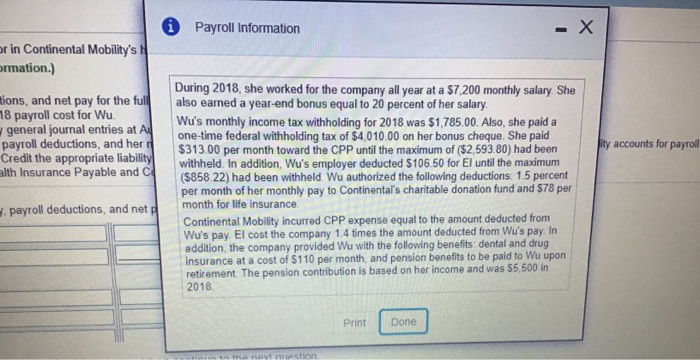

Asume that Jayce Wu ina makuting director in Continental Mobaby's head office in Ottawa Click the icon to view the payroll formation) 1. Compute Wu's oppayroll deductions and met pay for the year 2018 2. Compute Continental Mobily's total 2018 payroll cost for Wu 3. Prepare Continental Mobily's summary general Journal entes at August explanations we not required to records expense for the lowing .. Wu's total camings for the year her payroll deductions, and her not pay Debt Salary Expense and Executive Bonus Compensations appropriate Credits for productions and Care Employer payroll expenses for We Creathe appropriate Baby c. Beneles provided to Wu Credit Health Insurance Payable and Company Pension Payable Requirement 1. Compute Wu's grous pey, payrol deductions, and net pay for the full your 2018. (Round all amounts to the nearest cant) 0 Payroll Information - X or in Continental Mobility's H ormation.) tions, and net pay for the full 18 payroll cost for Wu. general journal entries at Al payroll deductions, and her Credit the appropriate liability alth Insurance Payable and lity accounts for payroll During 2018, she worked for the company all year at a $7,200 monthly salary. She also earned a year-end bonus equal to 20 percent of her salary. Wu's monthly income tax withholding for 2018 was $1,785.00. Also, she paid a one-time federal withholding tax of $4.010.00 on her bonus cheque. She paid $313.00 per month toward the CPP until the maximum of ($2,593.80) had been withheld. In addition, Wu's employer deducted $106.50 for El until the maximum (5858 22) had been withheld. Wu authorized the following deductions: 1.5 percent per month of her monthly pay to Continental's charitable donation fund and $78 per month for life insurance Continental Mobility incurred CPP expense equal to the amount deducted from Wu's pay. El cost the company 1.4 times the amount deducted from Wu's pay. In addition, the company provided Wu with the following benefits dental and drug insurance at a cost of $110 per month, and pension benefits to be paid to Wu upon retirement. The pension contribution is based on her income and was 55,500 in 2018 payroll deductions, and net Print Done the notection