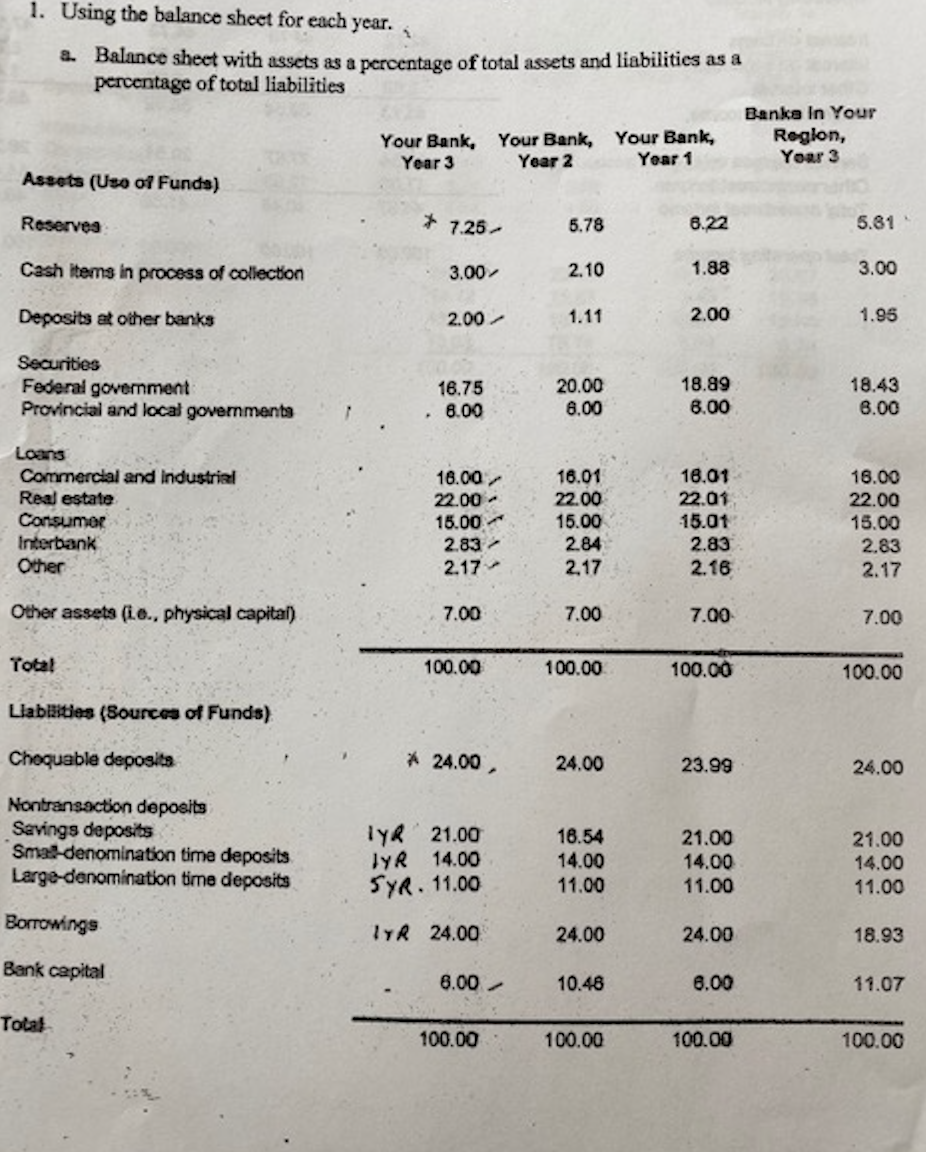

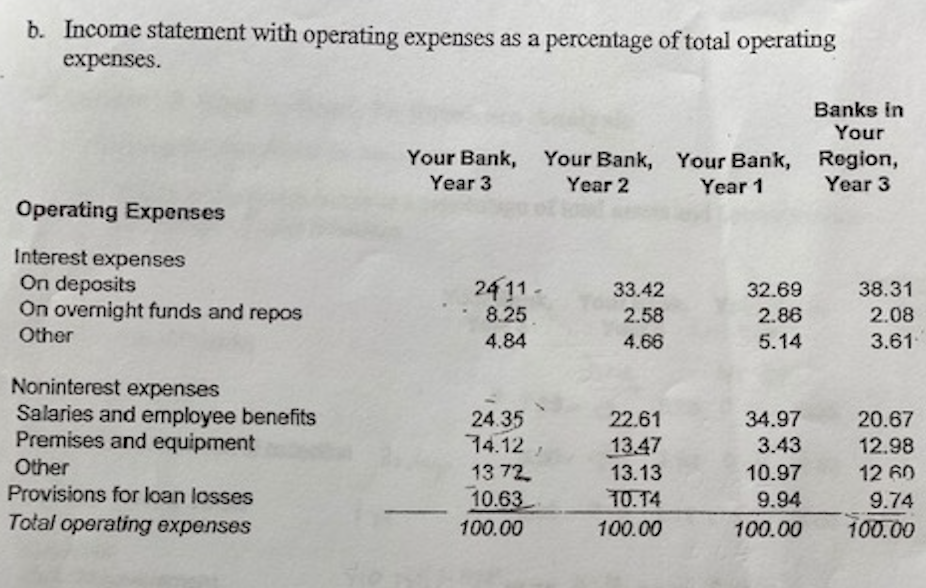

At attachment below please find a practice balance sheet and expenses and income statements for MJG Bank with a 3 year trend and with 3rd year figures only for other banks in the region. Please note that the figures are not actual dollar values but represent percentages .Please note that as percentages you will not be required to try to estimate ROA and ROE.

Your assignment will be to examine the balance sheet and income and expense statements and comment on the performance of MJG bank relative to its competitors in the region. You should provide analysis not just trends as to which areas of the banks are competing well /or not with each other and determine if MJG Bank is a good performing entity. Things to consider are an examination of regulatory issues e.g. Capital adequacy, Liquidity and Reserve requirements etc.

