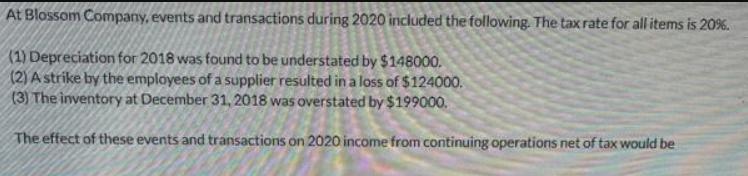

At Blossom Company, events and transactions during 2020 included the following. The tax rate for all items is 20%. (1) Depreciation for 2018 was

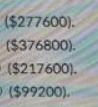

At Blossom Company, events and transactions during 2020 included the following. The tax rate for all items is 20%. (1) Depreciation for 2018 was found to be understated by $148000. (2) A strike by the employees of a supplier resulted in a loss of $124000. (3) The inventory at December 31, 2018 was overstated by $199000. The effect of these events and transactions on 2020 income from continuing operations net of tax would be ($277600). ($376800). ($217600). ($99200).

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below PARTICULRS AMOUNT A strike by th...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started