Answered step by step

Verified Expert Solution

Question

1 Approved Answer

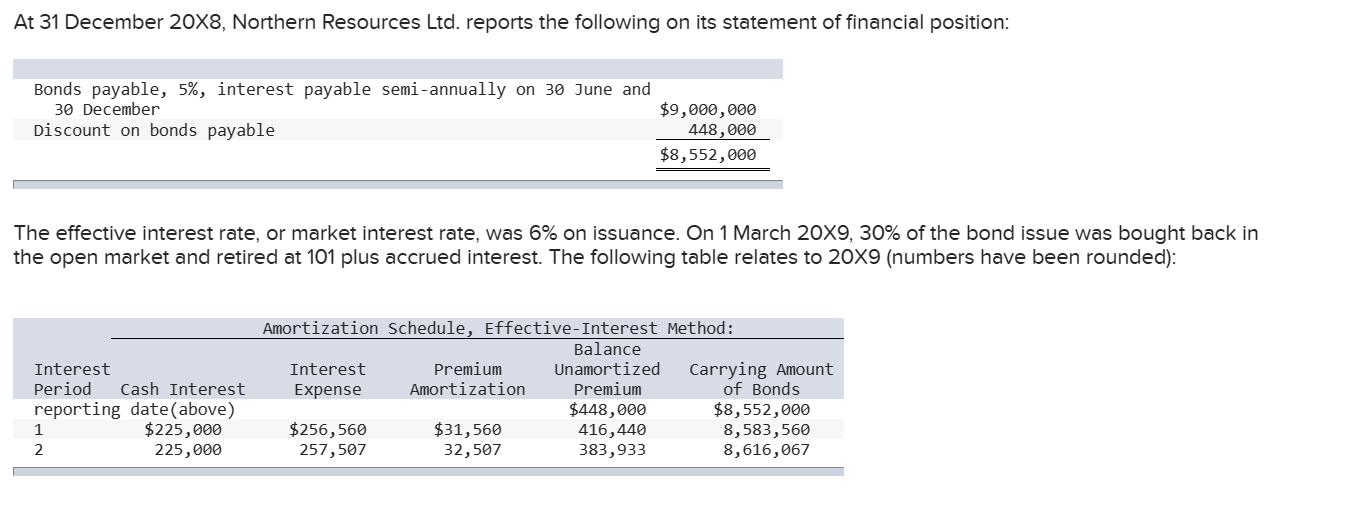

At 31 December 20X8, Northern Resources Ltd. reports the following on its statement of financial position: Bonds payable, 5%, interest payable semi-annually on 30

