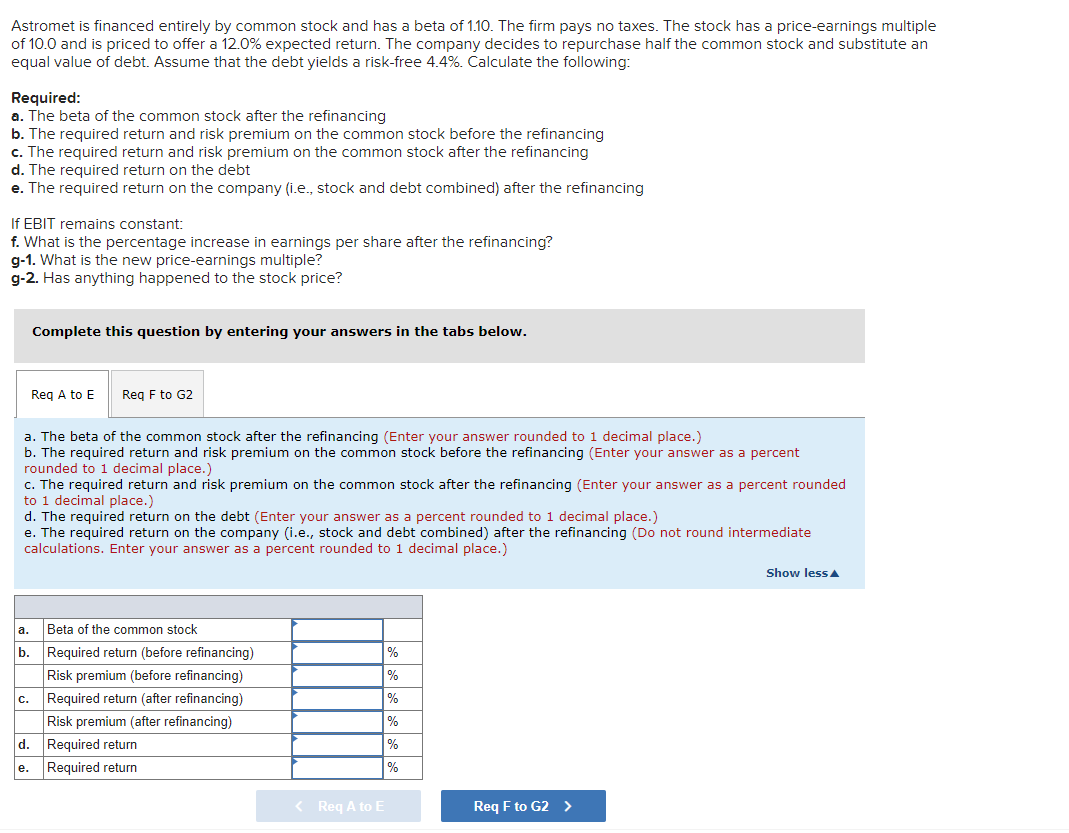

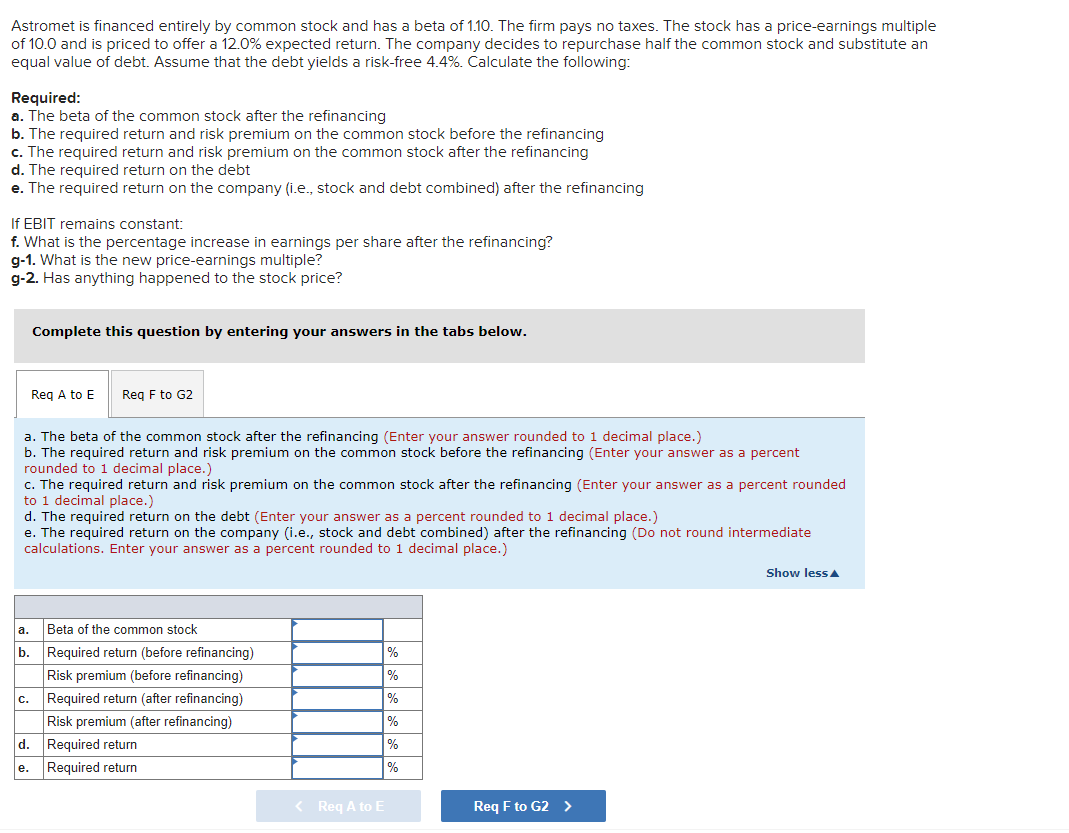

Astromet is financed entirely by common stock and has a beta of 1.10. The firm pays no taxes. The stock has a price-earnings multiple of 10.0 and is priced to offer a 12.0% expected return. The company decides to repurchase half the common stock and substitute an equal value of debt. Assume that the debt yields a risk-free 4.4%. Calculate the following: Required: a. The beta of the common stock after the refinancing b. The required return and risk premium on the common stock before the refinancing c. The required return and risk premium on the common stock after the refinancing d. The required return on the debt e. The required return on the company (i.e., stock and debt combined) after the refinancing If EBIT remains constant: f. What is the percentage increase in earnings per share after the refinancing? g-1. What is the new price-earnings multiple? g-2. Has anything happened to the stock price? Complete this question by entering your answers in the tabs below. Req A to E Req F to G2 a. The beta of the common stock after the refinancing (Enter your answer rounded to 1 decimal place.) b. The required return and risk premium on the common stock before the refinancing (Enter your answer as a percent rounded to 1 decimal place.) C. The required return and risk premium on the common stock after the refinancing (Enter your answer as a percent rounded to 1 decimal place.) d. The required return on the debt (Enter your answer as a percent rounded to 1 decimal place.) e. The required return on the company (i.e., stock and debt combined) after the refinancing (Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place.) Show less A % % a. Beta of the common stock b. Required return (before refinancing) Risk premium (before refinancing) Required return (after refinancing) Risk premium (after refinancing) d. Required