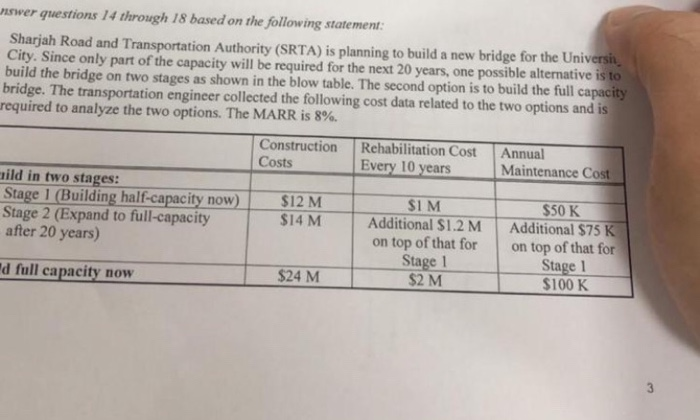

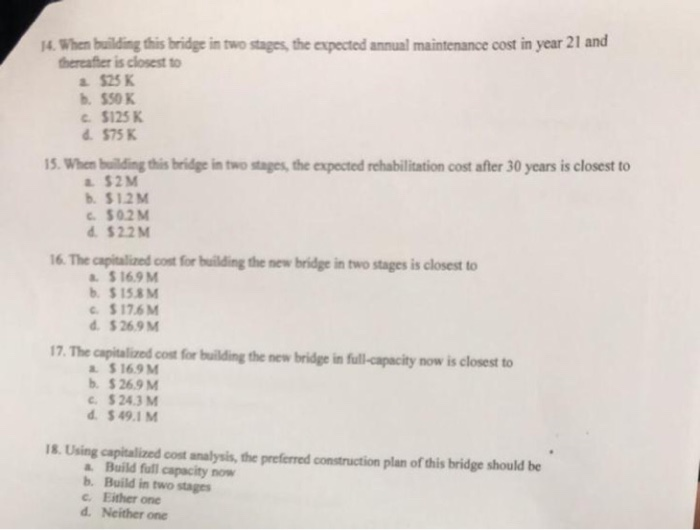

aswer questions 14 through 18 based on the following statement: Sharjah Road and Transportation Authority (SRTA) is planning to build a new bridge for the Universi City. Since only part of the capacity will be required for the next 20 years, one possible alternative is to build the bridge on two stages as shown in the blow table. The second option is to build the full capacity bridge. The transportation engineer collected the following cost data related to the two options and is required to analyze the two options. The MARR is 8%. Construction Costs Rehabilitation Cost Every 10 years Annual Maintenance Cost uild in two stages: Stage 1 (Building half-capacity now) Stage 2 (Expand to full-capacity after 20 years) $12 M $14M SIM Additional $1.2M on top of that for Stage 1 $2 M $50 K Additional $75 K on top of that for Stage 1 $100 K d full capacity now $24M 14. When building this bridge in two stages, the expected annual maintenance cost in year 21 and thereafter is closest to $25 K b. $SOK c. $125K d. 575K 15. When building this bridge in two stages, the expected rehabilitation cost after 30 years is closest to 52M b. 512M 502M . $22M 16. The capitalized cost for building the new bridge in two stages is closest to &.5 16.9 M b. 515.8M 6.5 176 M 6.5 26.9 M 17. The capitalized cost for building the new bridge in full-capacity now is closest to 25 16.9 M b. 526.9 M . 5 243 M d. 549.1 M 18. Using capitalized cost analysis, the preferred construction plan of this bridge should be Build full capacity now b. Build in two stages c. Either one d. Neither one aswer questions 14 through 18 based on the following statement: Sharjah Road and Transportation Authority (SRTA) is planning to build a new bridge for the Universi City. Since only part of the capacity will be required for the next 20 years, one possible alternative is to build the bridge on two stages as shown in the blow table. The second option is to build the full capacity bridge. The transportation engineer collected the following cost data related to the two options and is required to analyze the two options. The MARR is 8%. Construction Costs Rehabilitation Cost Every 10 years Annual Maintenance Cost uild in two stages: Stage 1 (Building half-capacity now) Stage 2 (Expand to full-capacity after 20 years) $12 M $14M SIM Additional $1.2M on top of that for Stage 1 $2 M $50 K Additional $75 K on top of that for Stage 1 $100 K d full capacity now $24M 14. When building this bridge in two stages, the expected annual maintenance cost in year 21 and thereafter is closest to $25 K b. $SOK c. $125K d. 575K 15. When building this bridge in two stages, the expected rehabilitation cost after 30 years is closest to 52M b. 512M 502M . $22M 16. The capitalized cost for building the new bridge in two stages is closest to &.5 16.9 M b. 515.8M 6.5 176 M 6.5 26.9 M 17. The capitalized cost for building the new bridge in full-capacity now is closest to 25 16.9 M b. 526.9 M . 5 243 M d. 549.1 M 18. Using capitalized cost analysis, the preferred construction plan of this bridge should be Build full capacity now b. Build in two stages c. Either one d. Neither one