Answered step by step

Verified Expert Solution

Question

1 Approved Answer

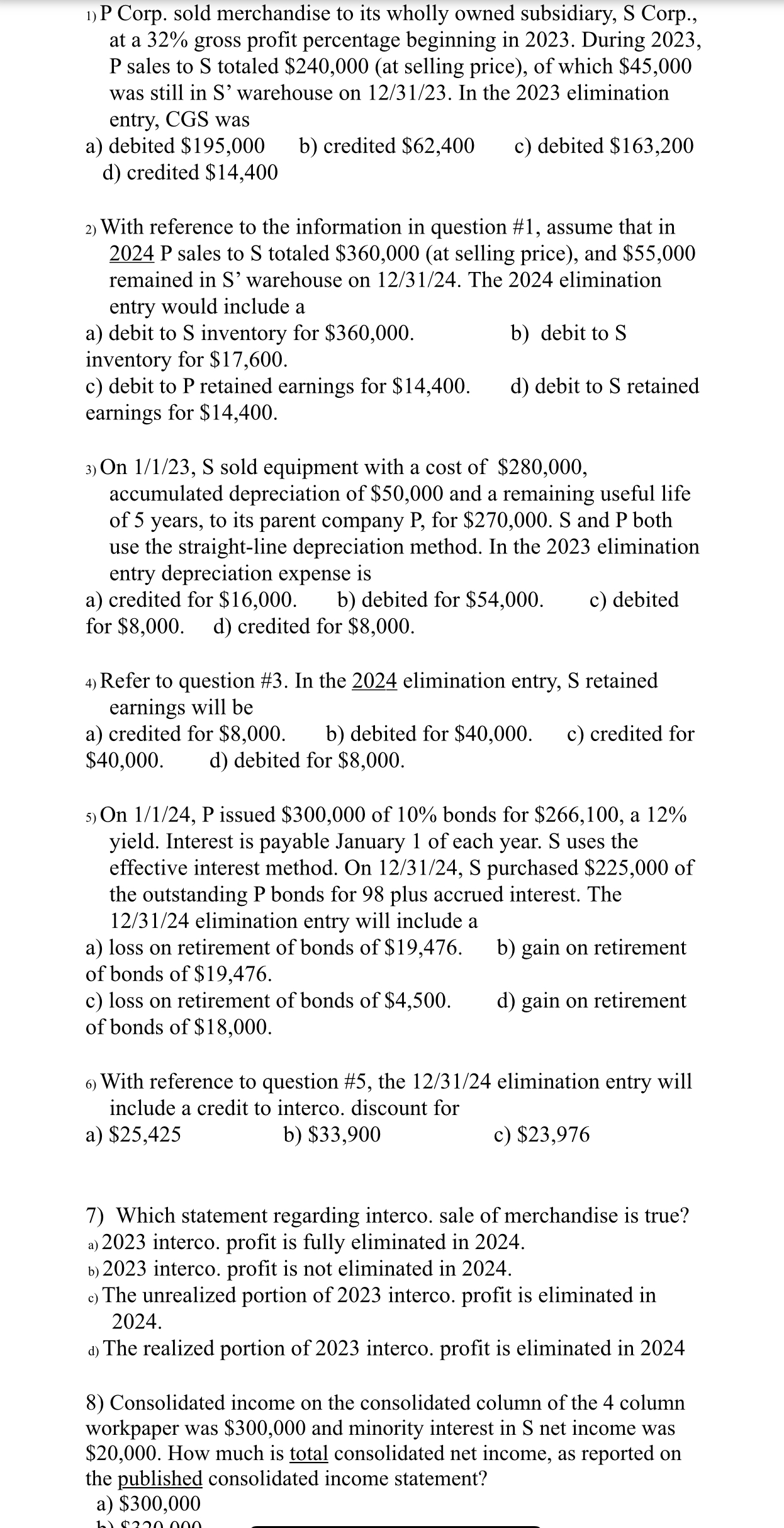

at a 3 2 % gross profit percentage beginning in 2 0 2 3 . During 2 0 2 3 , P sales to S

at a gross profit percentage beginning in During P sales to S totaled $at selling price of which $ was still in S warehouse on In the elimination entry, CGS was

a debited $

b credited $

c debited $

d credited $

With reference to the information in question # assume that in P sales to S totaled $at selling price and $ remained in S warehouse on The elimination entry would include a

a debit to S inventory for $

b debit to S

inventory for $

c debit to P retained earnings for $

d debit to S retained earnings for $

On S sold equipment with a cost of $ accumulated depreciation of $ and a remaining useful life of years, to its parent company P for $ S and P both use the straightline depreciation method. In the elimination entry depreciation expense is

a credited for $

b debited for $

c debited

for $

d credited for $

Refer to question # In the elimination entry, S retained earnings will be

a credited for $

b debited for $

c credited for

$

d debited for $

On P issued $ of bonds for $ a yield. Interest is payable January of each year. S uses the effective interest method. On S purchased $ of the outstanding P bonds for plus accrued interest. The elimination entry will include a

a loss on retirement of bonds of $

b gain on retirement of bonds of $

c loss on retirement of bonds of $

d gain on retirement of bonds of $

With reference to question # the elimination entry will include a credit to interco. discount for

a $

b $

c $

Which statement regarding interco. sale of merchandise is true? a interco. profit is fully eliminated in

b interco. profit is not eliminated in

c The unrealized portion of interco. profit is eliminated in

d The realized portion of interco. profit is eliminated in

Consolidated income on the consolidated column of the column workpaper was $ and minority interest in S net income was $ How much is total consolidated net income, as reported on the published consolidated income statement?

a $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started