Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At Arizona State University a bachelor's degree will cost roughly $33,270. Which is approximately $4,158 a semester. Assuming additional costs of $16,000 for an additional

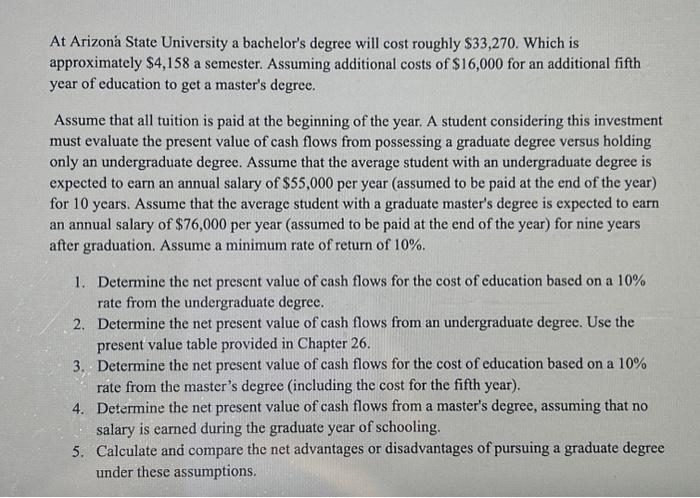

At Arizona State University a bachelor's degree will cost roughly $33,270. Which is approximately $4,158 a semester. Assuming additional costs of $16,000 for an additional fifth year of education to get a master's degree. Assume that all tuition is paid at the beginning of the year. A student considering this investment must evaluate the present value of cash flows from possessing a graduate degree versus holding only an undergraduate degree. Assume that the average student with an undergraduate degree is expected to earn an annual salary of $55,000 per year (assumed to be paid at the end of the year) for 10 years. Assume that the average student with a graduate master's degree is expected to earn an annual salary of $76,000 per year (assumed to be paid at the end of the year) for nine years after graduation. Assume a minimum rate of return of 10%. 1. Determine the net present value of cash flows for the cost of education based on a 10% rate from the undergraduate degree. 2. Determine the net present value of cash flows from an undergraduate degree. Use the present value table provided in Chapter 26. 3. Determine the net present value of cash flows for the cost of education based on a 10% rate from the master's degree (including the cost for the fifth year). 4. Determine the net present value of cash flows from a master's degree, assuming that no salary is earned during the graduate year of schooling. 5. Calculate and compare the net advantages or disadvantages of pursuing a graduate degree under these assumptions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started