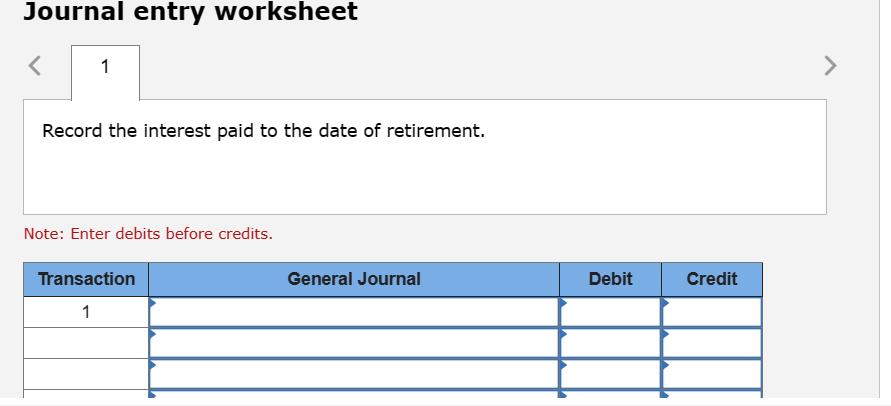

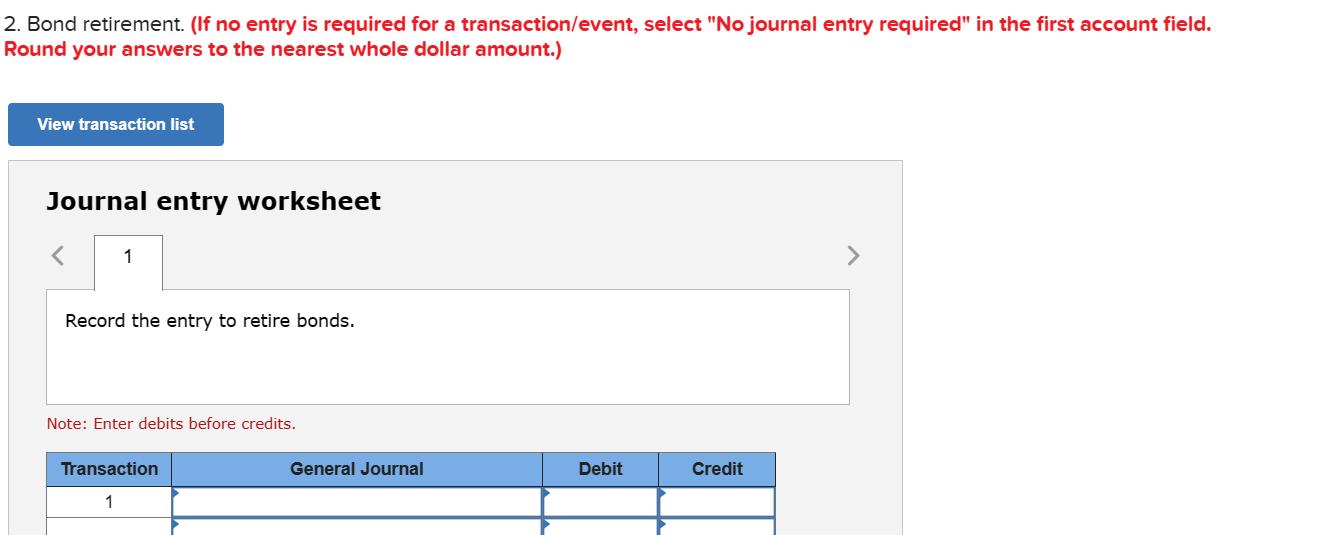

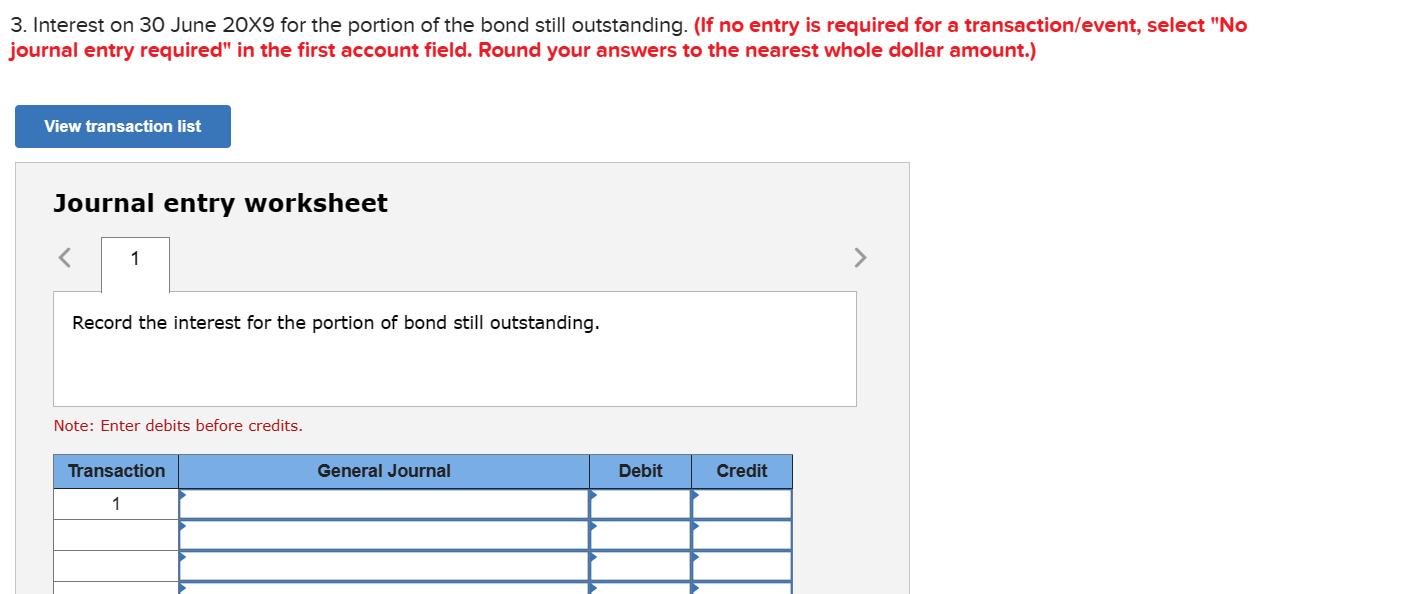

At 31 December 20X8, Northern Resources Ltd. reports the following on its statement of financial position: Bonds payable, 5%, interest payable semi-annually on 30 June and 30 December Discount on bonds payable The effective interest rate, or market interest rate, was 6% on issuance. On 1 March 20X9, 30% of the bond issue was bought back in the open market and retired at 101 plus accrued interest. The following table relates to 20X9 (numbers have been rounded): Interest Period Cash Interest reporting date (above) 1 2 $225,000 225,000 Amortization Schedule, Effective-Interest Method: Balance Interest Expense Unamortized Carrying Amount Premium of Bonds $448,000 $256,560 257,507 Premium Amortization $9,000,000 448,000 $8,552,000 $31,560 32,507 416,440 383,933 $8,552,000 8,583,560 8,616,067 Journal entry worksheet < 1 Record the interest paid to the date of retirement. Note: Enter debits before credits. Transaction 1 General Journal Debit Credit 2. Bond retirement. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollar amount.) View transaction list Journal entry worksheet 1 Record the entry to retire bonds. Note: Enter debits before credits. Transaction 1 General Journal Debit Credit 3. Interest on 30 June 20X9 for the portion of the bond still outstanding. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollar amount.) View transaction list Journal entry worksheet 1 Record the interest for the portion of bond still outstanding. Note: Enter debits before credits. Transaction 1 General Journal Debit Credit

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Date Account titles and explanation Debit Credit 1 01Mar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started