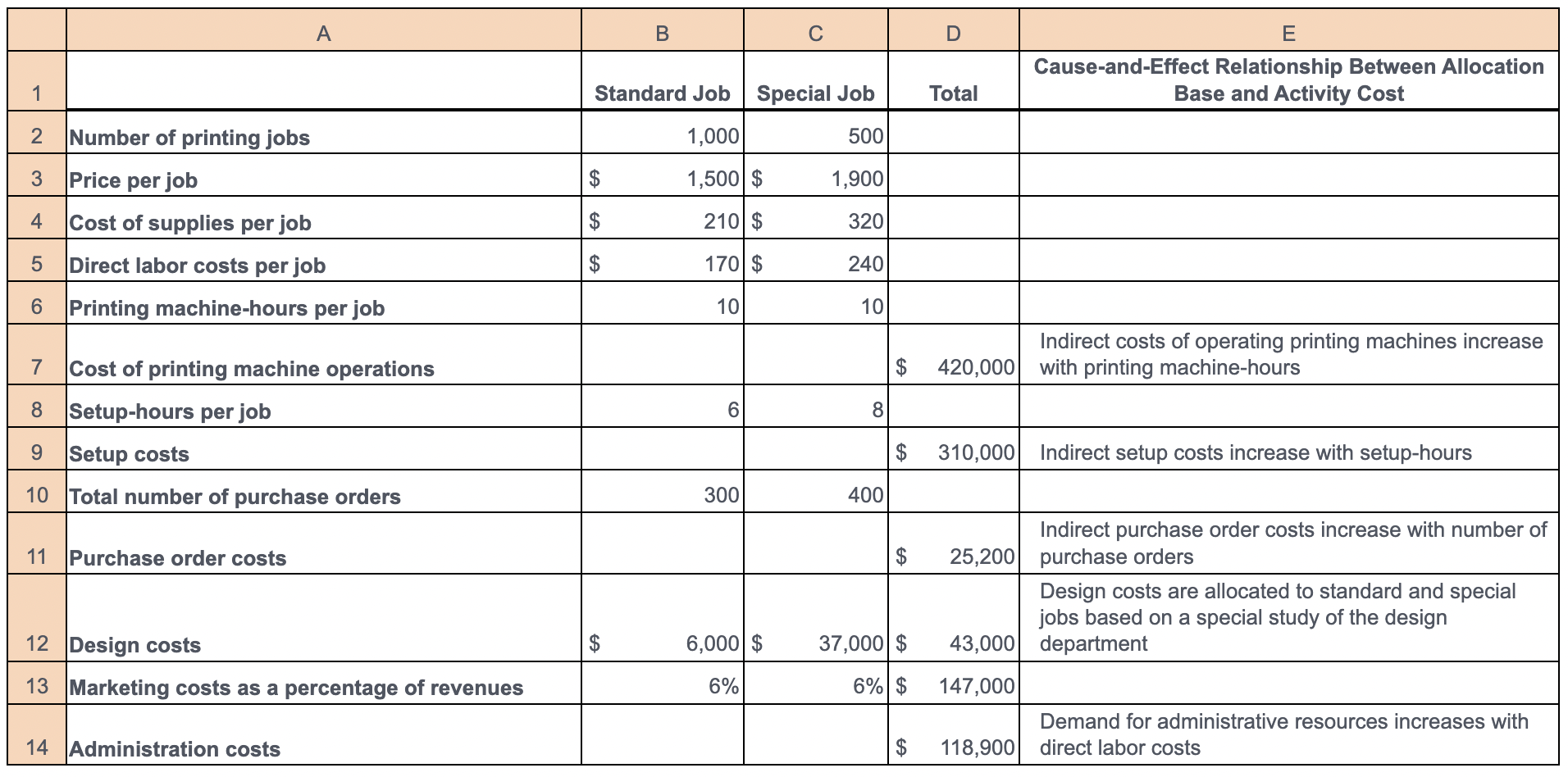

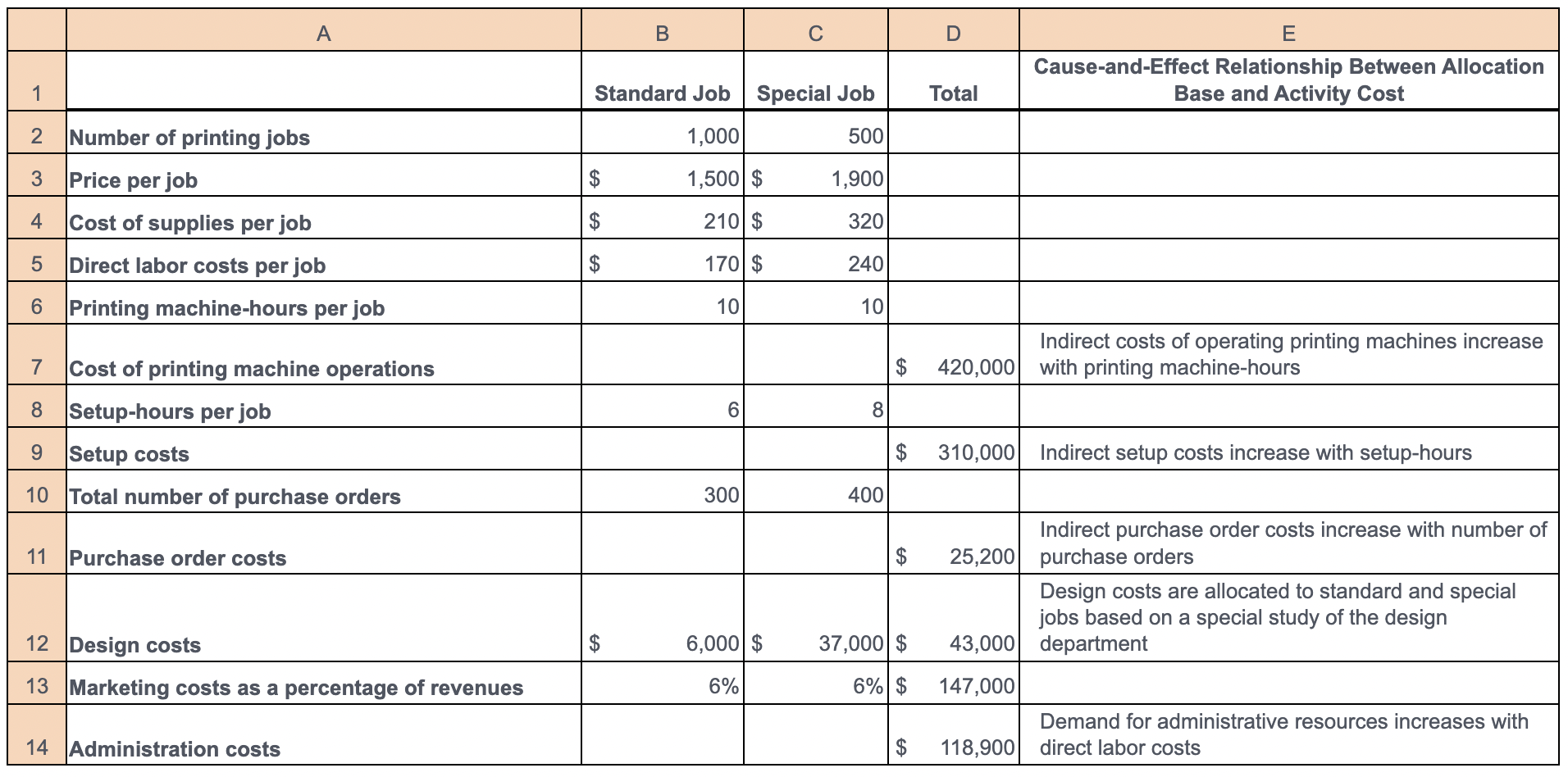

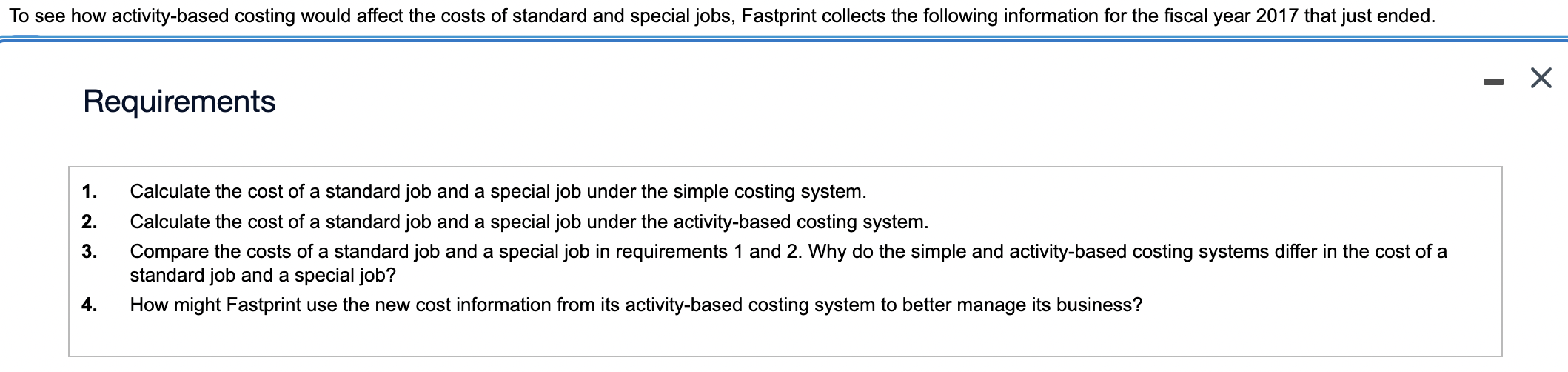

astprint Corporation owns a small printing press that prints leaflets, brochures, and advertising naterials. Fastprint classifies its various printing jobs as standard jobs or special jobs. More info Fastprint's simple job-costing system has two direct-cost categories (direct materials and direct labor) and a single indirect-cost pool. Fastprint operates at capacity and allocates all indirect costs using printing machine-hours as the allocation base. Fastprint is concerned about the accuracy of the costs assigned to standard and special jobs and therefore is planning to implement an activity-based costing system. Fastprint's ABC system would have the same direct-cost categories as its simple costing system. However, instead of a single indirect-cost pool there would now be six categories for assigning indirect costs: design, purchasing, setup, printing machine operations, marketing, and administration. Requirements 1. Calculate the cost of a standard job and a special job under the simple costing system. 