Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At 24, you finish college and are fortunate enough to have a job waiting for you. Your first job has a starting salary of $75,000

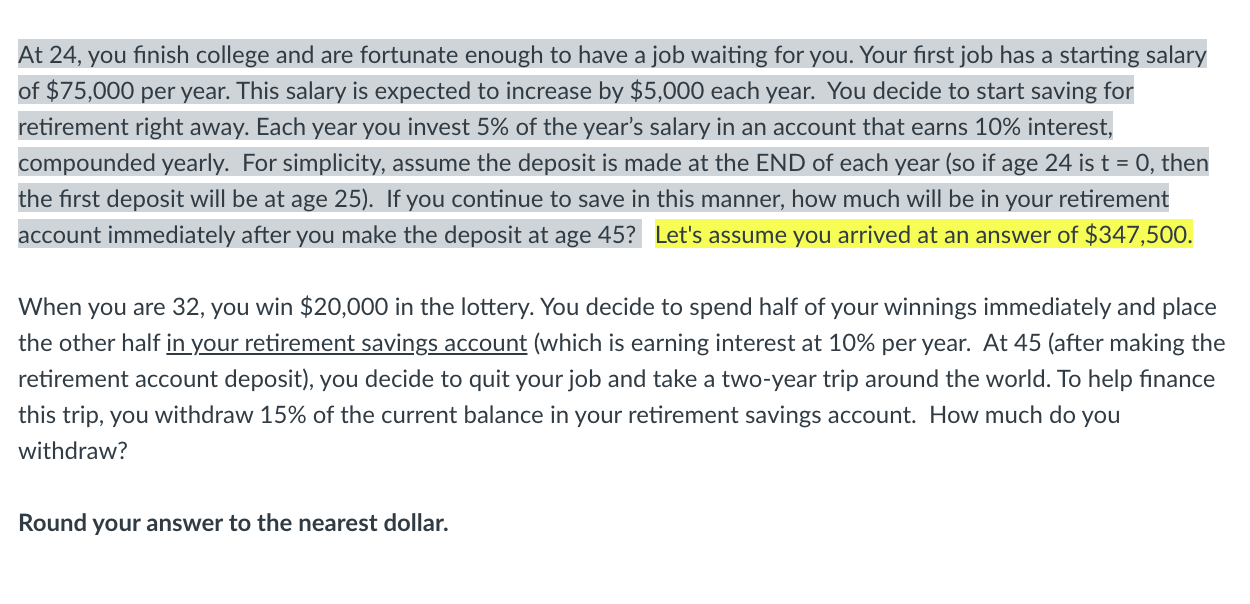

At 24, you finish college and are fortunate enough to have a job waiting for you. Your first job has a starting salary of $75,000 per year. This salary is expected to increase by $5,000 each year. You decide to start saving for retirement right away. Each year you invest 5% of the year's salary in an account that earns 10% interest, compounded yearly. For simplicity, assume the deposit is made at the END of each year (so if age 24 is t=0, then the first deposit will be at age 25). If you continue to save in this manner, how much will be in your retirement account immediately after you make the deposit at age 45 ? Let's assume you arrived at an answer of $347,500. When you are 32 , you win $20,000 in the lottery. You decide to spend half of your winnings immediately and place the other half in your retirement savings account (which is earning interest at 10\% per year. At 45 (after making the retirement account deposit), you decide to quit your job and take a two-year trip around the world. To help finance this trip, you withdraw 15% of the current balance in your retirement savings account. How much do you withdraw? Round your answer to the nearest dollar

At 24, you finish college and are fortunate enough to have a job waiting for you. Your first job has a starting salary of $75,000 per year. This salary is expected to increase by $5,000 each year. You decide to start saving for retirement right away. Each year you invest 5% of the year's salary in an account that earns 10% interest, compounded yearly. For simplicity, assume the deposit is made at the END of each year (so if age 24 is t=0, then the first deposit will be at age 25). If you continue to save in this manner, how much will be in your retirement account immediately after you make the deposit at age 45 ? Let's assume you arrived at an answer of $347,500. When you are 32 , you win $20,000 in the lottery. You decide to spend half of your winnings immediately and place the other half in your retirement savings account (which is earning interest at 10\% per year. At 45 (after making the retirement account deposit), you decide to quit your job and take a two-year trip around the world. To help finance this trip, you withdraw 15% of the current balance in your retirement savings account. How much do you withdraw? Round your answer to the nearest dollar Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started