Answered step by step

Verified Expert Solution

Question

1 Approved Answer

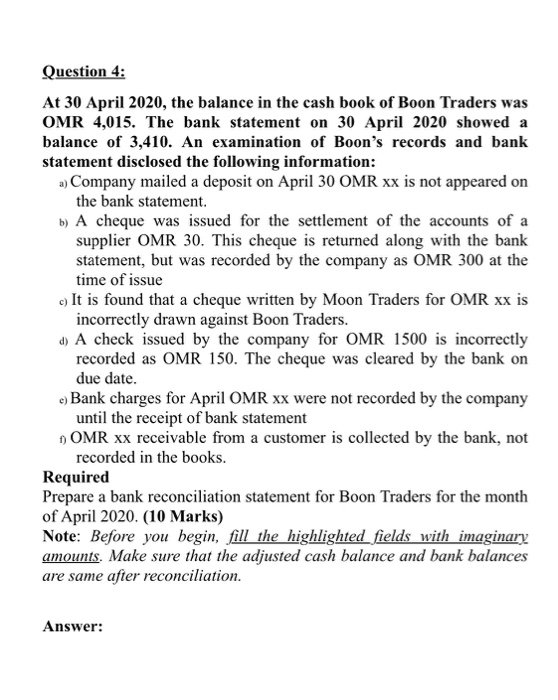

At 30 April 2020, the balance in the cash book of Boon Traders was OMR 4,015. The bank statement on 30 April 2020 showed a

At 30 April 2020, the balance in the cash book of Boon Traders was OMR 4,015. The bank statement on 30 April 2020 showed a balance of 3,410. An examination of Boons records and bank statement disclosed the following information:

a) Company mailed a deposit on April 30 OMR xx is not appeared on the bank statement.

b) A cheque was issued for the settlement of the accounts of a supplier OMR 30. This cheque is returned along with the bank statement, but was recorded by the company as OMR 300 at the time of issue

c) It is found that a cheque written by Moon Traders for OMR xx is incorrectly drawn against Boon Traders.

d) A check issued by the company for OMR 1500 is incorrectly recorded as OMR 150. The cheque was cleared by the bank on due date.

e) Bank charges for April OMR xx were not recorded by the company until the receipt of bank statement

f) OMR xx receivable from a customer is collected by the bank, not recorded in the books.

Required

Prepare a bank reconciliation statement for Boon Traders for the month of April 2020. (10 Marks)

Note: Before you begin, fill the highlighted fields with imaginary amounts. Make sure that the adjusted cash balance and bank balances are same after reconciliation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started