2. Calculate the cost of a standard job and a special job under the activity-based costing system. 3. Compare the costs of a standard job and a special job in requirements 1 and 2 . Why do the simple and activity-based costing systems differ in the cost of a standard job and a special job? 4. How might Fastprint use the new cost information from its activity-based costing system to better manage its business? astprint Corporation owns a small printing press that prints leaflets, brochures, and advertising naterials. Fastprint classifies its various printing jobs as standard jobs or special jobs. More info Fastprint's simple job-costing system has two direct-cost categories (direct materials and direct labor) and a single indirect-cost pool. Fastprint operates at capacity and allocates all indirect costs using printing machine-hours as the allocation base. Fastprint is concerned about the accuracy of the costs assigned to standard and special jobs and therefore is planning to implement an activity-based costing system. Fastprint's ABC system would have the same direct-cost categories as its simple costing system. However, instead of a single indirect-cost pool there would now be six categories for assigning indirect costs: design, purchasing, setup, printing machine operations, marketing, and administration. Requirements 1. Calculate the cost of a standard job and a special job under the simple costing system. 2. Calculate the cost of a standard job and a special job under the activity-based costing system. 3. Compare the costs of a standard job and a special job in requirements 1 and 2 . Why do the simple and activity-based costing systems differ in the cost of a standard job and a special job? 4. How might Fastprint use the new cost information from its activity-based costing system to better manage its business