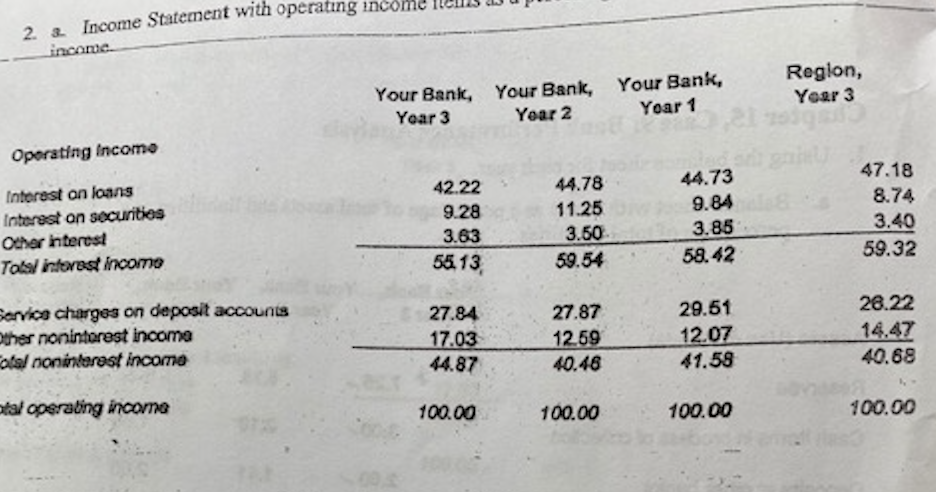

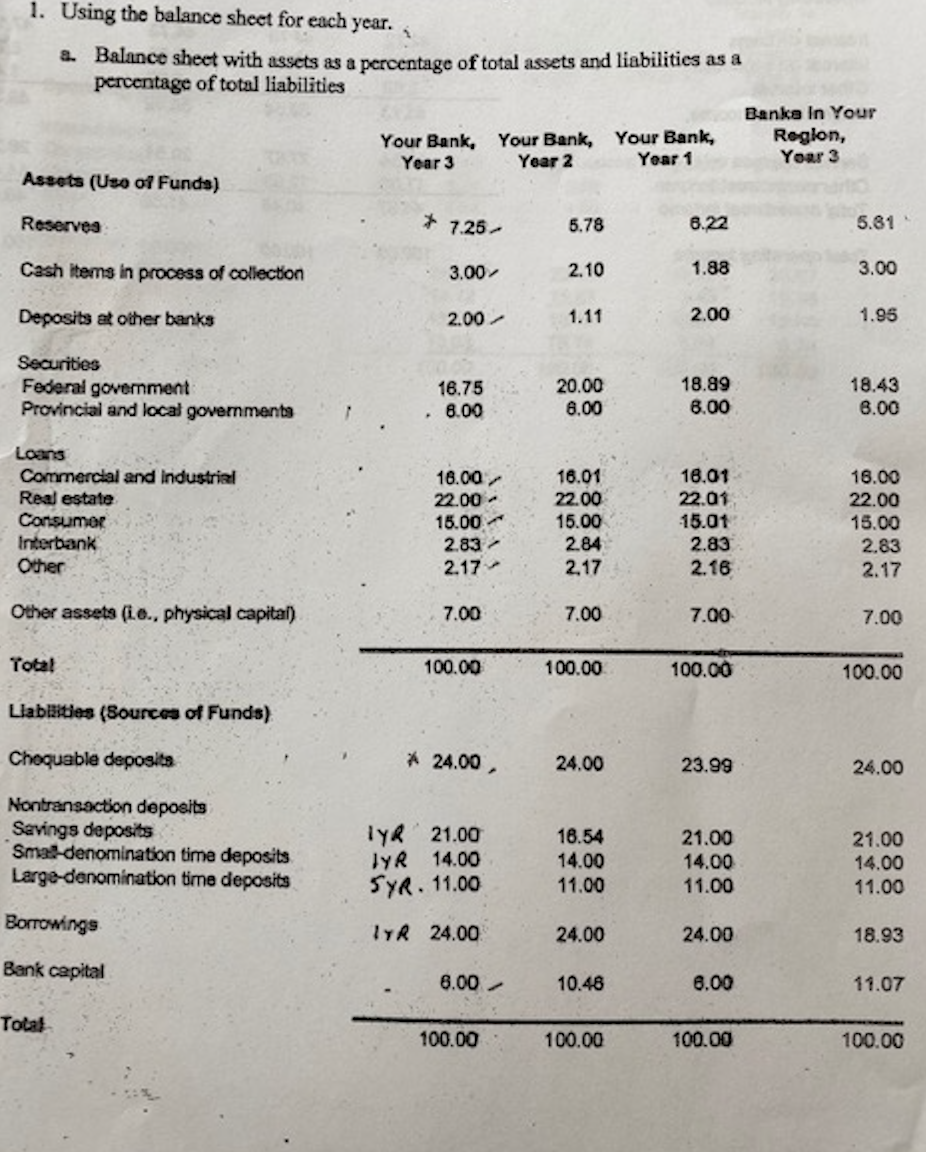

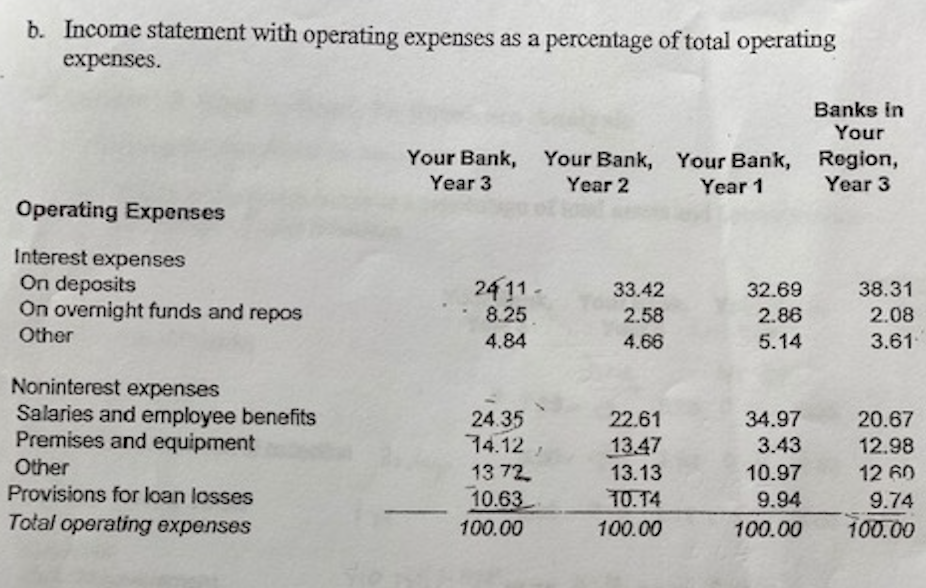

2. & Income Statement with operating income income Your Bank, Year 3 Your Bank, Year 2 Region, Yoer 3 Your Bank, Yoar 1 Oporating Income Interest on loans Interest on securities Other interest Tais interest incomo 42.22 9.28 3.63 5613 44.78 11.25 3.50 59.54 44.73 9.84 3.85 58.42 47.18 8.74 3.40 59.32 Servics charges on deposit accounts Other noninterest income otal noninterest income 27.84 17.03 44.87 27.87 1259 40.46 29.51 12.07 41.58 28.22 14.47 40.68 otal operating income 100.00 100.00 100.00 100.00 1. Using the balance sheet for each year. 1 2. Balance sheet with assets as a percentage of total assets and liabilities as a percentage of total liabilities Banka In Your Your Bank, Your Bank, Your Bank, Roglon, Year 3 Year 2 Year 1 Your 3 Assets (Uso of Funds) Reserves 5.78 6.22 5.81 * 7.25 Cash items in process of collection 3.00 2.10 1.88 3.00 Deposits at other banks 2.00 1.11 2.00 1.95 Securities Federal government Provincial and local governments 16.75 8.00 20.00 6.00 18.89 8.00 18.43 8.00 Loans Commercial and Industrial Real estate Consumer Interbank Other 16.00 22.00 - 15.00 2.83 2.17 16.01 22.00 15.00 2.84 2.17 18.01 22.01 15.01 2.83 2.16 16.00 22.00 15.00 2.83 2.17 Other assets (ie., physical capital) 7.00 7.00 7.00 7.00 Total 100.00 100.00 100.00 100.00 Llabilities (Sources of Funds) Choquable deposits * 24.00 24.00 23.99 24.00 Nontransaction deposits Savings deposits Smal-denomination