Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At date t = 1 the economy will be either in state 1 or in state 2. Two investors A and B only care

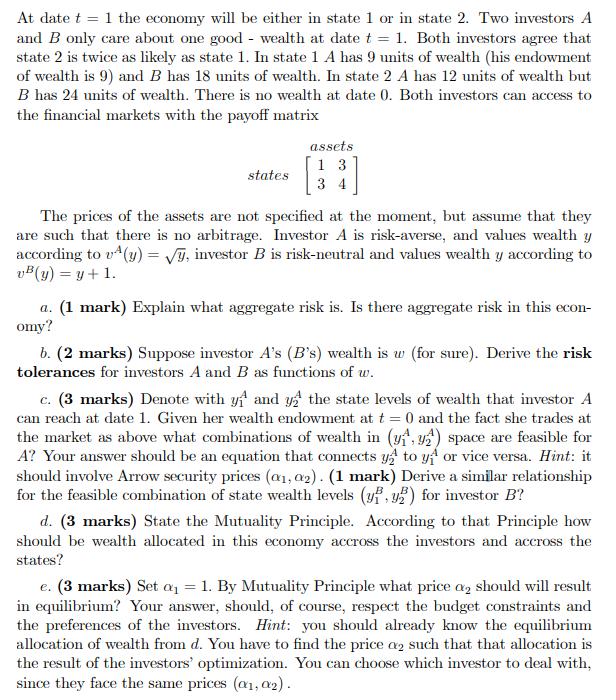

At date t = 1 the economy will be either in state 1 or in state 2. Two investors A and B only care about one good - wealth at date t = 1. Both investors agree that state 2 is twice as likely as state 1. In state 1 A has 9 units of wealth (his endowment of wealth is 9) and B has 18 units of wealth. In state 2 A has 12 units of wealth but B has 24 units of wealth. There is no wealth at date 0. Both investors can access to the financial markets with the payoff matrix states assets 1 3 34 The prices of the assets are not specified at the moment, but assume that they are such that there is no arbitrage. Investor A is risk-averse, and values wealth y according to v (y) = , investor B is risk-neutral and values wealthy according to v(y) = y+ 1. a. (1 mark) Explain what aggregate risk is. Is there aggregate risk in this econ- omy? b. (2 marks) Suppose investor A's (B's) wealth is w (for sure). Derive the risk tolerances for investors A and B as functions of w. c. (3 marks) Denote with y and y2 the state levels of wealth that investor A can reach at date 1. Given her wealth endowment at t= 0 and the fact she trades at the market as above what combinations of wealth in (y, y2) space are feasible for A? Your answer should be an equation that connects y to y or vice versa. Hint: it should involve Arrow security prices (0, 02). (1 mark) Derive a similar relationship for the feasible combination of state wealth levels (yi, y2) for investor B? d. (3 marks) State the Mutuality Principle. According to that Principle how should be wealth allocated in this economy accross the investors and accross the states? e. (3 marks) Set a = 1. By Mutuality Principle what price a should will result in equilibrium? Your answer, should, of course, respect the budget constraints and the preferences of the investors. Hint: you should already know the equilibrium allocation of wealth from d. You have to find the price a such that that allocation is the result of the investors' optimization. You can choose which investor to deal with, since they face the same prices (a, a2). f. Derive the equilibrium prices for the original assets (91-92) consistent with your answer in e.

Step by Step Solution

★★★★★

3.31 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a Aggregate risk Aggregate risk is the risk that affects the entire economy rather than individual sectors or firms It is often caused by events such ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started