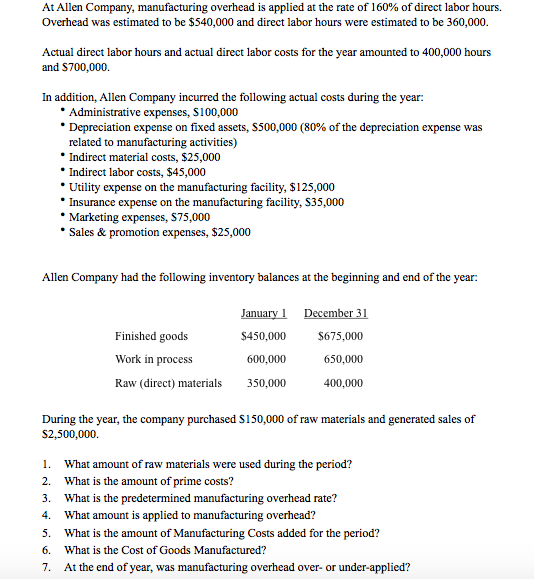

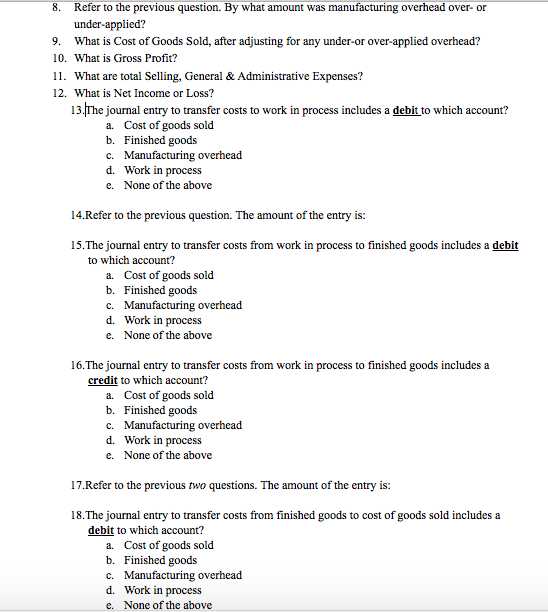

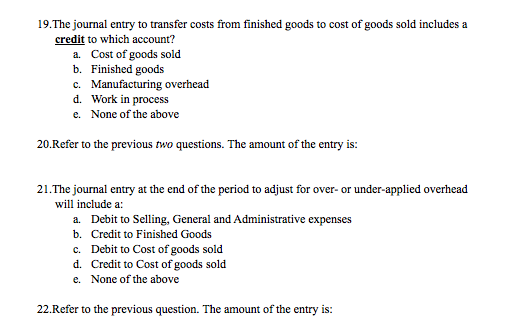

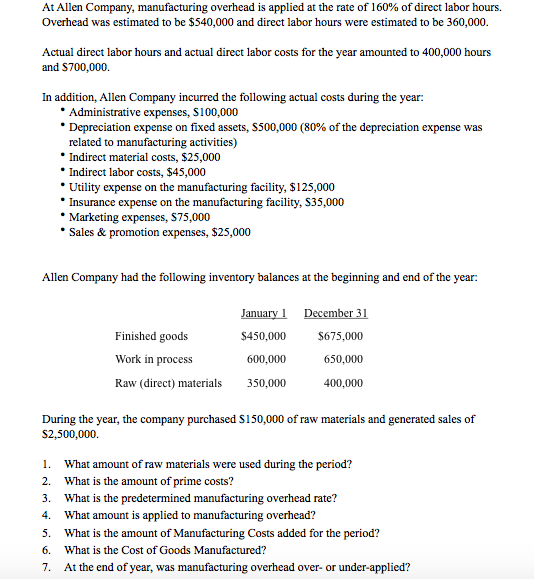

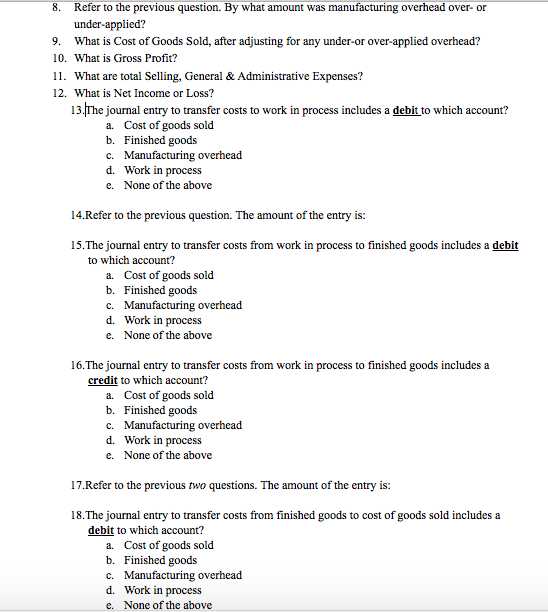

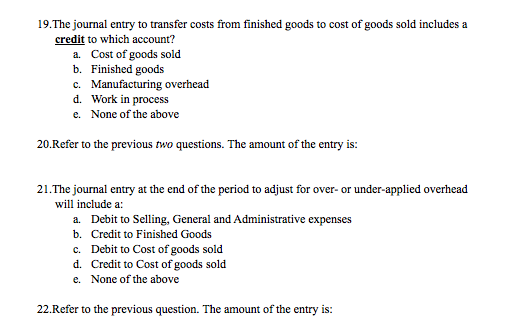

At Allen Company, manufacturing overhead is applied at the rate of 160% of direct labor hours. Overhead was estimated to be $540,000 and direct labor hours were estimated to be 360,000. Actual direct labor hours and actual direct labor costs for the year amounted to 400,000 hours and S700,000. In addition, Allen Company incurred the following actual costs during the year. Administrative expenses, S100,000 Depreciation expense on fixed assets, S500,000 (80% of the depreciation expense was related to manufacturing activities) Indirect material costs, $25,000 * Indirect labor costs, $45,000 Utility expense on the manufacturing facility, $125,000 * Insurance expense on the manufacturing facility, S35,000 Marketing expenses, S75,000 * Sales & promotion expenses, $25,000 Allen Company had the following inventory balances at the beginning and end of the year: Finished goods Work in process Raw (direct) materials January 1 $450,000 600,000 December 31 $675,000 650,000 350,000 400,000 During the year, the company purchased $150,000 of raw materials and generated sales of S2,500,000 1. What amount of raw materials were used during the period? 2. What is the amount of prime costs? 3. What is the predetermined manufacturing overhead rate? 4. What amount is applied to manufacturing overhead? 5. What is the amount of Manufacturing Costs added for the period? 6. What is the Cost of Goods Manufactured? 7. At the end of year, was manufacturing overhead over- or under-applied? 8. Refer to the previous question. By what amount was manufacturing overhead over or under-applied? 