time deposits Large-denomination time deposits TYR 21.00 JYR 14.00 SYR. 11.00 16.54 14.00 11.00 21.00 14.00 11.00 21.00 14.00 11.00 Borrowings IR 24.00 24.00 24.00 18.93 Bank capital 6.00 10.48 6.00 11.07 Total 100.00 100.00 100.00 100.00 b. Income statement with operating expenses as a percentage of total operating expenses. Banks in Your Your Bank, Your Bank, Your Bank, Your Bank, Region, Year 3 Year 2 Year 1 Year 3 Operating Expenses Interest expenses On deposits On overnight funds and repos Other 2411 - 8.25 4.84 33.42 2.58 4.66 32.69 2.86 5.14 38.31 2.08 3.61 Noninterest expenses Salaries and employee benefits Premises and equipment Other Provisions for loan losses Total operating expenses 24.35 74.12 13 72 10.63 100.00 22.61 1347 13.13 10.14 100.00 34.97 3.43 10.97 9.94 100.00 20.67 12.98 1260 9.74 100.00 2. & Income Statement with operating income income Your Bank, Year 3 Your Bank, Year 2 Region, Yoer 3 Your Bank, Yoar 1 Oporating Income Interest on loans Interest on securities Other interest Tais interest incomo 42.22 9.28 3.63 5613 44.78 11.25 3.50 59.54 44.73 9.84 3.85 58.42 47.18 8.74 3.40 59.32 Servics charges on deposit accounts Other noninterest income otal noninterest income 27.84 17.03 44.87 27.87 1259 40.46 29.51 12.07 41.58 28.22 14.47 40.68 otal operating income 100.00 100.00 100.00 100.00 1. Using the balance sheet for each year. 1 2. Balance sheet with assets as a percentage of total assets and liabilities as a percentage of total liabilities Banka In Your Your Bank, Your Bank, Your