return Required return C. % % % % e. Astromet is financed entirely by common stock and has a beta of 1.10. The firm pays no taxes. The stock has a price-earnings multiple of 10.0 and is priced to offer a 12.0% expected return. The company decides to repurchase half the common stock and substitute an equal value of debt. Assume that the debt yields a risk-free 4.4%. Calculate the following: Required: a. The beta of the common stock after the refinancing b. The required return and risk premium on the common stock before the refinancing c. The required return and risk premium on the common stock after the refinancing d. The required return on the debt e. The required return on the company (i.e., stock and debt combined) after the refinancing If EBIT remains constant: f. What is the percentage increase in earnings per share after the refinancing? g-1. What is the new price-earnings multiple? g-2. Has anything happened to the stock price? Complete this question by entering your answers in the tabs below. Req A to E Req F to G2 a. The beta of the common stock after the refinancing (Enter your answer rounded to 1 decimal place.) b. The required return and risk premium on the common stock before the refinancing (Enter your answer as a percent rounded to 1 decimal place.) C. The required return and risk premium on the common stock after the refinancing (Enter your answer as a percent rounded to 1 decimal place.) d. The required return on the debt (Enter your answer as a percent rounded to 1 decimal place.) e. The required return on the company (i.e., stock and debt combined) after the refinancing (Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place.) Show less A % % a. Beta of the common stock b. Required return (before refinancing) Risk premium (before refinancing) Required return (after refinancing) Risk premium (after refinancing) d. Required return Required return C. % % % % e.