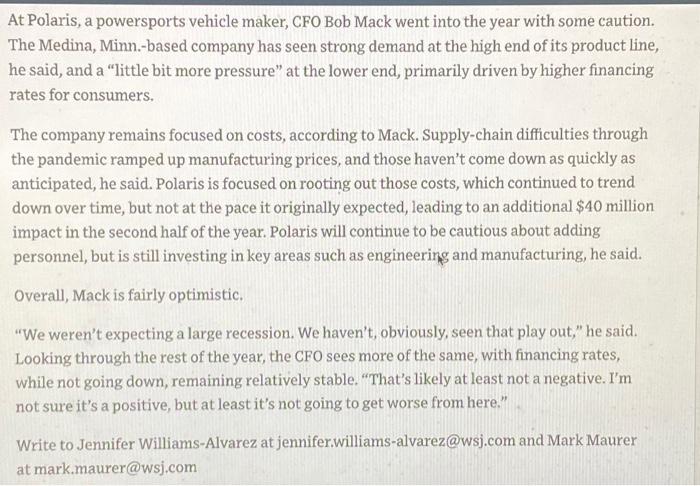

At Conagra Brands, Finance Chief David Marberger is also watching the unemployment rate as a proxy for where the economy is headed. Typically, when inflation and interest rates rise, joblessness also does. But the job figures have remained strong because of the shortage of labor, Marberger noted. hittpsi/www wsj.com/artidesidos-are-mere-optimistlo-on-side-stepping-o-recession-462be9of 2/5 8/12/23, 10:11 AM CFOs Are More Optimstc on Side-Stepping a Recissibr - W/SU "So things cost more, but people can go out and get a job and make money to pay for it," he said. "I'm not sure I'm seeing kind of a quick transition into a recession as long as that unemployment rate stays low." Chicago-based Conagra, which makes Hunt's ketchup, Healthy Choice frozen meals and Slim Jim meat snacks, has seen rising costs. Inflation on its total cost of goods sold was 30% cumulatively for the last three fiscal years ended May 28, which amounts to more than $2 billion in inflation, Marberger said. The company is expecting inflation will cool to around 3% in fiscal 2024, he added. A Chipotle in New York. 'All the indicators are that there's not going to be a recession's says the company's CFO, Jack Hartung. PHOTO:JEENAH MOON/BLOOMBERG NEWS Finance chiefs at companies from Chipotle Mexican Grill to Yelp have grown more encouraged throughout the year that the U.S. economy will skirt a full-blown downturn. Still, they are mixed on whether it is time to unwind some of their belt-tightening or pursue new avenues of growth. It remains an uncertain time to run a company's finance function, said Amol Dhargalkar, chairman and managing partner at Chatham Financial, a financial-risk adviser. "I wouldn't say it's 'Full steam ahead, let's go, with reckless abandon,' he said. "But it's certainly not, 'We think recession is coming so let's cut back right away?' " Chipotle Chief Financial Officer Jack Hartung is hopeful on the economy for the next couple of quarters and into 2024. At Polaris, a powersports vehicle maker, CFO Bob Mack went into the year with some caution. The Medina, Minn.-based company has seen strong demand at the high end of its product line, he said, and a "little bit more pressure" at the lower end, primarily driven by higher financing rates for consumers. The company remains focused on costs, according to Mack. Supply-chain difficulties through the pandemic ramped up manufacturing prices, and those haven't come down as quickly as anticipated, he said. Polaris is focused on rooting out those costs, which continued to trend down over time, but not at the pace it originally expected, leading to an additional $40 million impact in the second half of the year. Polaris will continue to be cautious about adding personnel, but is still investing in key areas such as engineering and manufacturing, he said. Overall, Mack is fairly optimistic. "We weren't expecting a large recession. We haven't, obviously, seen that play out," he said. Looking through the rest of the year, the CFO sees more of the same, with financing rates, while not going down, remaining relatively stable. "That's likely at least not a negative. I'm not sure it's a positive, but at least it's not going to get worse from here." Write to Jennifer Williams-Alvarez at jennifer.williams-alvarez@wsj.com and Mark Maurer atmark.maurer@wsi.com Yelp is in the middle of financial planning for next year and will run the same scenario exercises as last year, according to Schwarzbach. "We're not operating in a way where you're making significant operating decisions on a short-run basis," he said. "We're really executing against the plan and adjusting at the margins as we go through the year." Bob Mack, chief financial officer at Polaris. PHOTO: THOMAS STRAND E.l.f. Beauty has been focused on growth and sees greater opportunity as talk of a downturn diminishes, CFO Mandy Fields said. The Oakland, Calif--based beauty company is increasing distribution capacity and capital behind inventory to make sure it can meet the demand it is seeing, she said. And the company continues to invest in its workforce, which has grown around 60% in the last three years, according to Fields. "It's been great to see that the recessionary talk is kind of moving more into the background, which really illustrates a great opportunity for us to continue to invest and capitalize," she said. Other companies that waded cautiously into the year are planning to stick with that strategy for now, even as recession concerns lessen. Around the start of the year, Yelp said it would hold its head count flat from last year, which according to an April filing was about 5,030 employees. Even as a soft landing looks more likely, the San Francisco-based company plans on sticking to roughly that number of workers, who make up a majority of Yelp's cost structure, according to CFO David Schwarzbach. "That's part of how we approach the uncertainty, which is we don't want to be in a position, of course, where we have hired up and we find ourselves in a softer economy," he said. "All the indicators are that there's not going to be a recession," the CFO said. "As long as consumers have jobs, and they have the desire to do what they're doing right now-to enjoy experiences, those experiences in food, vacations, eating out-I expect that the economy will remain strong." Economists, too, are dialing back recession risks as the Federal Reserve's rate-hike campaign has helped tame inflation without derailing a strong labor market. On Thursday, the Labor Department said the consumer-price index had ticked up to 3.2% in July on an annual basis from 3% in June. But underlying price pressures, so-called core inflation, edged down to an annual 4.7% from 4.8% in June. And last week, the Labor Department reported that the unemployment rate fell to 3.5% in July, near a half-century lowk Even so, Hartung said he is sensitive to keeping costs down. The Newport Beach, Calif--based company doesn't tend to make investment decisions-particularly when it comes to devoting capital to new restaurants-based on whether or not a recession might be brewing, he said. "Those are 20-, 30-year decisions that we're making," he said of opening new locations. "During a recession, if the sales are a little softer, the return might be a little softer, but that would be for a year or two. For the remaining 18 to 28 years, we're going to generate very, very strong returns." 1. One of the chapter lectures discusses the role of the CFO as part Owner, part Operator and part Overseer. Which of these roles do you see at work in this article? Why-please explain? 2. There are several different areas of their businesses that the CFOs in this article discuss. Provide an example of one such area and share your thoughts on why would a CFO be thinking about or worried about that? Module 12308 wsi. cfos outlook.pdt _ Some of those higher costs have been passed along to customers through price increases, which, for the most part, they've stomached. But shoppers are looking at their budgets more closely and in some cases making trade-offs at the grocery store, according to Marberger. "There's been inflation in everything, and so you can see from a consumer perspective, it's just more challenging, especially for lower-income people that manage more on a fixed budget." Conagra is monitoring its brands and categories closely in light of these pressures, but generally Marberger said he isn't changing strategies based on the vicissitudes in the economy. "We have so many different brands that compete with so many different categories," he said. "You just can't paint it with a broad brush and say, 'OK, we're less likely to have a recession now, so our business is going to be X versus Y? It's just not how we look at it." Still, some finance chiefs are seizing the moment as the tone around the economy shifts