Bank, Roglon, Year 3 Year 2 Year 1 Your 3 Assets (Uso of Funds) Reserves 5.78 6.22 5.81 * 7.25 Cash items in process of collection 3.00 2.10 1.88 3.00 Deposits at other banks 2.00 1.11 2.00 1.95 Securities Federal government Provincial and local governments 16.75 8.00 20.00 6.00 18.89 8.00 18.43 8.00 Loans Commercial and Industrial Real estate Consumer Interbank Other 16.00 22.00 - 15.00 2.83 2.17 16.01 22.00 15.00 2.84 2.17 18.01 22.01 15.01 2.83 2.16 16.00 22.00 15.00 2.83 2.17 Other assets (ie., physical capital) 7.00 7.00 7.00 7.00 Total 100.00 100.00 100.00 100.00 Llabilities (Sources of Funds) Choquable deposits * 24.00 24.00 23.99 24.00 Nontransaction deposits Savings deposits Smal-denomination time deposits Large-denomination time deposits TYR 21.00 JYR 14.00 SYR. 11.00 16.54 14.00 11.00 21.00 14.00 11.00 21.00 14.00 11.00 Borrowings IR 24.00 24.00 24.00 18.93 Bank capital 6.00 10.48 6.00 11.07 Total 100.00 100.00 100.00 100.00 b. Income statement with operating expenses as a percentage of total operating expenses. Banks in Your Your Bank, Your Bank, Your Bank, Your Bank, Region, Year 3 Year 2 Year 1 Year 3 Operating Expenses Interest expenses On deposits On overnight funds and repos Other 2411 - 8.25 4.84 33.42 2.58 4.66 32.69 2.86 5.14 38.31 2.08 3.61 Noninterest expenses Salaries and employee benefits Premises and equipment Other Provisions for loan losses Total operating expenses 24.35 74.12 13 72 10.63 100.00 22.61 1347 13.13 10.14 100.00 34.97 3.43 10.97 9.94 100.00 20.67 12.98 1260 9.74 100.00