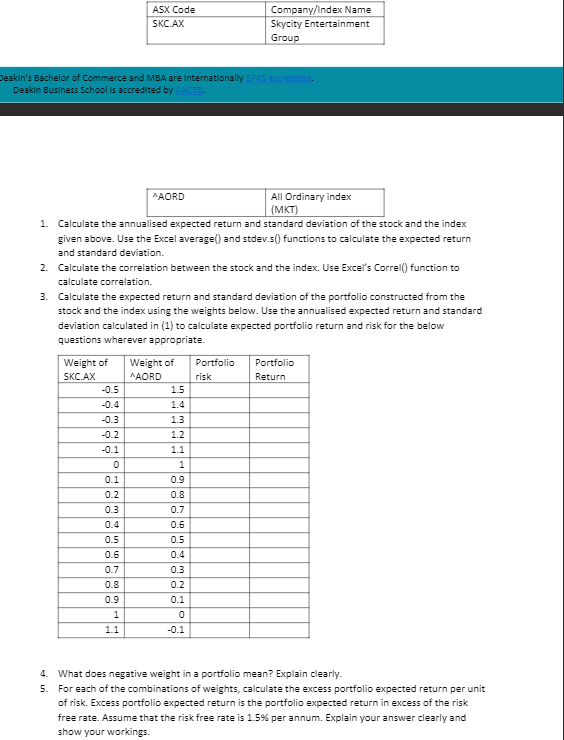

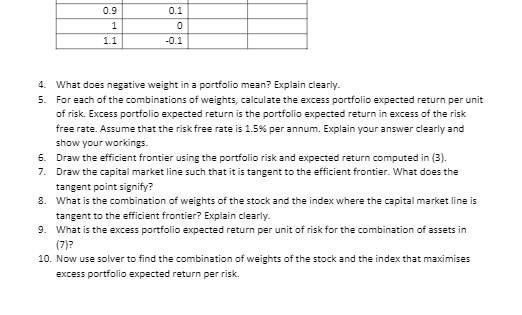

ASX Code SKC.AX Company/Index Name Skycity Entertainment Group Deakin's Bachelor of Commerce and MBA are Internationally EPAS accredited. Deakin Business School is accredited by AACSB. AAORD All Ordinary index (MKT) 1. Calculate the annualised expected return and standard deviation of the stock and the index given above. Use the Excel average() and stdev.s() functions to calculate the expected return and standard deviation. 2. Calculate the correlation between the stock and the index. Use Excel's Correl() function to calculate correlation 3. Calculate the expected return and standard deviation of the portfolio constructed from the stock and the index using the weights below. Use the annualised expected return and standard deviation calculated in (1) to calculate expected portfolio return and risk for the below questions wherever appropriate. Portfolio risk Portfolio Return Weight of AAORD 1.5 1.4 1.3 1.2 Weight of SKC.AX -0.5 -0.4 -0.3 -0.2 -0.1 0 0.1 0.2 0.3 0.4 0.5 1.1 1 0.9 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0 -0.1 0.7 0.8 0.9 1 1.1 4. What does negative weight in a portfolio mean? Explain clearly. 5. For each of the combinations of weights, calculate the excess portfolio expected return per unit of risk. Excess portfolio expected return is the portfolio expected return in excess of the risk free rate. Assume that the risk free rate is 1.5% per annum. Explain your answer clearly and show your workings. 0.1 0 1 1.1 -0.1 4. What does negative weight in a portfolio mean? Explain clearly. 5. For each of the combinations of weights, calculate the excess portfolio expected return per unit of risk. Excess portfolio expected return is the portfolio expected return in excess of the risk free rate. Assume that the risk free rate is 1.5% per annum. Explain your answer clearly and show your workings 6. Draw the efficient frontier using the portfolio risk and expected return computed in (3). 7. Draw the capital market line such that it is tangent to the efficient frontier. What does the tangent point signify? 3. What is the combination of weights of the stock and the index where the capital market line is tangent to the efficient frontier? Explain clearly 9. What is the excess portfolio expected return per unit of risk for the combination of assets in (7)? 10. Now use solver to find the combination of weights of the stock and the index that maximises excess portfolio expected return per risk. ASX Code SKC.AX Company/Index Name Skycity Entertainment Group Deakin's Bachelor of Commerce and MBA are Internationally EPAS accredited. Deakin Business School is accredited by AACSB. AAORD All Ordinary index (MKT) 1. Calculate the annualised expected return and standard deviation of the stock and the index given above. Use the Excel average() and stdev.s() functions to calculate the expected return and standard deviation. 2. Calculate the correlation between the stock and the index. Use Excel's Correl() function to calculate correlation 3. Calculate the expected return and standard deviation of the portfolio constructed from the stock and the index using the weights below. Use the annualised expected return and standard deviation calculated in (1) to calculate expected portfolio return and risk for the below questions wherever appropriate. Portfolio risk Portfolio Return Weight of AAORD 1.5 1.4 1.3 1.2 Weight of SKC.AX -0.5 -0.4 -0.3 -0.2 -0.1 0 0.1 0.2 0.3 0.4 0.5 1.1 1 0.9 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0 -0.1 0.7 0.8 0.9 1 1.1 4. What does negative weight in a portfolio mean? Explain clearly. 5. For each of the combinations of weights, calculate the excess portfolio expected return per unit of risk. Excess portfolio expected return is the portfolio expected return in excess of the risk free rate. Assume that the risk free rate is 1.5% per annum. Explain your answer clearly and show your workings. 0.1 0 1 1.1 -0.1 4. What does negative weight in a portfolio mean? Explain clearly. 5. For each of the combinations of weights, calculate the excess portfolio expected return per unit of risk. Excess portfolio expected return is the portfolio expected return in excess of the risk free rate. Assume that the risk free rate is 1.5% per annum. Explain your answer clearly and show your workings 6. Draw the efficient frontier using the portfolio risk and expected return computed in (3). 7. Draw the capital market line such that it is tangent to the efficient frontier. What does the tangent point signify? 3. What is the combination of weights of the stock and the index where the capital market line is tangent to the efficient frontier? Explain clearly 9. What is the excess portfolio expected return per unit of risk for the combination of assets in (7)? 10. Now use solver to find the combination of weights of the stock and the index that maximises excess portfolio expected return per risk