Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At 30 June 2022, Boxes Ltd reported the following assets. Land $100 000 Plant $500 000 Accumulated Depreciation (100 000) Goodwill 16 000 Inventories

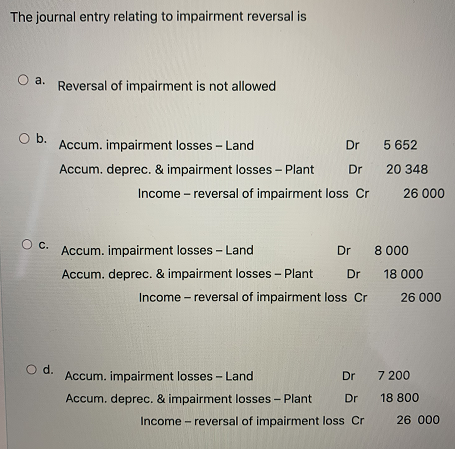

At 30 June 2022, Boxes Ltd reported the following assets. Land $100 000 Plant $500 000 Accumulated Depreciation (100 000) Goodwill 16 000 Inventories 80 000 Cash 4 000 All assets are measured using the cost model. At 30 June 2022, the recoverable amount of the entity, considered to be a single CGU, was $544 000. For the period ending 30 June 2023, the depreciation charge on plant was $36 800. If the plant had not been impaired the charge would have been $50 000.. At 30 June 2023, the recoverable amount of the entity was calculated to be $26 000 greater than the carrying amount of the assets of the entity. As a result, Boxes Ltd recognised a reversal of the previous year's impairment loss. The journal entry relating to impairment reversal is O a. Reversal of impairment is not allowed Ob. Accum. impairment losses - Land Dr 5 652 Accum. deprec. & impairment losses - Plant Dr 20 348 Income - reversal of impairment loss Cr 26 000 Accum. impairment losses - Land Dr 8 000 Accum. deprec. & impairment losses - Plant Dr 18 000 Income - reversal of impairment loss Cr 26 000 d. Accum. impairment losses - Land Dr 7 200 Accum. deprec. & impairment losses - Plant Dr 18 800 Income - reversal of impairment loss Cr 26 000

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

d Accum impairment losses Land Dr 7 200 Accum deprec impairment losses Plant Dr 18 800 Income revers...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started