Question

1. You regress the annual excess return of the ABC stock on the excess returns of the market portfolio. During the sample period, the

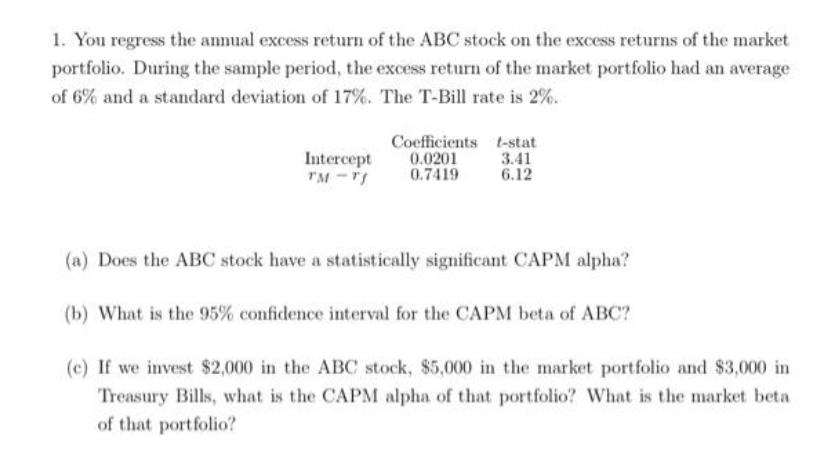

1. You regress the annual excess return of the ABC stock on the excess returns of the market portfolio. During the sample period, the excess return of the market portfolio had an average of 6% and a standard deviation of 17%. The T-Bill rate is 2%. Intercept TM-TI Coefficients 0.0201 0.7419 t-stat 3.41 6.12 (a) Does the ABC stock have a statistically significant CAPM alpha? (b) What is the 95% confidence interval for the CAPM beta of ABC? (c) If we invest $2,000 in the ABC stock, $5,000 in the market portfolio and $3,000 in Treasury Bills, what is the CAPM alpha of that portfolio? What is the market beta of that portfolio?

Step by Step Solution

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below a Does the ABC stock have a statistical...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Economics

Authors: Mark Hirschey

12th edition

9780324584844, 324588860, 324584849, 978-0324588866

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App