 Forecast Sales COGS Other expenses EBIT Interest EBT Taxes (35%) Net income Dividends Add. to Retained Earnings $743,000 $578,000 $ 15,200 $149,800 $ 11,200 $138,600 $ 48,510 $ 90,090 $ 18,018 $ 72,072 Balance Sheet for Fleury, Inc. as of December 31, 2021 Cash Receivables Inventory Total current assets Net fixed assets $ 15,240 $ 37,560 $ 69,520 $122,320 $330,400 Total assets $452,720 Accounts payable Notes payable Total current liabilities Long-term debt Total debt $ 54,400 $ 13,600 $ 68,000 $126,000 $194,000 Common stock Retained Earnings $112,000 $146,720 Total liabilities & equity $452,720 Assumptions: The firm is operating at 85% capacity. Sales are expected to increase by 20%. Interest expense will remain constant. Tax rate and dividend payout ratio remain constant. COGS, other expenses, and total current assets increase with sales. Accounts payable will be 7% of sales. Determine EFN. Assume external funds will be raised as follows: 20% notes payable, 30% long-term debt, and 50% common stock. Income Statement for Fleury, Inc. Year Ended December 31, 2020 Forecast Sales COGS Other expenses EBIT Interest EBT Taxes (35%) Net income Dividends Add to Retained Earnings $743,000 $578,000 $ 15,200 $149,800 $ 11,200 $138,600 $ 48,510 $ 90,090 $ 18,018 $ 72,072 Balance Sheet for Fleury, Inc. as of December 31, 2020 Cash Receivables Inventories Total current assets Net fixed assets $ 15,240 $ 37,560 $ 69,520 $122,320 $330,400 Total assets $452,720 Accounts payable Notes payable Total current liabilities Long-term debt Total debt $ 54,400 $ 13,600 $ 68,000 $126,000 $194,000 Common stock Retained Earnings $112,000 $146,720 Total Common equity $258,720 Total liabilities & equity $452,720