9. What is Cost of Goods Sold, after adjusting for any under-or over-applied overhead? 10. What is Gross Profit? 11. What are total Selling. General & Administrative Expenses? 12. What is Net Income or Loss? 13. The journal entry to transfer costs to work in process includes a debit to which account? a. Cost of goods sold b. Finished goods c. Manufacturing overhead d. Work in process e. None of the above 14. Refer to the previous question. The amount of the entry is: 15. The journal entry to transfer costs from work in process to finished goods includes a debit to which account? a. Cost of goods sold b. Finished goods c. Manufacturing overhead d. Work in process e. None of the above 16. The journal entry to transfer costs from work in process to finished goods includes a credit to which account? a. Cost of goods sold b. Finished goods c. Manufacturing overhead d. Work in process e. None of the above 17. Refer to the previous two questions. The amount of the entry is: 18. The journal entry to transfer costs from finished goods to cost of goods sold includes a debit to which account? a. Cost of goods sold b. Finished goods c. Manufacturing overhead d. Work in process e. None of the above 19. The journal entry to transfer costs from finished goods to cost of goods sold includes a credit to which account? a. Cost of goods sold b. Finished goods c. Manufacturing overhead d. Work in process e. None of the above 20. Refer to the previous two questions. The amount of the entry is: 21. The journal entry at the end of the period to adjust for over- or under-applied overhead will include a: a. Debit to Selling, General and Administrative expenses b. Credit to Finished Goods C. Debit to Cost of goods sold d. Credit to Cost of goods sold e. None of the above 22.Refer to the previous question. The amount of the entry is